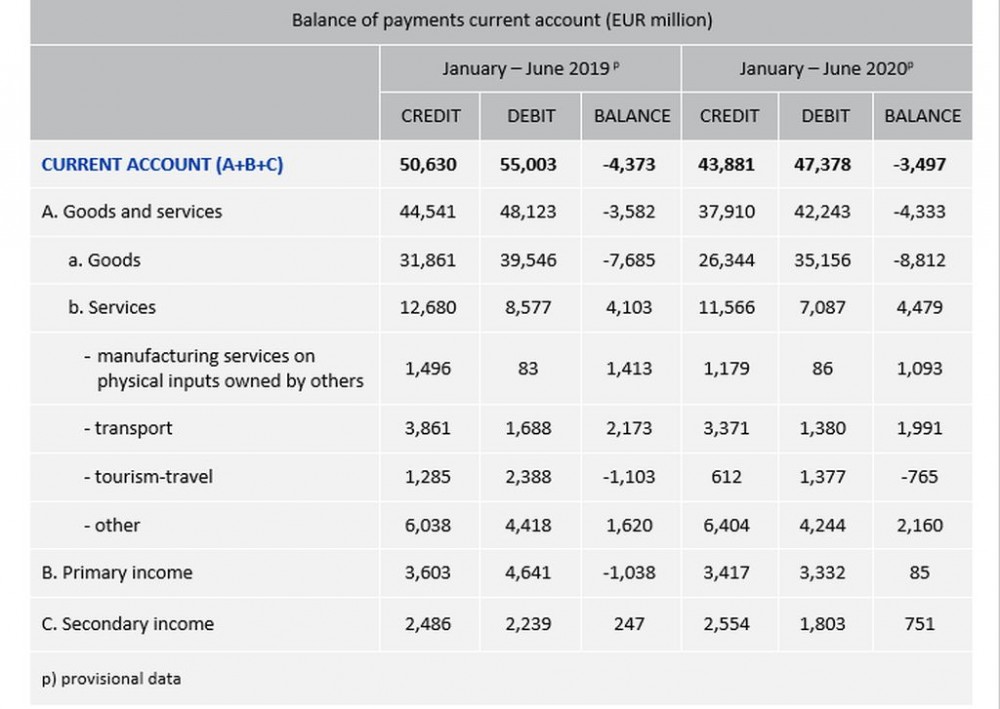

In January – June 2020(p), the balance-of-payments current account posted a deficit of EUR 3,497 million, compared with EUR 4,373 million in the same year-ago period. The deficit on trade in goods widened by EUR 1,127 million, the surplus on services increased by EUR 376 million, the primary income balance recorded a positive contribution of EUR 1,123 million, and the surplus of the secondary income balance rose by EUR 504 million.

Non-residents’ direct investment(e) in Romania totalled EUR 352 million (compared with EUR 2,697 million in January – June 2019), of which equity (including estimated net reinvestment of earnings) registered a net value of EUR 160 million and intercompany lending recorded a net value of EUR 192 million.

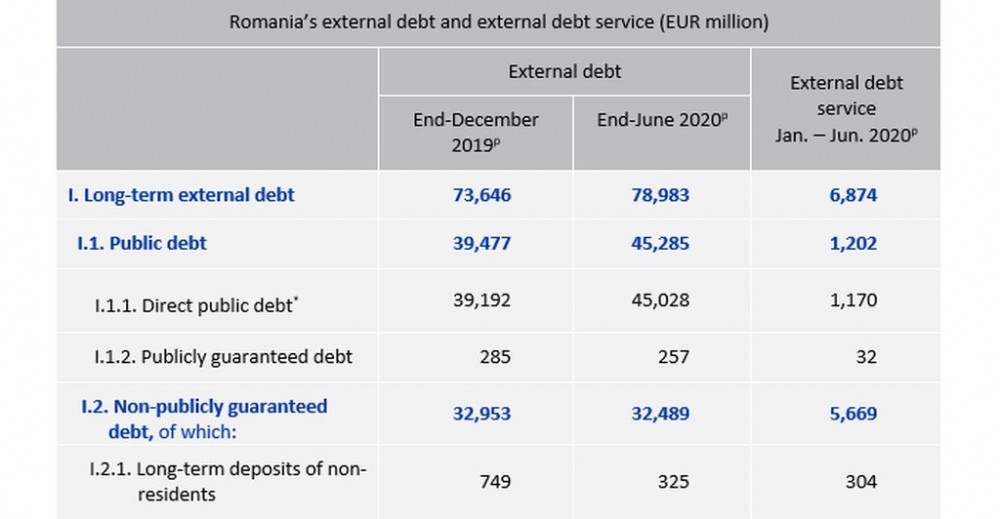

In January – June 2020, total external debt increased by EUR 5,579 million, of which:

- long-term external debt at end-June 2020 stood at EUR 78,983 million (70.9 percent of total external debt), up 7.2 percent against end-2019;

- short-term external debt at end-June 2020 amounted to EUR 32,469 million (29.1 percent of total external debt), up 0.8 percent from end-2019.

