Highlights 2021

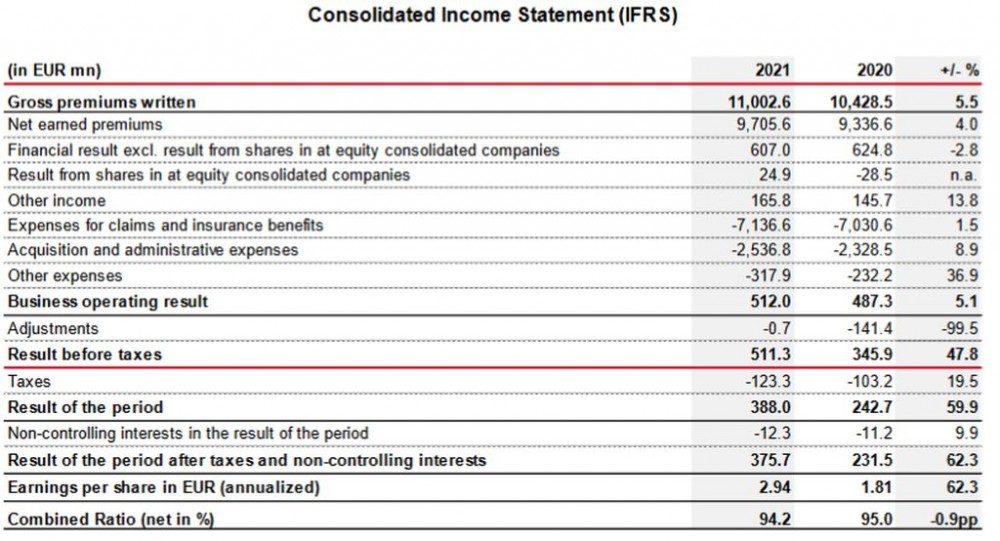

• Premium volume rose to EUR 11 billion (+5.5%)

• Profit (before taxes) increased to EUR 511 million (+47.8%)

• Combined ratio improved significantly to 94.2% (-0.8 percentage points)

• Proposed dividend increased to EUR 1.25/share (+66.7%)

“The VIG Group once again showed strong operational resilience in the second year of the worldwide pandemic with preliminary key figures for 2021 that are significantly above expectations. The results are proof of the successful, diversified position of the Group, of the excellent operating results of all of our insurance companies and of our early focus on the major challenges in the industry such as the digital transformation. For our shareholders, we will make a proposal to the Annual General Meeting that a significant dividend increase to EUR 1.25 per share be made for the financial year 2021. This corresponds to a year-on-year increase of 66.7% and to an attractive dividend yield of 5.0%. This also puts us clearly above the dividend of EUR 1.15 before the beginning of the COVID-19 pandemic.

We are deeply saddened by the war in Ukraine in the middle of one of our VIG markets. We are observing with great concern that people in a European country and within our Group are currently exposed to serious physical danger. The safety of our employees at our Ukrainian companies and helping them as much as possible are now the top priorities in this terrible situation. Our VIG companies started many assistance programs immediately after the war broke out and are showing the terrific team spirit within our Group. We have set up the “VIG Family Fund”, which is a fund with a base endowment of EUR 5 million, that all of our VIG companies and staff can pay into. The purpose of the fund is to provide direct financial support to our colleagues at the Ukrainian companies for emergencies and rebuilding caused by the war.

The current war situation in Ukraine is not only associated first and foremost with human suffering but also economic uncertainty and possible volatility on the capital markets. This has currently made it difficult to estimate business development for 2022. The VIG Group, however, sees itself as able to continue to manage its operational insurance business well because of its broad diversity and its conservative investment and reinsurance policies. We have repeatedly proven this in recent years in challenging situations. This is why we are confident that we will also be able to continue our positive performance in 2022”, explains CEO Elisabeth Stadler.

