Clifford Chance Badea, the local office of global law firm Clifford Chance, advised Nofar Energy, through its project companies Slobozia Solar Plant S.R.L., Aviv Renewable Investment S.R.L. and Corbii Mari Solar Plant S.R.L., in securing a EUR 192 million financing arranged by the European Bank for Reconstruction and Development (EBRD).

The financing will support the development of three photovoltaic parks in Slobozia, Corbii Mari and Iepuresti II, with a total installed capacity of 531 MW, and includes a Contracts for Difference (CfD) component for the Slobozia photovoltaic park, as well as the development of battery storage facilities.

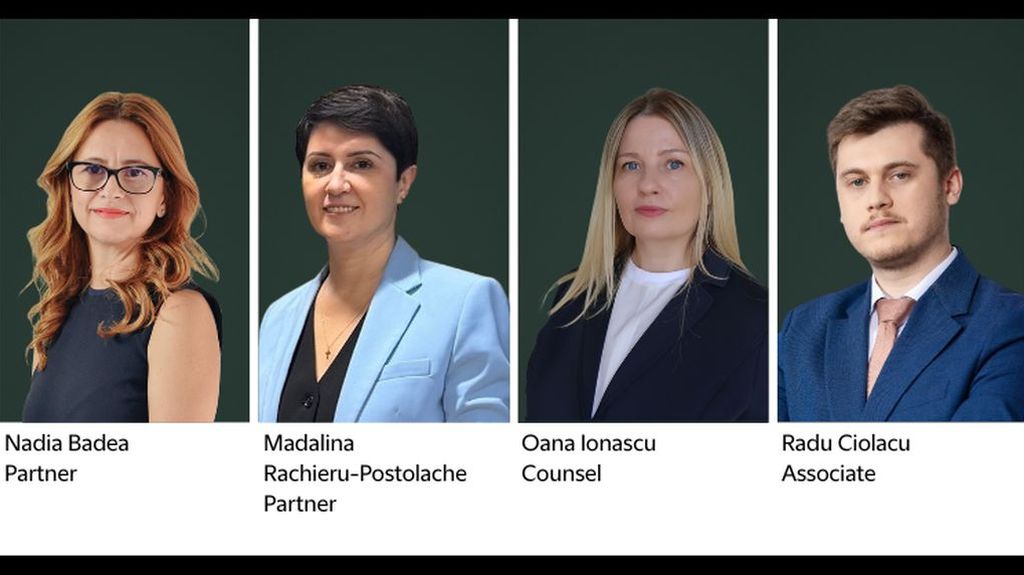

The Clifford Chance Badea team advising Nofar Energy included Nadia Badea (Partner), Madalina Rachieru-Postolache (Partner), Oana Ionascu (Counsel), Radu Ciolacu (Associate), and Vladimir Balan (Attorney).

The Nofar Energy team was led by Favi Stelian (CEO Nofar Energy Romania), Andreea Gilicel (Chief Commercial Officer Romania) and Alex Greenberg (Senior Legal Counsel) and also included Orly Dolev (Head of Business Development CEE), Roxana Gherghe (CFO Romania) and Andrei Sbarnea (Commercial Asset Manager).

Madalina Rachieru-Postolache, Partner, says: “We were honoured to have once again advised Nofar Energy in this strategic project, following last year’s financing of the two photovoltaic parks in Iepuresti and Ghimpati. Nofar Energy has already consolidated its foothold as a leading investor in renewable energy in Romania, while the EBRD remains one of the most active international financial institutions focused on energy transition. We are delighted when we can contribute our extensive experience and global know-how for the success of our clients’ strategic projects.”

Counsel Oana Ionascu adds: “We have successfully completed a complex financing project for Nofar, which once again demonstrated the remarkable expertise and experience of the Clifford Chance team. We were involved throughout the entire process, working closely with the other teams. We would like to thank everyone for their dedication and professionalism—each person's contribution was essential to concluding a valuable agreement for Nofar and for all parties involved."

The latest financing strengthens the collaboration between Clifford Chance and Nofar Energy, as part of an investment plan through which the company aims to achieve a total installed capacity of over 733 MW in Romania. The lawyers advise the company on financing and corporate M&A aspects, Engineering, Procurement and Construction (EPC) and Operation and Management (O&M) contracts, as well as regulatory issues.

Among others, in August 2024, Clifford Chance Badea advised Nofar Energy, through its project companies Solis Imperium and RTG Solar Energy, in the signing of a term loan agreement and a VAT facility agreement, with a total value of EUR 122 million, with EBRD and Raiffeisen International as lenders.

Clifford Chance Badea clients benefit from the entire experience and know-how of the Clifford Chance offices in countries that are more advanced in the development of renewable energy projects. The local team advises developers, infrastructure funds, utility companies and banks throughout the entire project development cycle of a renewable energy project – sell side or buy side M&A, signing of EPC and O&M contracts, Power Purchase Agreements (PPAs), Project Finance, development contracts, regulatory matters including project amendments, or litigation.

