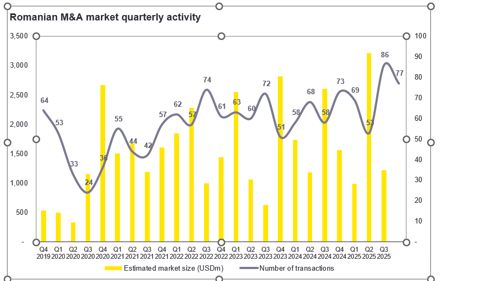

Romanian mergers and acquisitions (M&A) recorded 216 transactions2 during the first nine months (9M) of 2025, marking an 8.5% increase compared to the same period last year (199 deals). The estimated value of Romanian M&A activity stood at USD 5.4bn2, reflecting a modest 1.9% decline from USD 5.5bn in 9M 2024. However, disclosed deal values showed far stronger momentum, climbing 22.7% to USD 3.2bn, driven by the USD 1.4bn acquisition of Regina Maria by CVC-backed Mehilainen.

This trajectory in Romanian disclosed values is consistent with regional dynamics, as European M&A deal values rose by around 11% during 9M 2025, while global values increased by a notable 33%. In contrast to Romanian M&A, the number of deals fell 7% globally and in Europe during this period. The third quarter highlighted the strongest momentum of 2025 global dealmaking, fueled by robust mega-deal activity (>USD 10bn) and a growing focus on strategic repositioning. This renewed appetite comes on the back of improving financing conditions, dynamic IPO activity, and sustained investor confidence. In this wider context, Romanian M&A activity continued its upward path, reflecting both regional tailwinds and solid local fundamentals.

The third quarter of 2025 saw only one transaction surpassing USD 100m, in contrast to four in Q3 2024. The two largest transactions in Q3 2025 were both outbound, a rare shift given that such top-ranking deals are typically inbound, and the first time this has occurred since 2018.

Topping the list for the quarter’s largest deals was Paval Holding’s USD 151m acquisition of Praktiker Hellas, a prominent Greek DIY and home goods retailer, from Fairfax Financial Holdings Limited, the Canadian investment and insurance group. The deal follows earlier acquisitions such as the Waldhaus Flims Wellness Resort in Switzerland (USD 78m, 2024) and the Grand Hotel Gardone in Italy (2023).

The second-largest deal in Q3 2025 was Premier Energy’s acquisition of a 51% stake in a 158 MW wind park portfolio in Hungary from Spain’s Iberdrola for USD 77m. The portfolio comprises 79 Gamesa turbines with an annual output of around 300,000 MWh.

Ranking third was FrieslandCampina’s announced sale of Napolact, a flagship Romanian dairy brand, together with two local production facilities to Hungary’s largest agri-food company Bonafarm for USD 76m.

During this period, EY provided full sell-side M&A advisory services to OX2 for the sale of a 96 MW onshore wind farm in eastern Romania to HELLENiQ Renewables, a wholly owned subsidiary of HELLENiQ ENERGY Holdings. The project is backed by a 12-year virtual power purchase agreement (vPPA) signed with the international group Ahold Delhaize, covering more than 50% of the estimated electricity output. The ready-to-build wind farm includes 15 Vestas turbines of 6.4 MW each.

In terms of investor dynamics, strategic players continued to dominate Romanian M&A in 9M 2025, accounting for 86% of deal volume. Financial investors increased their activity by almost 80% compared with 9M 2024, with more than a third of their transactions involving multi-country acquisitions. Inbound activity grew modestly by 4%, totaling 108 deals, while domestic investors recorded stronger growth of 10%, with 89 deals announced. Moreover, inbound acquisitions significantly outpaced foreign-owned disposals (79 deals) in 9M 2025, underscoring the market’s role as a net recipient of foreign investment.

The top five most active sectors by volume for the first nine months of the year were Real Estate, Hospitality & Construction (45 deals) - traditionally a leading sector, Technology, Media & Telecommunications and Health & Life Sciences (32 deals each), followed by Energy & Utilities (31), and Advanced Manufacturing & Mobility and Consumer Products & Retail (27 each). Notably, Health & Life Sciences showed strong momentum, with volumes up 60% compared with the prior year, driven by increased activity in veterinary clinic acquisitions.

In terms of country of origin, the United States led with 15 deals, while the United Kingdom followed closely with 14. The US maintained its historic leadership, while the UK sustained the momentum established earlier this year. Poland ranked next with 10 deals, followed by Germany and France with 7 each.

***

About EY Romania

EY is one of the world's leading professional services firms with 392,995 employees in more than 700 offices across 150 countries, and revenues of approx. US$51.2b in the financial year that ended on 30 June 2024. Our network is the most integrated worldwide, and its resources help us provide our clients with services allowing them to take advantage of opportunities anywhere in the world.

With a presence in Romania ever since 1992, EY provides, through its more than 1000 employees in Romania and the Republic of Moldova, integrated services in assurance, tax, strategy and transactions, and consulting to clients ranging from multinationals to local companies.

Our offices are based in Bucharest, Cluj-Napoca, Timisoara, Iasi and Chisinau. In 2014, EY Romania joined the only global competition dedicated to entrepreneurship, EY Entrepreneur Of The Year. The winner of the national award represents Romania at the world final taking place every year in June, at Monte Carlo. The title of World Entrepreneur Of The Year is awarded in the world final. For more information, please visit: www.ey.com

1EY’s M&A database for Romania excludes transactions with stakes acquired of less than 15% as well as the transaction value for multi-country deals if the value of the country-specific assets are not disclosed.

2includes an estimate of the value of transactions where no data was formerly disclosed by the parties or is not available in third party databases and/or reported by media sources