Organic growth reached 7.2%, with pricing of 7.5% and real internal growth (RIG) of -0.3%. Growth was broad-based across geographies and categories. Total reported sales were CHF 93.0 billion, a decrease of 1.5% (FY-2022: CHF 94.4 billion).

Mark Schneider, Nestle CEO, commented: "Unprecedented inflation over the last two years has increased pressure on many consumers and impacted demand for food and beverage products. Looking to 2024, we are prioritizing volume- and mix-led growth with increased brand support, as we enhance value for consumers through active innovation and renovation, premiumization, affordability and more nutritious options. We are confident that we have the right strategy, portfolio and capabilities to deliver on our 2025 targets."

Group sales

Organic growth was 7.2%. Pricing was 7.5%, reflecting cost inflation over the last two years. RIG was -0.3%, impacted by soft consumer demand, capacity constraints and a temporary supply disruption for vitamins, minerals and supplements in the second half. As expected, RIG turned positive in both the fourth quarter and the second half, supported by the benefits from portfolio optimization, improving customer service levels and increased brand support. Growth was broad-based across most geographies and categories. In developed markets, organic growth was 6.4%, led by pricing with negative RIG. In emerging markets, organic growth was 8.4%, driven by pricing and positive RIG.

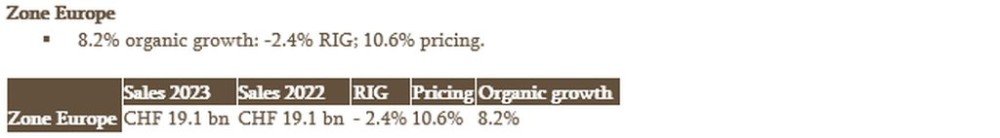

Organic growth was 8.2%, with pricing of 10.6%. RIG was -2.4%, reflecting demand elasticity and capacity constraints. Growth in Zone Europe was supported by pricing, strong sales development for e-commerce and continued momentum for out-of-home channels. The Zone saw market share gains in pet food and Infant Nutrition.

By product category, the key contributor to growth was Purina PetCare, driven by differentiated offerings across premium brands Felix, Gourmet and Purina ONE. Coffee saw mid single-digit growth, led by Nescafe soluble and ready-to-drink products. Confectionery reported high single-digit growth, with continued market share gains for KitKat. Nestle Professional posted double-digit growth, led by beverages. Infant Nutrition recorded high single-digit growth, based on continued momentum for premium infant formula, particularly NAN. Culinary posted mid single-digit growth, with robust sales developments for Maggi.

Nestle Romania financial results for 2023

"In a year full of challenges and changes, Nestle Romania has achieved a remarkable performance, with an organic growth of 18.8% throughout the year. This growth is due to the team of over 600 Nestle professionals who have shown dedication and commitment every day. I would like to thank the entire Nestle Romania team, all the partners we collaborate with, and of course, all the consumers who continue to prefer and use our brands and products every day", states Silvia Sticlea, Country Manager of Nestle Romania.

The results were equally good in terms of the social involvement of Nestle Romania, which continued to promote education for balanced nutrition through national campaigns and educational programs in schools, reaching over 80,000 students nationwide. They also made donations of over 60 tons to the Food Bank and provided product support to the activities of the 38 student associations they collaborate with.

Business as a force for good: Net Zero plan on track

Nestle has achieved a net reduction of 13.5% of its greenhouse gas (GHG) emissions versus its 2018 baseline, while continuing on its growth path over the same period. Advancing towards Net Zero, the company moved past peak carbon in 2019 and has successfully decoupled its growth from emissions. Nestle is on track to reach a 20% reduction of GHG emissions by 2025. For the first time, the company now also provides transparency on the reductions of specific gases. For example, it has achieved a reduction of 15.3% of methane versus the 2018 baseline. This significant reduction was possible due to Nestle's focus on dairy, as its single largest source of methane emissions. Nestle is making its own operations more energy efficient and is increasing its use of renewable electricity. As of the end of 2023, 91.9% of the electricity in its global manufacturing sites was from renewable sources. The goal is to reach 100%. The company is additionally continuing to reduce its value chain emissions (Scope 3). It works with its suppliers and the farmers it sources from to help them tackle their emissions and transition to regenerative agriculture. At the end of last year, 15.2% of Nestle's raw materials were sourced from farmers adopting such practices. The company's ambition is to get to 20% by 2025. It has also reduced the use of fossil fuels in areas such as product packaging and distribution.

More details can be found in Nestle's Creating Shared Value and Sustainability Report (pdf, 20Mb), which was published today.

Outlook: 2024 outlook: we expect organic sales growth around 4%. 2025 mid-term targets fully confirmed: mid single-digit organic sales growth.

About Nestle

Nestle is the largest food and beverage company in the world. It is present in 189 countries around the world, and its 308,000 employees are dedicated to Nestle's goal of improving the quality of life and contributing to a healthier future. Nestle offers a wide portfolio of products and services for people and pets, for life. Nestle's more than 2,000 brands include iconic names such as NESCAFE®, Nespresso®, Maggi® and Nesquik®. The company's performance is supported by the Nutrition, Health and Wellness strategy. Nestle is headquartered in Vevey, Switzerland, where the company was founded more than 150 years ago. Nestle maintains the number one position in a ranking of food and beverage manufacturers on making healthy food affordable and accessible to consumers. The Access To Nutrition Initiative (ATNI) Global Index assesses the 25 largest food and beverage manufacturers in the world on their nutrition-related policies, practices and performance.