11 billion premium mark reached

The total premium volume of EUR 11 billion exceeded the value in the previous year by 5.5% with more than EUR 574 million. At the same time, the 11 billion mark was reached for the first time. The VIG Group was able to achieve significant growth in all lines of business. The only exception is single premium life insurance, which is falling slightly according to our strategy. In 2021, good premium growth was achieved especially in the other property and casualty insurance line of business (+8.0%) as well as in the motor lines of business (motor third party liability +7.0%, motor own damage +8.7%).

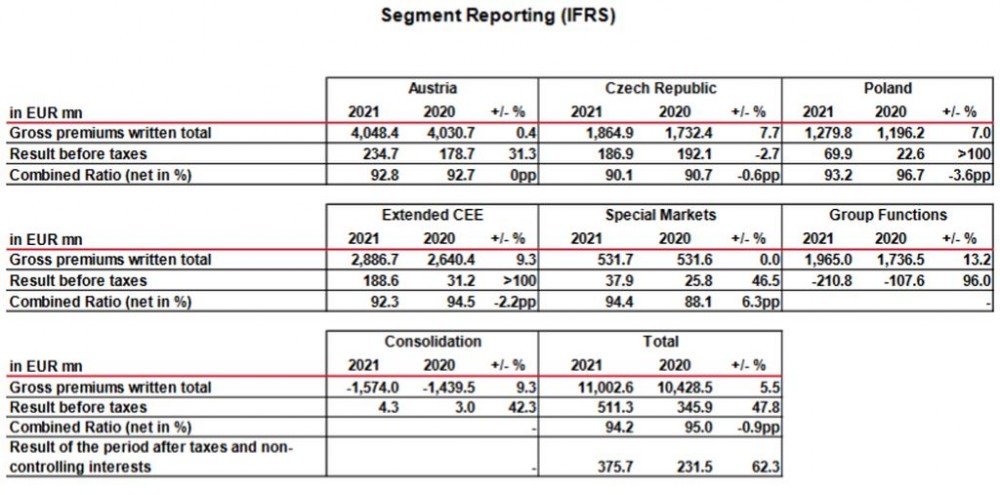

There was particularly strong growth for premiums written in the segments Czech Republic (+7.7%), Extended CEE (+9.3%) and Group Functions (+13.2%). Among the countries in the Extended CEE segment, especially the Baltic states (+9.1%), Croatia (+23.1%), Romania (+17.2%) and Hungary (+13.6%) had a dynamic premium growth. Overall, the Group generated 61.8% of its premiums outside Austria in 2021. The largest premium share of EUR 5,267 million is allocated to other property and casualty insurance, followed by regular premium life insurance at EUR 2,683 million, motor third party liability insurance at EUR 1,612 million, motor own damage insurance at EUR 1,402 million, single premium life insurance at EUR 869 million and health insurance at EUR 743 million.

Benefits with Serviceplus

Insurance benefits rose marginally by 1.6% to EUR 7.14 billion. The increase was the result of factors such as the significantly higher business volume in the non-life lines of business. A special focus was placed on expanding digital services for claims assessment and payments of claims and benefits.

Some VIG companies have put special app solutions on the market for this such as our Baltic company BTA with BTA DriveX that enables digital vehicle evaluation and automated claims entry for motor own damage insurance. The Romanian VIG company Asirom and Bulgarian Bulstrad are also among the companies that put digital claims processing apps on the market in 2021.

Profit (before taxes) increases by almost 50%

At EUR 511.3 million, the upper range of EUR 500 million expected for 2021 was exceeded and improved the previous year's result by 47.8%. The profit increase was primarily based on the significantly improved combined ratio as well as the good development of the financial result. The previous year’s result also included, among other things, goodwill impairments. The business operating result, adjusted for impairments of intangible assets, amounted to EUR 512 million and also showed a 5.1% increase compared to the previous year. At EUR 375.7 million, the net result was 62.3% higher than in the equivalent period in the previous year.

