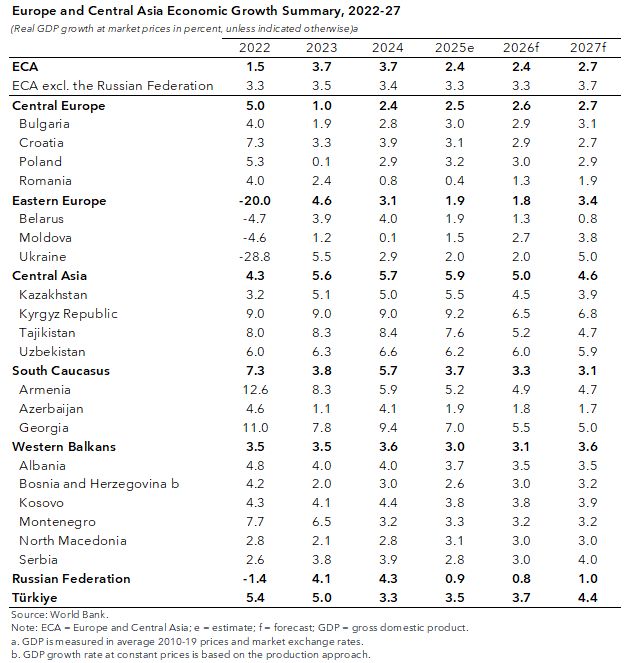

Economic growth in Europe and Central Asia (ECA) has slowed but the region has remained resilient amid continued global and regional challenges. Regional gross domestic product is likely to grow by 2.4 percent in real terms this year, down from 3.7 percent in 2024, because of a weaker pace of expansion in the Russian Federation. Excluding Russia, which accounts for about 40 percent of the region’s output, growth is likely to remain little changed at about 3.3 percent this year and next. Growth in Turkiye and Poland is set to strengthen to 3.5 percent and 3.2 percent, respectively, supported by strong consumer demand and robust investment growth. The pace of economic expansion in Central Asia—ECA’s fastest growing subregion for the third consecutive year—is projected to firm to 5.9 percent in 2025 from 5.7 percent last year, driven by higher oil output in Kazakhstan, stronger remittances, and higher public and private investment spending.

Private consumption remains the main driver of growth in ECA, although its pace is moderating as real wage gains ease and job creation slows. Strong credit growth—especially in Central Asia, the South Caucasus, the Western Balkans, and Turkiye—continues to sustain household demand. In many countries, investment has propped up growth, supported by public infrastructure and defense spending and increased inflows of foreign direct investment. Exports are recovering modestly, with global trade policy uncertainty affecting supply chains and weighing on auto suppliers in Central Europe and the Western Balkans.

Higher food prices have pushed up inflation. Average annual inflation rose to 4.9 percent by August from 3.8 percent a year ago. Hikes in administered prices also contributed. Fiscal consolidations across ECA have mostly been delayed. In more than half of the countries, fiscal deficits are set to rise this year due to higher public investment, interest costs, social spending, and defense outlays.

Growth in ECA is expected to pick up only modestly to 2.6 percent on average in 2026–27. In Russia, growth is likely to weaken further to 0.8 percent next year before picking up slightly to 1 percent in 2027. In contrast, economic expansion in Turkiye is expected to continue gaining momentum, with growth reaching 4.4 percent in 2027. Private consumption, supported by wages, remittances, and social transfers; continued infrastructure spending; and a gradual recovery in trade outside Russia are likely to sustain growth across the region. Nonetheless, there are substantial downside risks. Slow progress in advancing structural reforms has limited the scope for productivity growth to rebound and convergence to high income status to accelerate. Trade and geopolitical tensions and persistent inflation pressures have also heightened the region’s vulnerabilities.

Weakening reform momentum and slowing productivity growth resulted in positive but modest job creation in the ECA region after the 2008 Global Financial Crisis. Developments since then have contrasted with the remarkable gains across the region in the late 1990s and early 2000s, reflecting the start of the transition from planned to market economies and deeper integration into the global economy. Since then, job creation in ECA has been faster than population growth but smaller than in other developing regions with much larger increases in population. The number of people employed in ECA grew by 12 percent between 2009 and 2024. That exceeded the 7 percent increase in the region’s population, even with the substantial migration many countries experienced. Jobs growth has been driven largely by higher participation rates and a shift away from agriculture into services, which now account for over half of all jobs. Many of the new service jobs have been in low-skill occupations, even as employment in information technology and other global innovator services in the region also increased.

