As Coronavirus (COVID-19) cases have grown in markets around the world, many non-essential retailers have closed due to government orders and even essential retailers, such as supermarkets and warehouse clubs, are finding shopper behaviour significantly changed. While retailers quickly turned to e-commerce promotions to drive sales during the early days of the closures, many brands and retailers are finding that discounts are insufficient to clear out existing inventory to make way for selling new products.

While the problem is most acute for seasonal merchandise – such as Easter candy or spring apparel in the Northern Hemisphere – brands and retailers of all product types need to consider alternative options for offloading excess merchandise for the sake of smoother future operations. Three options are turning to off-price stores, resale platforms and getting rid of the merchandise altogether through donation or recycling schemes.

1. Sell inventory to off-price retailers

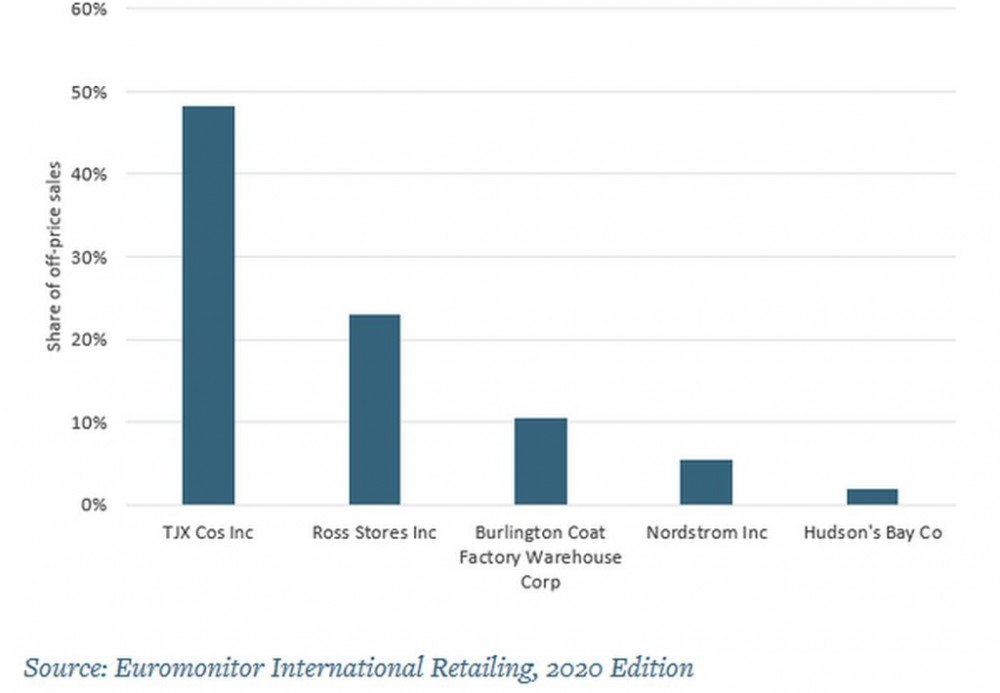

Off-price is an established destination for excess merchandise, particularly in North America and Western Europe. In these regions, companies such as TJX, Nordstrom and Ross have grown rapidly since the Global Financial Crisis of 2008 as consumers increasingly sought value and as brands endeavoured to wean consumers off the heavy discounts seen at the start of the 2010s. As the expected economic recession in 2020 plays out, consumers are likely to once again turn to value-orientated channels such as off-price.

Due to this format’s scale and the possibility of leveraging existing partners, many brands are likely to turn to off-price retail to handle inventory excess caused by COVID-19. Brands that go this route should entertain a back-up option. First, off-price retailers may find themselves flooded with interest from companies in 2020, making it hard for a brand to obtain attractive terms. Second, most off-price stores depend on an in-store “treasure hunt” experience, and it may be some time before most consumers are eager to linger in brick-and-mortar stores. Lastly, many off-price players have nascent e-commerce capabilities, making them vulnerable in the event of subsequent pandemic-related store closures.