Long-term external debt service ratio ran at 18.1 percent in January – June 2020 against 18.6 percent in 2019. At end-June 2020, goods and services import cover stood at 5.7 months, as compared to 4.6 months at end-2019.

At end-June 2020, the ratio of the National Bank of Romania’s foreign exchange reserves to short-term external debt by remaining maturity came in at 80.0 percent, against 73.8 percent at end-2019.

Methodological Notes

1. Data are updated on a monthly basis. Data for the current period together with the revised data for the base period are available under Data sets; historical monthly and quarterly data going back to 2005 are available in the Interactive database.

2. Data from the NBR’s statistical surveys on International Trade in Services and Foreign Direct Investment may be affected by the impact of the pandemic, which, in statistical terms, consisted in the reduction of the reporting samples and the ensuing expansion of internal estimations. Accordingly, a greater magnitude of subsequent data revisions should not be ruled out.

3. The international standard framework for statistics on the transactions and positions between an economy and the rest of the world is set forth in the sixth edition of the IMF’s Balance of Payments and International Investment Position Manual (BPM6). The BPM6 methodology has been transposed into the EU legislation based on Commission Regulation (EU) No 555/2012 on Community statistics concerning balance of payments, international trade in services and foreign direct investment, as regards the update of data requirements and definitions.

4. In order to analyse current account data, the following aspects should be considered:

4.1. Goods (on a BOP basis): Source: National Institute of Statistics (NIS) – International Trade of Goods. Imports FOB are calculated by the NBR based on the CIF/FOB conversion factor set by the NIS. The balance of payments principle consists in entering goods based on the “change in economic ownership” criterion (goods acquired by residents are included, irrespective of whether the goods cross the country border or not), while in international trade statistics goods are recorded based on the “cross-border” criterion (goods are recorded when crossing the border, irrespective of whether they belong to residents or not). In order to ensure compliance with the “change in economic ownership” principle, the NIS data are adjusted by the NBR, so that the values of exports and imports of goods in the BOP statistics are different from those in international trade statistics. The main difference between the two types of statistics comes from manufacturing services on physical inputs owned by others which, according to BPM6, has been reclassified from Goods to Services and the data source has been changed from International Trade in Goods to the Quarterly Survey on international trade in services conducted by the NBR;

4.2. Services: Source: Quarterly Survey on International Trade in Services;

4.3. Primary income: includes compensation of employees, investment income (direct investment, portfolio investment, other investment) and other primary income (taxes, subsidies);

4.4. Secondary income: includes current private transfers and transfers of the general government.

5. Foreign direct investment: The permanent debt between affiliated financial intermediaries (banks, NBFIs) is not treated as direct investment, but recorded under financial account/other investment.

6. External debt includes the following debt financial instruments: currency and deposits, loans, debt securities, trade credit and advances, liabilities from insurance, pension, and standardised guarantee schemes, SDR allocation and other liabilities (according to the IMF’s External Debt Statistics Guide for Compilers and Users, 2014).

7. External direct public debt includes external loans taken directly by the MPF and local governments, in compliance with the legislation on public debt, including government securities purchased by non-residents – calculated at market value. The value of government securities purchased by non-residents is estimated as a difference between the total value of issues by general government and the total value of holdings of government securities by resident institutional sectors reported by the main financial intermediaries on their behalf and on behalf of their clients for which they render custody services, according to NBR Regulation No. 4/2014, as subsequently amended and supplemented.

8. External publicly guaranteed debt includes external loans guaranteed by the Ministry of Public Finance and local governments in compliance with the legislation on public debt.

9. Long-term external debt service ratio is calculated as a ratio of long-term external debt service to exports of goods and services.

10. Import cover is calculated as a ratio of the international reserves (foreign exchange + gold) at the end of period to average monthly imports of goods and services for the period under review.

11. Short-term external debt by remaining maturity refers to the short-term external debt outstanding at the end of period plus the payments related to long-term external debt due in the following 12 months.

12. Statistical data for the period 2013 – September 2019 have been updated according to the framework for the 2019 benchmark revision. Starting with October 2019, the data are compiled in the same methodological framework. More details can be found at: http://www.bnr.ro/Process-of-statistical-data-revision-20812.aspx.

The next monthly press release on the “Balance of payments and external debt” will be issued on 14 September 2020.