Its portfolio of public deals recently announced includes:

1. Advising Aukera Energy in securing a EUR 60 million debt facility from Kommunalkredit Austria AG to finance the construction of its first stand-alone battery energy storage system in Romania;

2. Advising Nofar Energy in relation to

a. the signing of three Operation & Management (O&M) contracts with EnergoBit, covering substations and connection infrastructure related to photovoltaic parks at Iepuresti, Ghimpati and Slobozia, with a total combined capacity exceeding 360 MW;

b. the sale of its 50% stake in Ratesti Solar SRL, a solar plant with a capacity to produce 155MW of electric power, to project partner Econergy International Limited, in a EUR 45.6 million deal;

3. Advising T2Y Capital, a financial investor specializing in growth capital with a focus on the energy sector and adjacent industries, in relation to its strategic partnership with Prime Batteries Energy Holding, an investment making it the second-largest shareholder of the Romanian battery producer;

4. Advising lenders UniCredit Bank SA and Garanti BBVA, and UniCredit SpA as Facility Agent and Sustainability Agent, in the signing of a financing agreement for a package of non-recourse loans of up to EUR 60 million equivalent (approx. EUR 56 million and RON 22 million VAT facility) with DRI as borrower;

5. Advising Banca Comerciala Romana (BCR) in the signing of an EUR 18.5 million financing agreement for the development of a 34.69 MW solar park in Calarasi County by a company owned by Italian group Alerion Clean Power;

6. Advising PPC Group in the closing of its EUR 700 million deal with Evryo Group, owned by Macquarie Asset Management, to acquire their renewable energy portfolio in Romania, including 629 MW RES in operation and about 145 MW in pipeline assets;

7. Advising the banking syndicate including UniCredit Bank, BCR and Erste Group Bank in the signing of the EUR 214.45 million financing agreement with Austrian group Enery Power Holding for its entire Romanian portfolio of renewable energy projects and batteries;

8. Advising Erste Group Bank and BCR in the financing of the successfully completed EUR 214 million transaction, through which Nala Renewables took over a 99.2 MW onshore wind project from OX2. The deal includes a long-term power purchase agreement with a multinational corporate offtaker;

9. Advising energy infrastructure investment fund Eiffel Investment Group, co-lender alongside EBRD, in the EUR 24.4 million facility signed with INVL Asset Management for the construction of two solar power plants in Dolj County, with a combined capacity of 60 MW;

10. Advising Premier Energy, one of the largest renewable energy players in Romania and the Republic of Moldova, in relation to the Initial Public Offering and listing on the Bucharest Stock Exchange amounting to approximately RON 700 million;

11. Advising Nala Renewables Limited, a global power and renewable energy investment platform and independent power producer, in its acquisition from Monsson Group of a ready-to-build photovoltaic park in Caras-Severin, with a total installed power of approximately 64 MW;

12. Representing Premier Energy in a high-stakes dispute against Azomures, part of the Swiss group Ameropa. In October 2024, the lawyers obtained an important victory in the court of first instance in favour of Premier Energy;

13. Advising Greek-based Motor Oil Renewable Energy Single Member S.A. (MORE) in the 86-MW deal marking its entry on the Romanian renewable energy market. MORE alongside Premier Energy Group, through Alive Renewable Holding Limited, has acquired its first two new photovoltaic projects in Buzau County;

14. Advising the European Bank for Reconstruction and Development (EBRD) and OTP Bank in relation to the EUR 93-million financing agreement for the construction and operation of the Urleasca Wind Farm (Braila) by Urleasca Wind Farm SRL, the project company equally co-owned by BIG Shopping Centers ltd and MEGA OR ltd.

***

About Clifford Chance Badea

Clifford Chance Badea is the local office of global law firm Clifford Chance LLP, which has been present in Romania since 2006. The Bucharest office is constantly involved in complex transactions of syndicated loans, project finance, restructurings, Eurobonds and shares issues on international capital markets, derivative financial instruments, acquisitions by strategic investors or private equity funds, infrastructure and highway projects, real estate investments, as well as domestic and international litigation and arbitration.

About Clifford Chance

Clifford Chance is a global law firm committed to creating advantage for its clients. The firm combines legal and commercial intelligence to grow, transform, protect and defend its clients’ business. Operating as a single, fully-integrated global partnership, Clifford Chance provides forward-thinking insights and tech-enabled solutions in the sectors and markets that matter most to its clients. The firm’s culture of collaboration and commitment to rigorous and ethical standards, ensures consistent, high-quality service worldwide.

For further information about Clifford Chance please access www.cliffordchance.com or www.linkedin.com/company/clifford-chance-llp

![2026 consumer trends and industry insights [Webinar]](https://doingbusiness.ro/media/covers/6979dc6c4329e_cover.jpg)