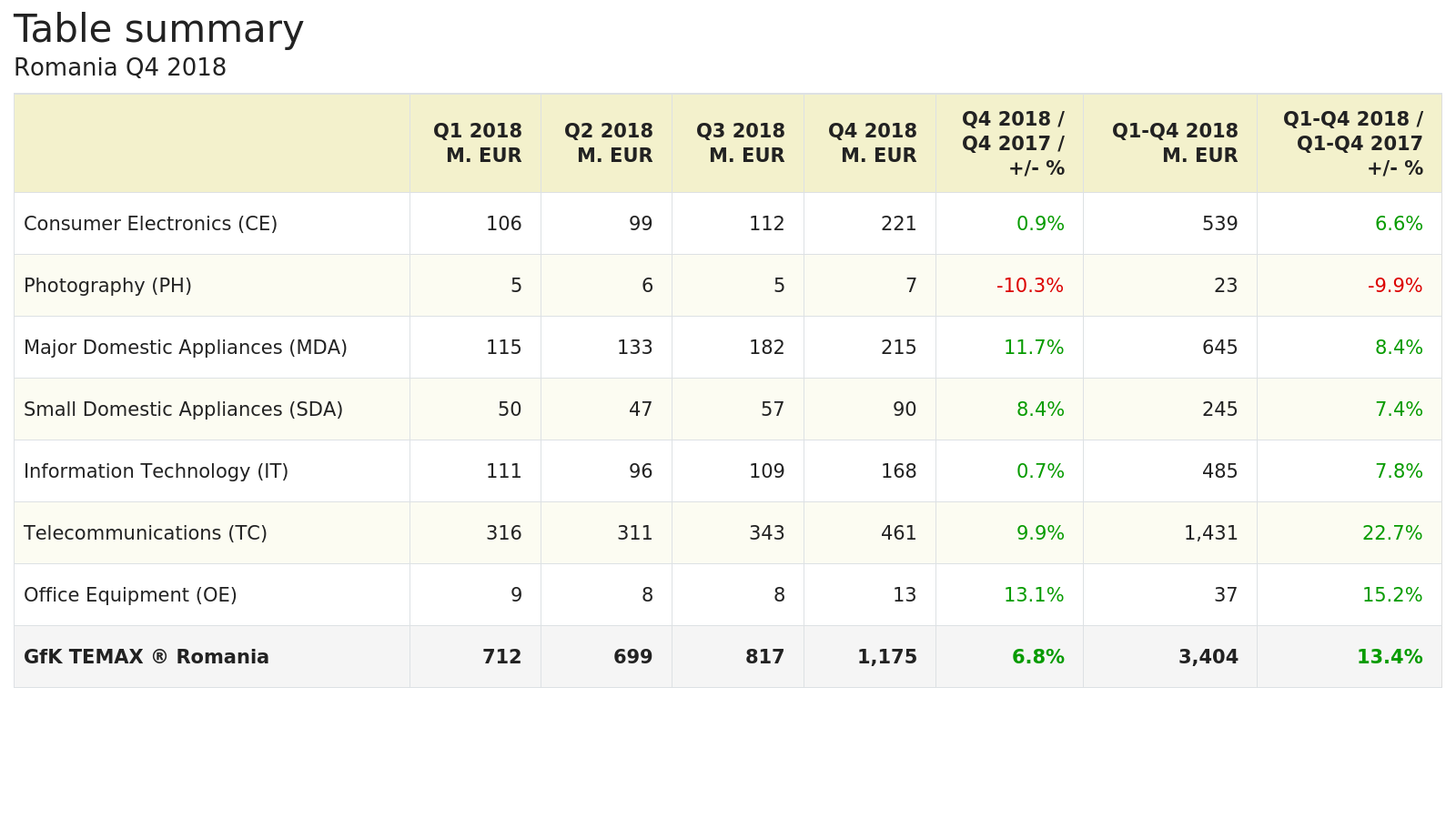

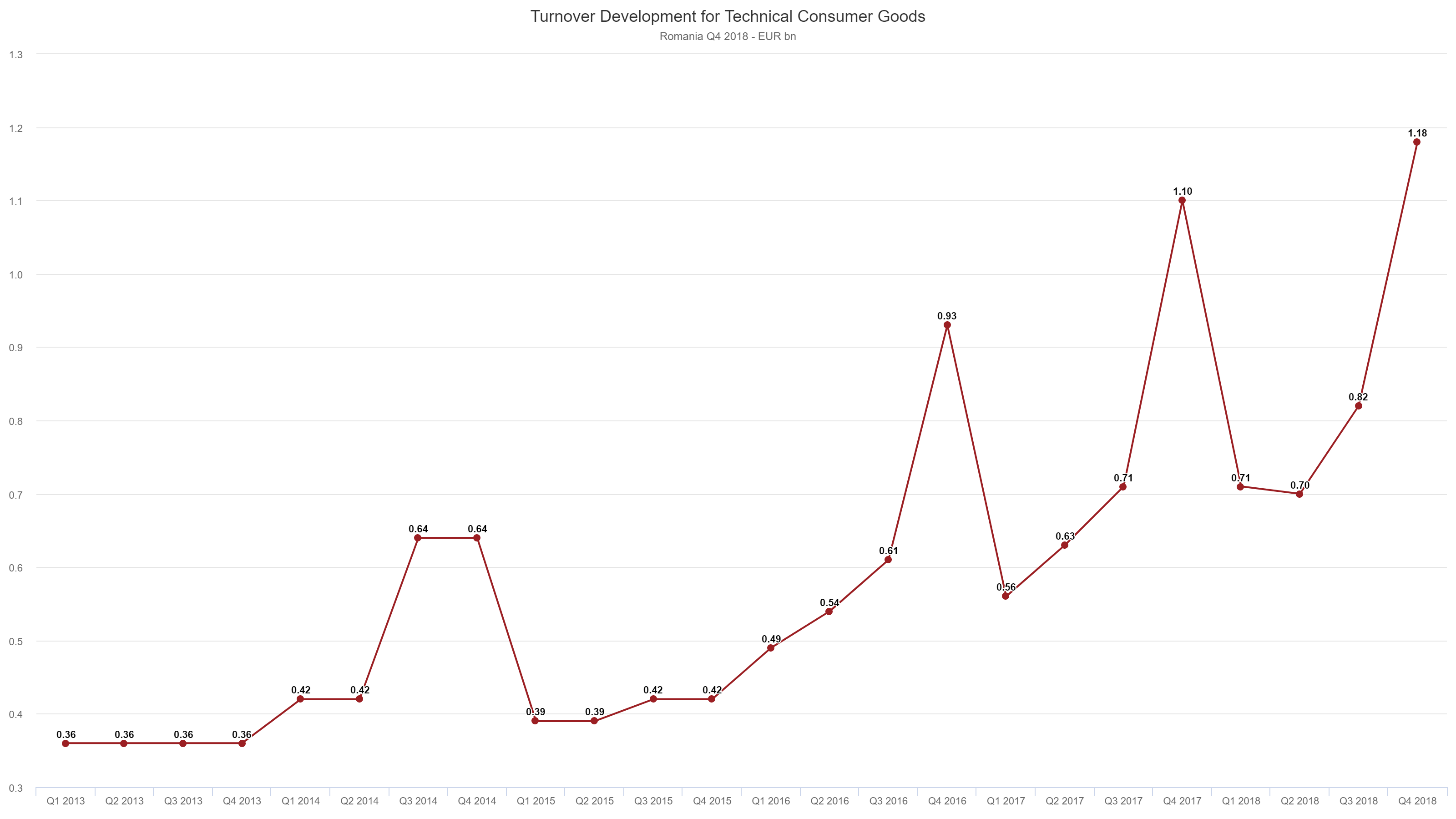

The Romanian durable goods market reached 3.4 billion euros in 2018, representing a 13% increase over the previous year. The main driver of this growth was the telecom sector, with an advance of 23% in value, to 1.4 billion euros. Telecom is the most important sector in the market, with a share of 42%.

At fourth quarter, the Romanian electro-IT market reached almost 1.2 billion euros, driven by promotional events such as Black Friday and Christmas. Compared to T4 2017, the market grew by almost 7%, with the major engines being the large home appliance and office equipment industries, with growth rates of 12% and 13%, respectively.

