• Total value of transactions estimated at US$ 7.1bn in 2023

• Real estate, hospitality & construction was the most active sector by deal count, displacing technology from the top position

• The United States continued to be the #1 country by origin of investor for inbound transactions

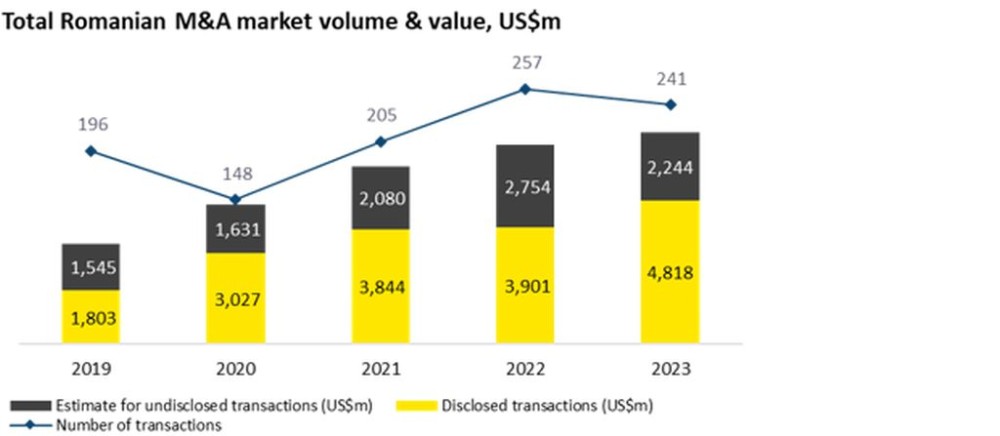

The Romanian mergers and acquisitions (M&A) market recorded 241 transactions1 during 2023, with a total estimated value of US$ 7.1bn2. This indicates a 6.1% increase by estimated value on a year-on-year basis (US$ 6.6 billion in 2022) and a 6.2% reduction compared to the transaction count of 2022 (257).

On a global level, M&A activity during 2023 continued its downward trajectory, extending a previous decline observed in 2022 and marking a 10-year low in terms of value. This trend was attributed to a prolonged environment of sustained higher financing costs, rising geopolitical tensions, general economic slowdown and heightened regulatory constraints. These headwinds led the value of global M&A to decrease by 13% year-on-year, while the value of European M&A decreased by 19%. In this context, Romanian M&A activity during 2023, much like in 2022, continued to defy both global and regional patterns, emerging once again as a notable outperformer.

Strategic investors maintained their predominant role in the local M&A market, accounting for 88% of transactions in 2023 by volume. Domestic deals experienced a marginal uptick, with 119 recorded transactions, compared to 116 in 2022, while the volume of transactions by foreign investors (inbound) declined by 13.9% year-on-year, totaling 105. Despite a lower overall weight in the total number of deals and a decrease to 11 deals from 14 in 2022, the number of outbound transactions remains strong from a historical perspective and reflects the resilience of Romanian investors’ willingness to execute cross-border transactions.

“In a challenging regional market environment, Romania continued its upward trend for M&A activity and outperformed established markets in 2023. Domestic M&A transaction levels remained elevated and represented almost half of total volumes, reflecting solid market fundamentals. The investor confidence in the local market is also marked by the announcement of two mega deals – Profi Rom Food and Enel Romania – which accounted for a significant portion of 2023’s transaction values. Given that dealmakers now have greater clarity over what the future holds, in particular about the trajectory of inflation and monetary policy normalization, we expect 2024 to bring further positive dynamics for the Romanian M&A market, backed by pent-up demand from willing investors and record levels of private equity dry powder”, said Iulia Bratu, Head of Lead Advisory at EY Romania.

