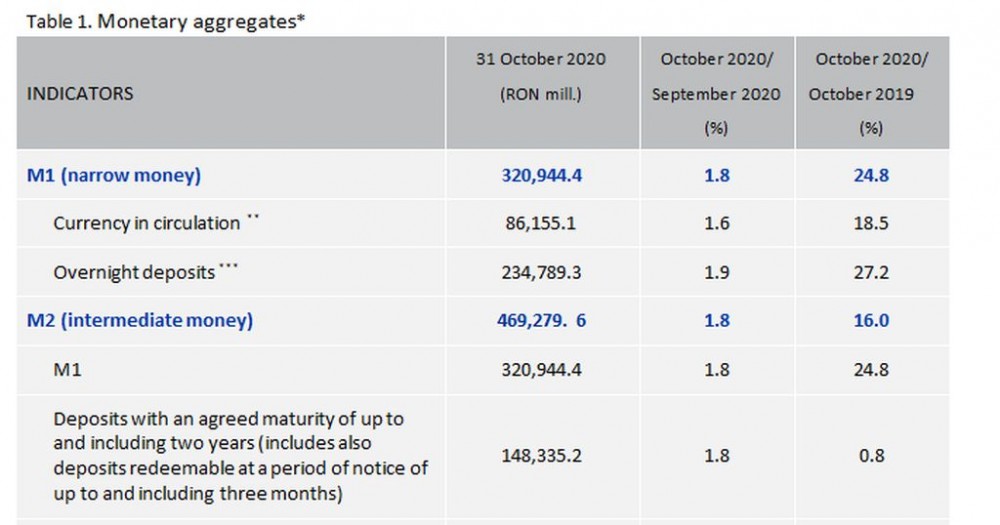

At end-October 2020, broad money (M3) amounted to RON 469,279.6 million, up 1.8 percent (1.6 percent in real terms(1)) month on month and 16.0 percent (13.5 percent in real terms) year on year.

(1)According to press release no. 294 issued on 11 November 2020 by the National Institute of Statistics, in October 2020 the consumer price index was 100.22 month on month and 102.24 year on year.

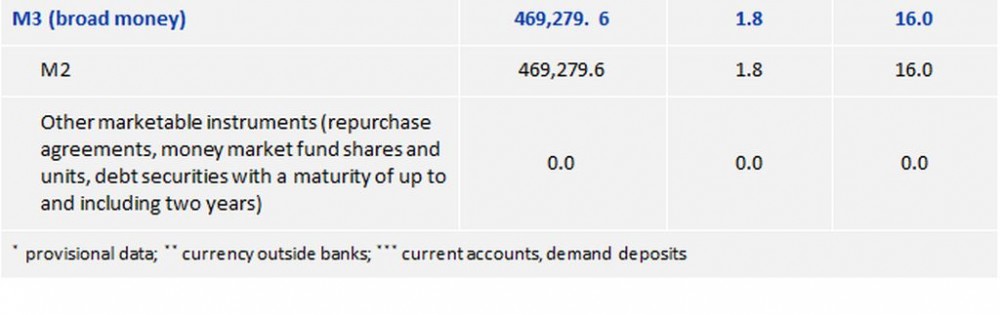

Table 2. Broad money and its counterpart*

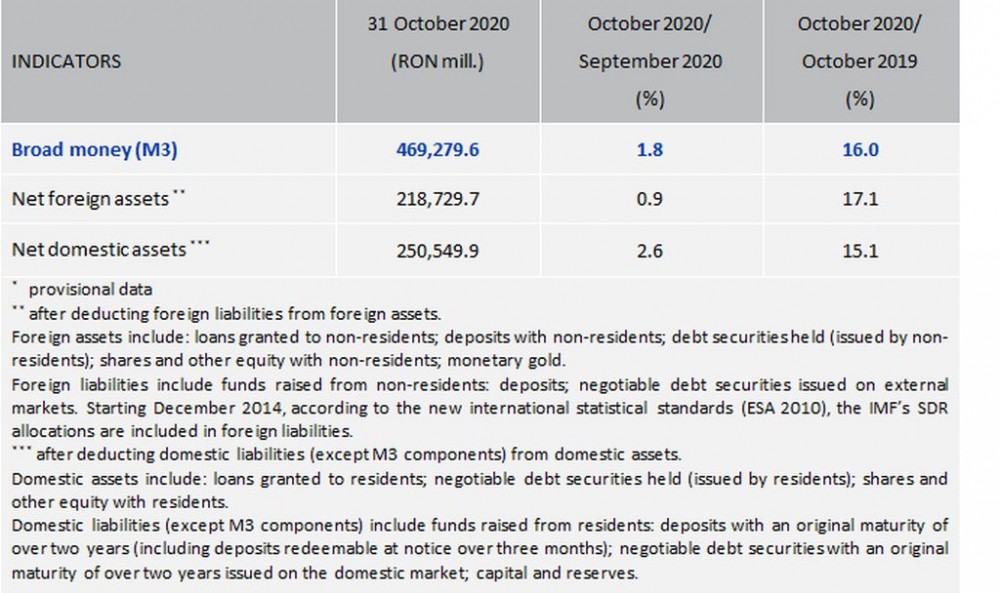

At end-October 2020, loans to non-government sector granted by credit institutions increased 0.6 percent (0.4 percent in real terms) from September 2020 to RON 279,172.6 million. RON-denominated loans, representing 69.0 percent of total volume of loans to non-government sector, moved up 1.2 percent, whilst foreign currency-denominated loans, representing 31.0 percent of total loans to non-government sector, decreased 0.8 percent when expressed in RON (when expressed in EUR, the indicator went down 0.9 percent).