Telecom

The telecom market includes smart and mobile phones, phablets (smartphones with display size> 5.4 inches), earphones and wearables. While mobile phone sales are rapidly losing market share, smartphones and phablets benefit from growth rates of over 300%.

Also, the wearables category is booming (+ 45% compared to T4 2017), driven by new gadgets launched at a fast pace.

Compared to 2017, the entire sector increased by 35%. If we look at the quarterly performance, the T4 2018 saw a 10% gain compared to the same period in 2017, while within the sector, the phablets market grew by 287%.

Large home appliances

Large household appliances are the second sector of value in the local durable consumer goods market. They have enjoyed an annual increase of almost 12%, as a result of positive developments in products such as laundry dryers, + 45% compared to 2017 and dishwashers (+ 18%).

Quarterly, laundry dryers increased 52%, while freezers ranked second with an increase of 18% compared to Q4 2017. All other products in this sector have seen a growing trend, with microwave ovens remaining relatively constant in value (only + 0.6%).

The Electronics

The electronics market registered a value of 539 million euros in 2018, the third sector as a share of the entire electro-IT market and marking an increase of nearly 7 percent compared to 2017. 85% of the total value of the sector (or 458 million euros) comes from sales of TVs, a category of products that also tends to grow the sector, with the same increase of almost 7% compared to 2017.

We can also see dropping categories here, such as portable media players (-26% versus 2017) or video players who lost 21%.

What happened in T4? The trend is almost similar. For TVs, the last three months of the year brought 40% of sales, while the increase compared to T2017 was almost non-existent (0.2%).

Home cinema systems had a good evolution, + 2% over the T4 2017, along with audio systems, with an increase of over 12%. All the other categories were down in the 2018 T4, the most severe being for video players (-36%).

IT

The IT market grew by almost 8% to 485 million euros. Within this, the most important category is Mobile Computing (laptops), as it represents 55% of the value of the entire sector, up 7.5% from 2017.

However, computers and accessories continue to enjoy a healthy 14% growth, as well as monitors, with a 16% increase versus 2017.

Tablets represent the most affected product group of phablets and laptops. The value of sales reached 50 million in 2018, with 7.5% less than a year earlier. And for the IT sector, the fourth quarter represents the best period of the year, bringing 34% of total annual sales. The increase from T4 2017 was 1%.

Mobile Computing accounts for 55% of the quarterly sales of the sector and nearly 5% growth versus 2017 T4. But the largest increase was recorded by video cameras, 9.5%, up to a value of 3 million.

Computers accounted for nearly 18% of quarterly sales, down more than 8 percent over the same period in 2017, to a value of 30 million. The same situation was recorded in the case of tablets, with a decrease in sales of 9%, up to 16 million euro.

Small Appliances

With a value of € 245 million in 2018, small appliances account for just over 7% of the total electro-IT market and a 7% increase versus 2017.

Vacuum cleaners are the sector's star, a product category where product launches and innovations have raised sales value by more than 12% to 61 million and have a market share of 25% of the total.

We can see high growth rates for products such as razor, + 14%, up to 26 million, hot drinks, 26% increase and 39 million or fryers, with a 41% , but with a small base of only 2 million in 2018.

The categories that lose value are juice extractors and meat grinders: -17% and -9%, respectively.

At quarterly level, the vacuum cleaners increased by more than 17% to € 22 million, while hot drink makers registered sales of € 17 million, representing an increase of nearly 34% versus 2017 Q4.

What are the products that mark the highest growth rates in this sector? Ironing stations (over 57% compared to T4 2017), multicookers (56%) and fryers (50%), but at very low bases, with sales of only 1 million euros per product type at quarterly level.

Office equipment and consumables

The Office and Consumables segment, which includes all types of multifunction and print devices, had a healthy growth of 15% in 2018 to 37 million. With 13 million euros, the fourth quarter represents 34% of annual sales and 13% over the same quarter of 2017.

Photo

The sector includes digital cameras with a value of 23 million in 2018 and 10 percent below 2017. With tablets, it seems that the increase in the phablets category has had a negative impact on the cameras. At quarterly level, the sector reached 7 million euros, more than 10% less than the 2017 Q4.