Although the implementation phase is complex, we believe that these measures will, in the long run, generate both more efficient reporting processes and lower reporting costs and the costs of tax inspections in the VAT field.

The European Commission has recently published a survey of the 2016 VAT gap estimates registered by the EU Member States, Romania again highlighting the lack of tax collection results, with a VAT gap of 35.88%.

More specifically, the Romanian tax authorities have failed to collect about 36% of the VAT that could have been collected, while our neighbors, Bulgaria and Hungary, are making visible progress in reducing the VAT gap in their countries.

How is it possible that a relatively large number of EU member states are heading in the right direction, while Romania is struggling with the VAT collection exercise?

What is their secret, given that the measures applied by the Romanian tax authorities, including the reduction of the VAT rate from 24% to 19%, did not have the expected impact on the percentage of VAT collection in Romania?

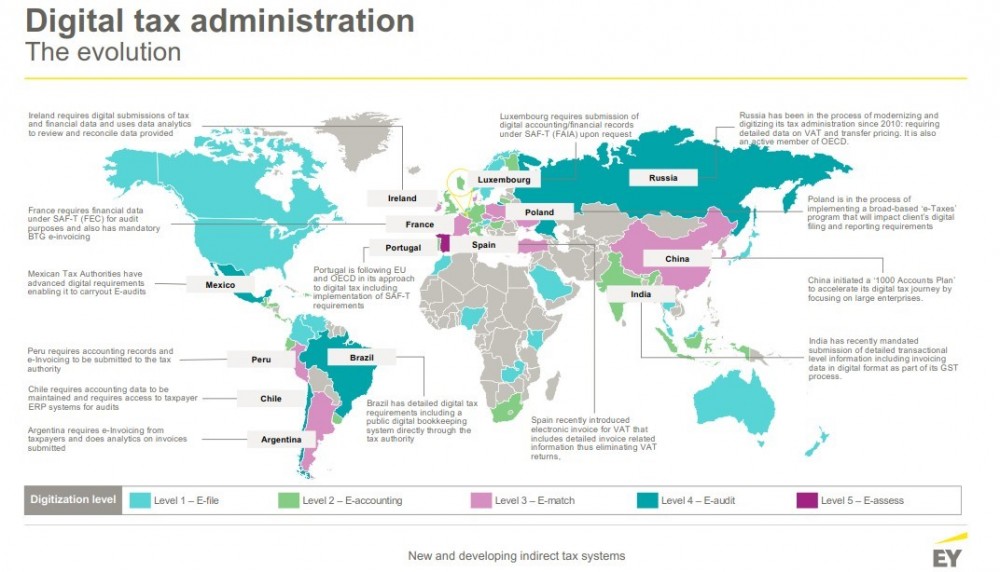

In the European context, it can be clearly seen that tax authorities are choosing the path of digitization, which steadily leads to a drop in the VAT collection gap.

Taxpayers have to align with this trend and accept the path of digitization to ensure continued economic activity and compliance with long-term requirements.

The map below highlights the current state of digitization of tax authorities, relative to the digital maturity level of each country (1-5).

Where does Romania stand in the context of digitizing the VAT reporting and inspection process?

Currently, Romania has implemented e-invoicing as an optional measure and has managed to move to the electronic filing of aggregate VAT declarations, physically depositing no longer accepted. However, these measures do not even place us at the first level on the digitization map as shown below.

VAT returns in the form of aggregated forms of operations, which Romanian taxpayers submit electronically in Romania, are not a form of digital tax reporting.

Digital reporting involves passing to the tax authorities information related to the operations of a company, detailed up to the level of an invoice (transaction transaction), either periodically - for example, monthly or in real time.

The extended 394 form, introduced in September 2016, was considered at that time a step towards more granular transaction reporting, but it turned out to be a tremendous burden on taxpayers and remained a form of aggregate VAT reporting.

A more effective alternative could be to file standard e-journals and waive the 394 statement.

As a result, we believe that introducing a digital VAT reporting method such as SAF-T (EU Standard Tax Audit File) would help the Romanian tax authorities in collecting VAT, limiting fraud and conducting a VAT tax audit more efficient.

Equally, for Romanian taxpayers, it would lead, in the long run, to less time spent on reporting activities, more efficient checks, fewer manual errors, better control of VAT reporting activities and, consequently, of the VAT function.