The preference for online shopping is growing, care for physical and mental health has become as high as care for the job, while spending intentions are deeply affected by declining personal incomes, according to PwC’s Global Consumer Insights Survey.

Consumer behavior change in 2020, following the outbreak of the COVID-19 pandemic, highlights three major trends: digital adaptation, concern for health and sustainability:

● 45% of global consumers say healthcare is one of the top three reasons for living in a city

● 69% of global consumers are more focused on mental health and well being

● 43% of global consumer expect businesses to be accountable for their environmental impact

More online shopping

While in-store grocery shopping is the main channel of choice, over a third of consumers (35%) are now buying food online, with 86% of those who shop online planning to continue after social distancing measures are removed.

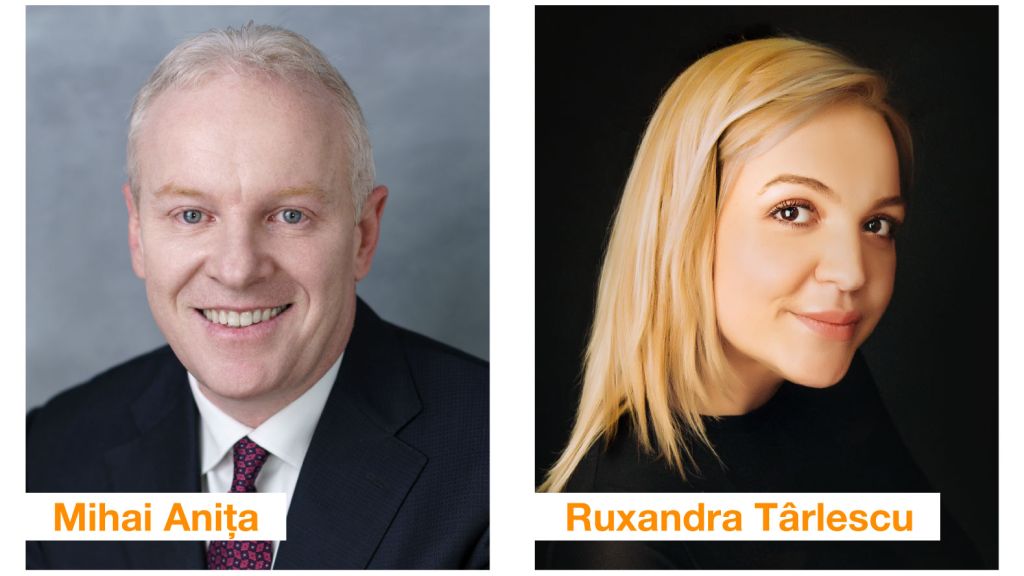

"The pandemic highlighted the benefits of online shopping and shaped consumer behavior and habits in a short time. This trend is expected to accelerate and, implicitly, stimulate companies and retailers to reinvent the way they operate. Most likely, we are heading for an omnichannel experience that will integrate more and more offline purchases with online ones sooner than expected ", said Mihai Anita, Partner, Retail & Consumer Leader, PwC Romania.

For non-food items, prior to the pandemic in-store shopping was still dominant compared to online shopping with 47% of consumers saying they shopped at brick-and-mortar stores daily or weekly compared to shopping via mobile phones (30%) and computers (28%).

Since then, online shopping for non-food items has seen a substantial increase: mobile phone 45% and computer 41%.

Growing self-care concerns

Focus on self-care has increased, with 51% of urban consumers agreeing or strongly agreeing that they are more focused on taking care of their mental health and wellbeing, physical health and diet as a result of COVID-19.

Urban dwellers surveyed after the outbreak, viewed safety and security, and healthcare just as important to their quality of life as employment prospects, with 49% and 45% of respondents saying so, respectively, compared to 45% for employment.

"Consumers' interest in health, well-being, diet is on the rise and will influence both the industries that offer products and services in these categories, as well as general consumption habits because people will expect all producers and suppliers to pay more attention to hygiene, safety, sustainability”, explains Ruxandra Tarlescu, Retail & Consumer Tax Leader Partner, PwC Romania.

Impact on personal expenses

Before the outbreak, consumer confidence was sky-high, with almost half (46%) of our survey respondents saying they expected to spend more in the next 12 months. When we reached back out to people after the outbreak had begun, 40% reported a decrease in income as a result of job loss or redundancy. In addition, the percentage of those who said they were going to spend less in the next few months almost doubled, and the number who said they were going to spend more dropped by more than 10 percentage points.

● 41% said their household bills (e.g., food, home heating, electricity) increased.

● 40% experienced a decrease in household income due to redundancy/loss of job/

● reduction in hours.

● 18% have experienced a decrease in income and an increase in household bills

Currently, consumers spend less on most categories of non-food products, with the largest decreases in clothing and footwear (51%) and sports equipment (46%).

Consumers and sustainability

In survey results taken prior to the pandemic, 45% of our global respondents say they avoid the use of plastic whenever possible, 43% expect businesses to be accountable for their environmental impact, and 41% expect retailers to eliminate plastic bags and packaging for perishable items. Interestingly, when we asked consumers who were most responsible for encouraging sustainable behaviours in their city, 20% chose “me the consumer,” while 15% chose “the producer or manufacturer.”

About the survey

Global Consumer Insights Survey is PwC’s 11th consecutive survey of global consumers. PwC conducted two separate online surveys, the first survey collected responses from 19,098 consumers from 27 countries or territories and 74 cities between August and September 2019. The second survey collected responses from 4,447 consumers from 9 countries or territories and 35 cities between April and May 2020.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We are a network of firms in 158 countries with over 276,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com. PwC refers to the PwC network and / or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.