Rising labor force participation is a welcome development that has supported employment growth in many parts of ECA, especially Turkiye and the Western Balkans. Higher labor force participation—especially by women—accounted for just under one-half of gross job creation in ECA between 2010 and 2023. This is remarkable given that labor force participation rates in many ECA countries are already among the highest in the world. Nevertheless, significant underutilization persists among specific groups, with female and youth labor force participation rates in the region well below the levels observed in high-income European countries. A substantial portion of the region’s underutilized labor resources could be mobilized to mitigate the effects of a declining working-age population.

Young and dynamic firms, together with very large firms, generate almost all the net job creation in ECA. Startups and young small and medium-sized enterprises account for 14 percent of total employment in ECA but almost 40 percent of gross jobs created. Large businesses also contribute substantially to net job creation. By contrast, mature small and medium-sized enterprises tend to eliminate more jobs than they create.

In contrast to high-income economies, despite substantial changes in the global and regional economic environment, job responsiveness to productivity growth in ECA has remained stable over the past decade. On average, a 1 percent increase in productivity translated into a 0.9 percent increase in employment in the region. Therefore, strong productivity growth is essential for job creation.

Unless resolved, structural impediments will limit the region’s productivity growth and jobs potential. Several persistent obstacles exist: an abundance of small firms that rarely scale up; subdued competition; high barriers to entry and exit; underdeveloped credit; inefficient allocation of capital and talent; outdated education and training systems, resulting in skills mismatches; and underinvestment in lifelong learning. State-owned enterprises often distort the competition environment, and they create half as many jobs and eliminate twice as many jobs, compared to private firms.

Demographic headwinds—including aging and low fertility rates—also threaten labor market resilience. Fertility is below replacement in most of the region, and the working-age population is projected to fall by about 17 million by 2050. Unlike the rest of the region, however, Central Asia and Turkiye will see significant increases in the working-age population, creating the need for more jobs.

Turning resilience into stronger growth in productivity and jobs requires bold reforms. Part II of this update is structured around three pillars of the jobs challenge that policy makers in the region need to consider to strengthen the link between economic growth and employment, reduce distortions, unlock the region’s underutilized labor potential, and help manage complex labor market transitions.

First, they need to create the infrastructure foundations for jobs, including health care, education, skills training, transportation, and energy. These investments support inclusive labor market participation and productivity and are essential to mobilize underutilized labor, increase female and youth participation rates, and support the structural transformation needed for convergence to high-income status.

Second, strengthening governance and business-enabling policies is essential to ensure a predictable regulatory environment, simplify taxes, and deepen trade and competition. Reforms of state-owned enterprises should prioritize performance, governance, and a level playing field while supporting affected workers. Deeper trade integration will enable firms to join dynamic value chains and increase their returns on innovation.

Third, mobilizing private capital is critical for investments that can drive sustainable job creation. Countries stand to gain from promoting policies to support businesses through financing, equity investments, guarantees, and political risk insurance. These policies include co-investment programs, public-private partnerships, and support to local financial intermediaries. Such policies not only bring in much-needed private capital to strategic sectors but can also expand access to risk capital.

Sectoral priorities must complement structural reforms. To translate these pillars into tangible employment gains, countries should orient sectoral policy toward five priority areas. Agribusiness can support rural development and absorb informal labor. Value-added manufacturing can anchor tradable employment and raise productivity. Tourism offers opportunities to engage youth and catalyze service ecosystems. Healthcare expands higher-skilled employment. Energy and infrastructure underpin competitiveness and green growth.

The region’s heterogeneity implies that countries cannot follow a single approach. For instance, compared to the rest of the region, the demographic pressures are different in Central Asia and Turkiye, where increasing the number of jobs employing the growing young population is an urgent priority. In the Western Balkans or Central Europe, in a context of a shrinking workforce, it will be crucial to upgrade jobs in terms of quality and productivity. Success will depend on country ownership, tailored approaches, and leveraging assets such as human talent and natural resources.