Leading Off-Price Retailers Globally: 2019

2. Partner with resale platforms

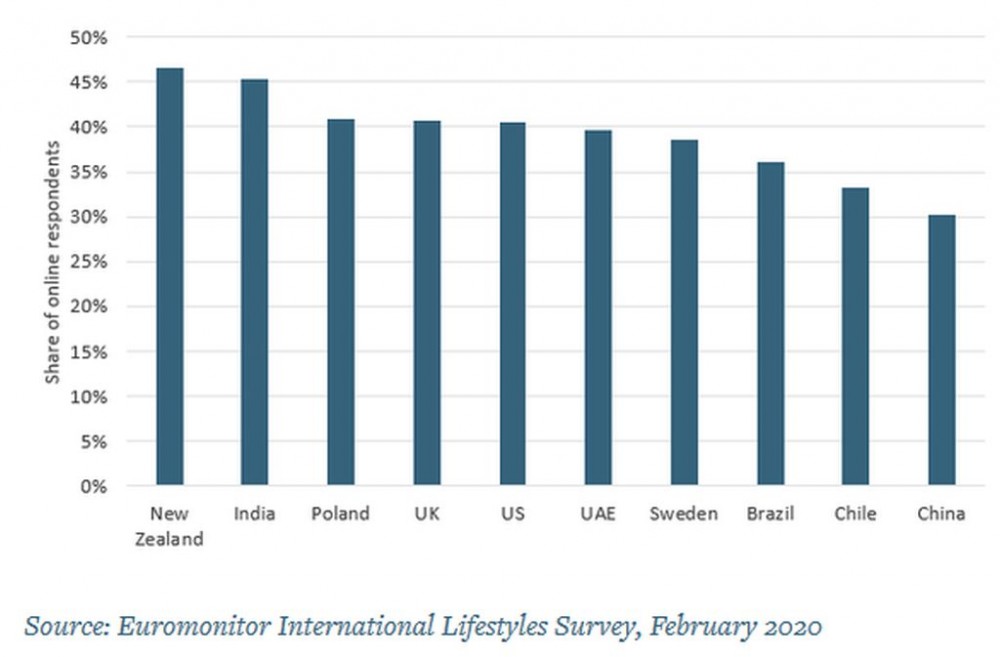

Over the last decade, numerous digital platforms such as Poshmark, Xianyu and OfferUp have emerged with the purpose of connecting buyers and sellers of second-hand items, driven by technology and growing consumer concern about the environment. Many of these platforms have also developed B2B revenue streams, such as services for brands to sell extra inventory to a resale platform or for a brand to maintain a storefront on one of these platforms.

For brands dealing with excess merchandise due to COVID-19-induced store closures, partnering with a resale platform offers an opportunity to recoup some of the costs of that inventory without diluting the brand value or resorting to heavy discounts. Consumers may be mildly discouraged from resale in the short term due to worries about sanitation of merchandise, but this is likely to be a short-term consideration. Indeed, as an example of this, high-end resale platform The RealReal has indicated that it has received a flurry of interest from luxury brands looking to sell excess merchandise on The RealReal’s platform.

Brands that go this route should first identify which resale platform is the best fit for the brand’s overall strategy. For example, a brand might seek to partner with a resale platform whose audience is slightly younger or lower income than the brand’s core shopper in order to reach new consumers. Brands should also consider cross-marketing with resale platforms – for example, by retargeting resale shoppers with future marketing campaigns once the pandemic has passed. Lastly, brands that were considering launching their own resale site prior to COVID-19 should consider accelerating such initiatives.

Shopping Frequency of Second-Hand Items: At Least Once Every Few Months

3. Donate or recycle excess items

............................................................................

The article is property of Euromonitor International, a market research provider, and can be read in full here.