The most active sectors by deal volume were real estate, hospitality & construction (17.0% of the number of transactions) and consumer products & retail (15.4%), followed by technology (12.4%) and energy & utilities (12.0%). In comparison to 2022, the number of transactions within the real estate, hospitality & construction sector decreased by 16.3% in 2023 due to sustained higher financing costs, but also surpassed technology as the primary sector, suggesting its relative strength. Technology, however, still secured the third position in terms of deal volume, emphasizing the growing importance of addressing digital transformation needs in a new economy, accelerated by the advent of emerging technologies such as artificial intelligence. Consumer products & retail claimed the second spot, boosted by local consumer strength and investor confidence in the Romanian market. Meanwhile, energy & utilities targets continued to benefit from the green energy transition at the European level.

The largest transactions of the year

• The acquisition of Profi Rom Food by Ahold Delhaize, a major player in the global food retail market from the private equity fund Mid Europa Partners for US$ 1.4 billion

• The acquisition of Enel Romania by the Greek energy group Public Power Corporation for US$ 1.3 billion

• The acquisition of Alpha Bank’s Romania unit by Italy-based Unicredit for US$ 319 million

• Mitiska REIM sold 25 retail parks to M Core Property HQ for US$ 236 million, one of the largest transactions ever recorded in the local commercial real estate sector

• Grupo Bimbo, the Mexican food company, acquired local bakery Vel Pitar for US$ 210 million

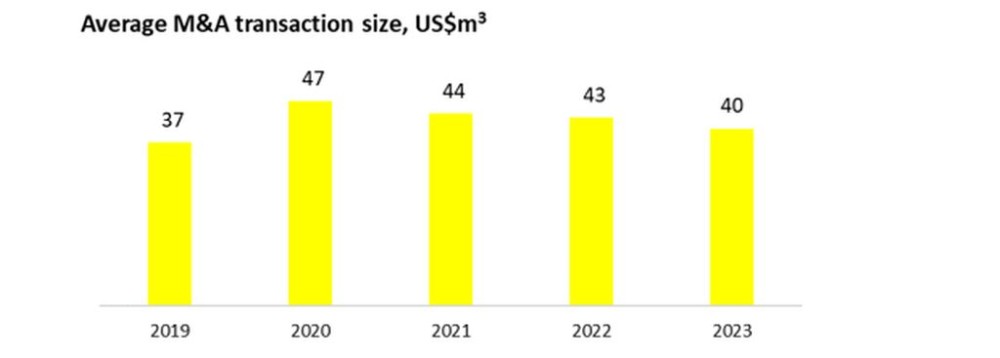

In 2023, the average transaction size decreased slightly to US$ 40m, continuing its post-2020 downward trend. This effect is also amplified by the consistent trend of unreported transaction values for larger deals. Lastly, the most active investors by country of origin came from the United States (9.5% of inbound deals), the Netherlands (8.6%), France, Switzerland, and Poland (7.6% each).

Note: (1) EY’s M&A database for Romania excludes transactions with stakes acquired of less than 15% as well as the transaction value for multi-country deals if the value of the country-specific assets is not disclosed. (2) includes an estimate of the value of transactions where no data was formerly disclosed by the parties or is not available in third party databases and/or reported by media sources (3) refers to transactions with disclosed values between US$ 5m – 500m

***

About EY Romania

EY is one of the world's leading professional services firms with 395,442 employees in more than 700 offices across 150 countries, and revenues of approx. $49.4 billion in the financial year that ended on 30 June 2023. Our network is the most integrated worldwide, and its resources help us provide our clients with services allowing them to take advantage of opportunities anywhere in the world.

With a presence in Romania ever since 1992, EY provides, through its more than 900 employees in Romania and the Republic of Moldova, integrated services in assurance, tax, strategy, and transactions, and consulting to clients ranging from multinationals to local companies.

Our offices are based in Bucharest, Cluj-Napoca, Timisoara, Iasi, and Chisinau. In 2014, EY Romania joined the only global competition dedicated to entrepreneurship, EY Entrepreneur Of The Year. The winner of the national award represents Romania at the world final taking place every year in June, at Monte Carlo. The title of World Entrepreneur Of The Year is awarded in the world final. For more information, please visit: www.ey.com