Central Asia’s sectoral growth is likely to be driven by expanding agrifood and livestock processing. The region will also benefit from developing transport and logistics along Eurasian corridors, investing in renewable energy, and targeting specific manufacturing niches. In addition, the tourism industry can leverage Central Asia’s exceptional heritage sites and rich cultural assets.

Across Central Europe, the most promising dynamic opportunities center on manufacturing and energy value chains, modern tradable services, and support for the aging population. These countries have strong potential in green manufacturing and energy, as well as a broad range of offshore business services, including software development, business process outsourcing, accounting, and architectural and engineering services.

Turkiye’s biggest opportunities for growth and job creation lie in tradable services and logistics, upgrading global value chain–linked manufacturing, renewable energy, care services that increase female participation, and digital and information and communications technology–enabled services.

Ukraine’s economy is undergoing a significant transformation, with the emergence of new sectors and productivity upgrades in existing industries likely to contribute to job creation. Information technology and digital industries, along with agriculture and agro-processing, have emerged as Ukraine’s main comparative advantages. In addition, defense and associated industries have the potential to generate employment opportunities for skilled workers.

The Western Balkans presents robust opportunities for agribusiness and food processing, tourism diversification and upgrading, targeted light manufacturing (notably automotive parts), and care services.

The South Caucasus stands out for opportunities in renewable energy and exportable digital business services. The South Caucasus’s position on the Middle Corridor also creates a platform for growth in regional transport and logistics services.

Across the remainder of ECA, sectoral growth is expected to be driven by deeper integration with the European Union, modernization of financial intermediation, advancement in high-value agriculture, and expansion of digital service offshoring.

Europe and Central Asia: Investing in Jobs Is Key to Boosting Productivity and Growth

Economic growth in Europe and Central Asia (ECA) has slowed but the region has remained resilient amid continued global and regional challenges, according to the World Bank’s latest Europe and Central Asia Economic Update: Jobs and Prosperity, released today.

Regional GDP is likely to grow by 2.4 percent in real terms this year, down from 3.7 percent in 2024, driven primarily by a weaker pace of expansion in the Russian Federation. Excluding Russia, which accounts for about 40 percent of the region’s output, growth is likely to remain little changed at about 3.3 percent this year and next.

“Developing economies in the region need to undertake bold reforms to translate resilience into stronger growth in productivity, output, and jobs that fit with the region’s shifting demographics and capitalize on their natural advantages,” said Antonella Bassani, World Bank Vice President for Europe and Central Asia. “It is important for countries to strengthen their private sectors, improve education, and connect better internationally, regionally, and domestically, while attracting more private capital. The region’s challenge is to increase job opportunities and transform low-skill jobs into high quality employment.”

In a special focus on jobs, the report finds that investing in infrastructure, improving the business environment and mobilizing private capital will be critical to jumpstarting productivity.

Countries need to begin by investing in the foundation for jobs – physical and human infrastructure. Improving the quality of education, particularly vocational and higher education, is also necessary. There is still untapped potential among women and young people, who are underrepresented in the labor force.

The region has created significant jobs over the last decades, yet slowing growth, lagging productivity and weak reform momentum are amplifying job challenges. While employment in ECA has increased by 12 percent over the last 15 years, particularly in services which now account for more than half of jobs, the report finds that most opportunities have been in relatively low-skilled jobs with limited earning potential.

Demographic headwinds threaten labor market resilience: the working-age population is projected to decrease by 17 million over the next decades, a decline concentrated in Eastern and Central Europe and the Western Balkans. In Central Asia and Türkiye, the working-age population will grow, putting a different kind of pressure on the labor market. Structural impediments limit ECA’s potential, such as the abundance of small firms that rarely scale up, undeveloped credit and venture finance markets, underperforming education and training systems, subdued competition, and state-owned enterprises (SOEs) that dampen business dynamism and market efficiency.

“Each country can tailor its approach to best use its assets - human talent, physical infrastructure, institutions, and natural resources,” said Ivailo Izvorski, World Bank Chief Economist for Europe and Central Asia. “Expanding job opportunities can benefit nearly all workers as different industries require different skillsets. Focusing on these areas gives policymakers a real chance to tackle the jobs challenge and generate growth.”

The full report can be accessed here: https://www.worldbank.org/en/region/eca/publication/europe-and-central-asia-economic-update