The expansion of the Coronavirus (COVID-19) outbreak into a global pandemic in March 2020 has shifted the global economic outlook into a recession. At the beginning of April, Euromonitor International downgraded the baseline global real GDP growth forecast for 2020 to a range of -1.5% to 0.0% (compared to 2.6-3.4% growth forecast in January 2020).

China’s real GDP growth forecast has been cut to just 1.0% in 2020, while the US economy is expected to contract by 3.0%. The Eurozone economy is forecast to contract by 4.4% in 2020, with Italian real GDP declining by 7.0%.

The size of the downgrades due to the COVID-19 pandemic reflect the strong impact of social distancing measures on economic activity. Each month of strict quarantine/lockdown is expected to reduce annual output growth in advanced economies by around three percentage points.

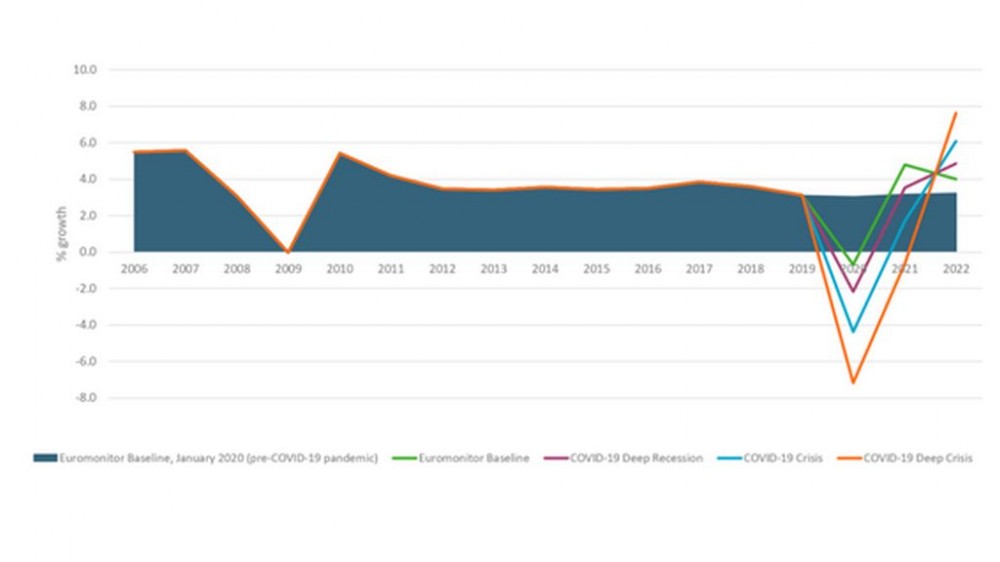

Global Real GDP Growth: 2006-2022

COVID-19 scenarios predict a worse impact than the 2008 global financial crisis

In addition to updating the baseline forecast, there have been introduced three adverse global scenarios to capture the major downside risks related to the COVID-19 pandemic. In the baseline forecast, the size of the contraction in economic activity is comparable to that during the 2008-2009 global financial crisis.

The projected world real GDP growth rate for 2020 is lower than in 2009, but trend growth was faster in the 2000s, so the deviation from trend growth is similar at around 4 percentage points below the pre-pandemic forecast. Our adverse downside risks scenarios are worse than the 2008-2009 financial crisis.

The baseline forecasts assume that strict social distancing measures successfully flatten infection rate curves over 1-2 quarters, with infection rates below 10% in key economies and case mortality rates that are less than 1% on average (accounting for a large number of mild or asymptomatic infections).

Risks of health crisis turning into a longer-term financial crisis

The pandemic is causing severe financial strains in many sectors of the economy, as businesses are forced to shut down and employees lose work shifts or are laid off. The hit to business revenues and household incomes risks turning a health crisis and temporary cuts in economic activity into a longer-term financial crisis.

Governments in advanced economies have reacted to the COVID-19 pandemic with unprecedented fiscal and credit stimulus measures, exceeding 10% of pre-pandemic output in some cases. The baseline outlook assumes these measures are enough to avoid massive business liquidations and eliminate most of the losses in disposable income for workers. As a result, the economy rebounds relatively quickly once social distancing measures are relaxed. Global real GDP growth is expected to improve to 3.7-5.7% in 2021.

However, the level of uncertainty around baseline forecasts is now unprecedented in the last 30 years. There is epidemiological uncertainty about the spread of COVID-19 and its death rate, as well as the length of strict social distancing measures. There is economic uncertainty about the ability of government credit and fiscal stimulus measures to counter negative financial amplification effects.

Adverse COVID-19 scenarios are as important as the baseline outlook

To account for all this uncertainty, there have been introduced three adverse COVID-19 economic scenarios, ranging from a deep recession all the way to economic crisis scenarios:

• The baseline forecast is assigned around...................................................

By: Daniel Solomon

The article is property of Euromonitor International, a market research provider, and can be read in full at: https://blog.euromonitor.com/introducing-euromonitors-coronavirus-global-economic-scenarios/