In year-on-year comparison, broad money rose by 8.5 percent (4.4 percent in real terms).

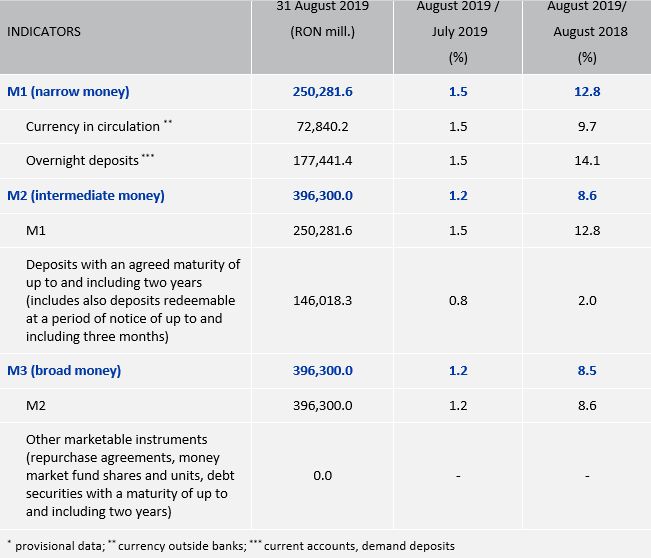

Table 1. Monetary aggregates*

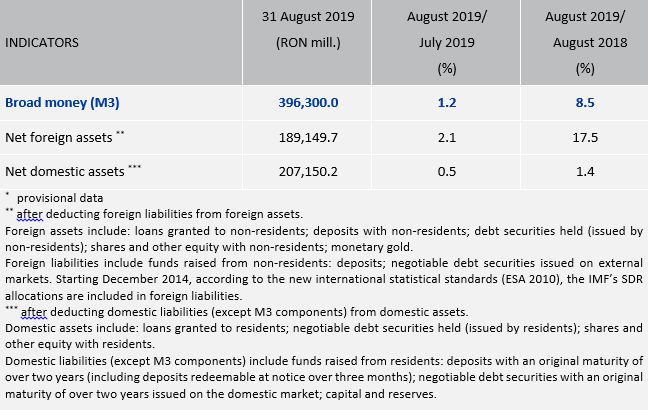

Table 2. Broad money and its counterpart*

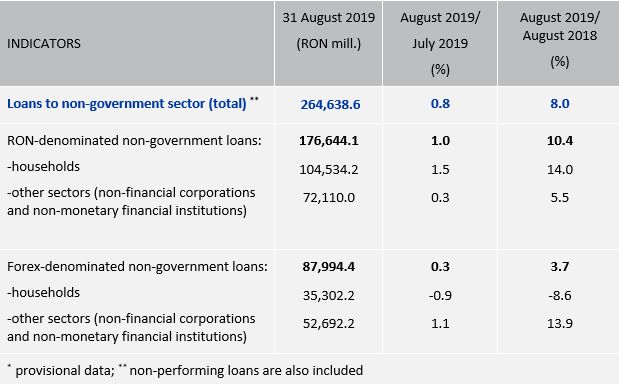

At end-August 2019, loans to non-government sector granted by credit institutions advanced by 0.8 percent (0.7 percent in real terms) from July 2019 to RON 264,638.6 million. RON-denominated loans went up 1.0 percent (0.9 percent in real terms) and foreign currency-denominated loans increased 0.3 percent when expressed in RON (0.4 percent when expressed in EUR). In year-on-year comparison, loans to non-government sector went up 8.0 percent (4.0 percent in real terms), on the back of the 10.4 percent increase in RON-denominated loans (6.2 percent in real terms) and the 3.7 percent increase in foreign currency-denominated loans expressed in RON (when expressed in EUR, forex loans stood 1.8 percent higher).

Table 3. Loans to non-government sector*

Credit to general government advanced by 1.7 percent in August 2019 from the previous month to RON 104,812.3 million and by 4.8 percent (0.9 percent in real terms) versus the year-ago period.

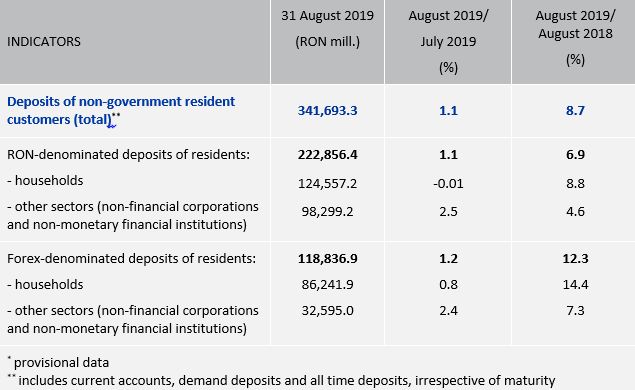

Deposits of non-government resident customers went up 1.1 percent month-on-month to RON 341,693.3 million in August 2019, and the annual growth rate was 8.7 percent (4.6 percent in real terms).

Table 4. Deposits of non-government resident customers*

RON-denominated household deposits decreased by RON 12.7 million to RON 124,557.2 million month on month and moved up 8.8 percent (4.7 percent in real terms) year on year.

RON-denominated deposits of other sectors (non-financial corporations and non-monetary financial institutions) advanced by 2.5 percent to RON 98,299.2 million. At end-August 2019, RON-denominated deposits of other sectors climbed by 4.6 percent year on year.

Residents’ forex-denominated deposits increased 1.2 percent against the previous month to RON 118,836.9 million when expressed in domestic currency (when expressed in EUR, forex deposits moved up 1.3 percent to EUR 25,127.3 million). In year-on-year comparison, residents’ forex deposits expressed in RON grew 12.3 percent (when expressed in EUR, residents’ forex deposits rose by 10.3 percent).

At end-August 2019, forex deposits of households advanced month on month 0.8 percent (0.7 percent in real terms) when expressed in domestic currency (when expressed in EUR, forex deposits of households moved up 0.9 percent). At end-August 2019, households’ forex deposits climbed by 14.4 percent year on year when expressed in domestic currency (when expressed in EUR, households’ forex deposits expanded by 12.3 percent).

Forex-denominated deposits of other sectors (non-financial corporations and non-monetary financial institutions) went up 2.4 percent (2.3 percent in real terms) when expressed in RON (when expressed in EUR, forex deposits of other sectors increased 2.4 percent). In year-on-year comparison, forex deposits of other sectors (non-financial corporations and non-monetary financial institutions) stood 7.3 percent higher when expressed in RON (when expressed in EUR, forex deposits of residents from other sectors rose by 5.4 percent).

Note:

In the monetary balance sheets of monetary financial institutions, the accrued interest receivable/payable related to financial assets and liabilities is recorded under remaining assets/remaining liabilities.

Data for preparing monetary indicators are reported by monetary financial institutions in accordance with NBR Regulation No. 4/2014 on reporting statistical data and information to the National Bank of Romania, as subsequently amended and supplemented, Title I, Chapters I and II.

The statistical data are provisional and may be subject to periodic review. Series of indicators (available from January 2007) can be accessed in various formats (html, xls, xml and csv) in the interactive database http://www.bnr.ro/Interactive-database-1107.aspx.