The financial result (including the result from at-equity consolidated companies) was up 6% above the value in the previous year at EUR 632 million. The increase on the same period of the previous year is mainly based on a better result from shares in at-equity consolidated companies.

Operating return on equity (operating RoE)

The VIG Group will report the operating return on equity as its new profitability key figure starting from the financial year 2021. This ratio is calculated by dividing the business operating result by the average shareholders’ equity. The VIG Group achieved an operating return on equity before taxes of 10.9% in 2021.

Combined ratio under the target value of 95%

The combined ratio showed especially clear improvement. At 94.2%, the value for 2021 was 0.8 percentage points below the previous year’s value. This success is mainly based on better claims development in the segments Czech Republic, Poland and Extended CEE and on sustainable efficiency increases in business operations. The comprehensive reinsurance programme made it possible to restrict the effects of the severe natural disasters (NatCat) on the combined ratio, which were reflected in the result at a net amount of roughly EUR 90 million.

Solvency

The preliminary solvency ratio of the Group was approximately 250% on 31 December 2021 (including transitional measures) and underscores the excellent capital adequacy of the Vienna Insurance Group.

Investments

Total investments (including cash and cash equivalents) were EUR 37.3 billion as of 31 December 2021 and rose by around 2%. The increase compared to the same reporting period in the previous year was mainly the result of a temporary increase in cash and cash equivalents in preparation for the planned acquisition of Aegon’s Eastern European business.

Proposed dividend of EUR 1.25 per share

Because of the very positive business development, the Managing Board of Vienna Insurance Group will make a proposal to the Annual General Meeting that, for financial year 2021, a significant dividend increase to EUR 1.25 per share be made compared to the dividend of 75 cents in the previous year.

This corresponds to an increase of 66.7% and to a dividend payout ratio of 42.6%. The dividend yield is a pleasing 5.0%. Compared to the previous year, earnings per share improved dramatically by 62.3% to EUR 2.94.

Outlook for 2022

The further development of the financial year 2022 will remain influenced by uncertainty factors especially associated with the war situation in Ukraine and its unforeseeable consequences. Furthermore, the ongoing pandemic, inflation, high commodity prices, supply chain problems and resource scarcity are included among the factors that lead to increased risks and may affect VIG markets accordingly. The consequences of these uncertainty factors and the resulting effects on the business development in 2022 cannot currently be estimated. For 2022, we are aiming for a positive operating performance subject to the aspects mentioned and taking into account the fact that the VIG Group has managed the current challenges in its operating insurance business very well up to this point.

Preliminary results

The information in this press release for the financial year 2021 is based on preliminary data. The final data for the financial year 2021 will be published in the Group Annual Report on 14 April 2022 on the website www.vig.com.

Note: New classification of reporting segments

For reporting purposes, the segments have been reduced from twelve to six to provide increased clarity. The six segments are made up of Austria, the Czech Republic, Poland, Extended CEE, Special Markets and Group Functions. Extended CEE covers Albania incl. Kosovo, the Baltic states, Bosnia- Herzegovina, Bulgaria, Croatia, Hungary, Moldova, North Macedonia, Romania, Serbia, Slovakia and Ukraine. The Special Markets segment comprises the four countries Germany, Georgia, Liechtenstein and Turkey. The Group Functions segment mainly includes the business of VIG Holding and VIG Re. The Montenegro and Belarus markets are not included in the scope of consolidation due to the immateriality of their contribution size.

Vienna Insurance Group AG Wiener Versicherung Gruppe (VIG) is the leading insurance group both in Austria and in the entire Central and Eastern European (CEE) region. Around 50 insurance companies in 30 countries form a Group with a long-standing tradition, strong brands and close customer relations. The more than 25,000 employees in the VIG take care of the day-to-day needs of more than 22 million customers. VIG shares have been listed on the Vienna Stock Exchange since 1994. The VIG Group has an A+ rating with stable outlook by the internationally recognised rating agency Standard & Poor's. VIG cooperates closely with the Erste Group, the largest retail bank in Central and Eastern Europe.