In year-on-year comparison, loans to non-government sector advanced 4.1 percent (1.8 percent in real terms), on the back of the 7.4 percent increase in RON-denominated loans (5.1 percent in real terms) and the 2.7 percent decrease in foreign currency-denominated loans expressed in RON (down 5.0 percent when expressed in EUR).

Table 3. Loans to non-government sector*

Credit to general government(2) increased by 3.5 percent in October 2020 from the previous month to RON 138,924.1 million and moved up 26.3 percent (23.6 percent in real terms) versus the year-ago period.

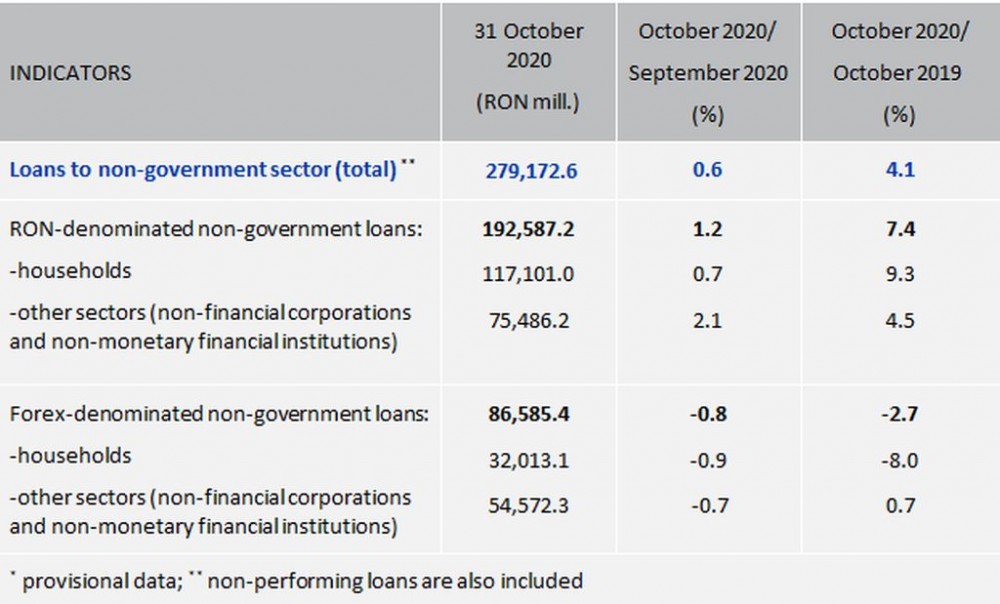

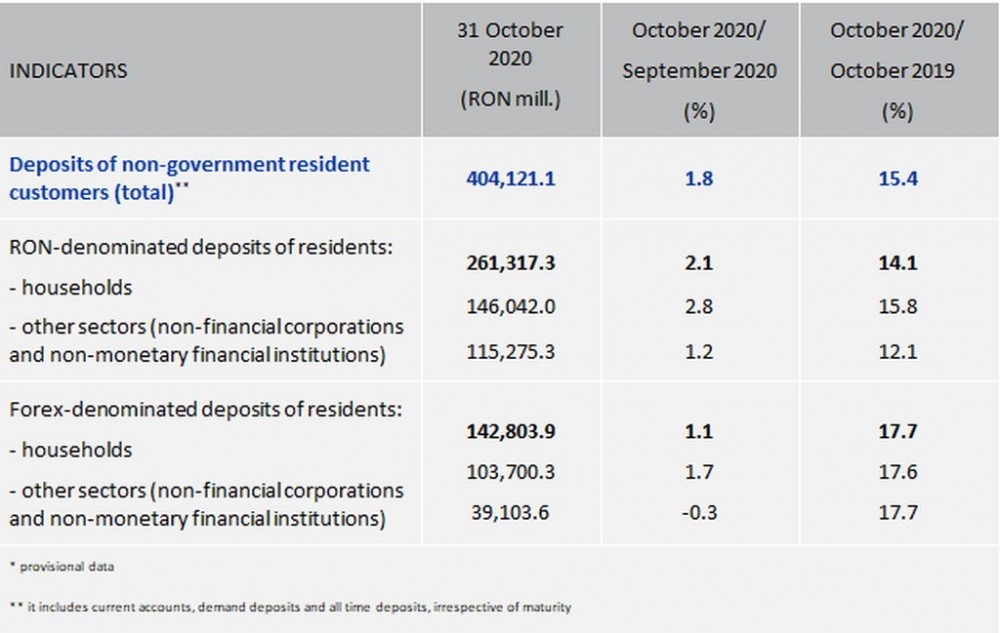

Deposits of non-government resident customers advanced by 1.8 percent month on month to RON 404,121.1 million and the annual growth rate was 15.4 percent (12.8 percent in real terms).

RON-denominated deposits of residents, representing 64.7 percent of deposits of non-government customers, moved up 2.1 percent to RON 261,317.3 million month on month and 14.1 percent (11.6 percent in real terms) year on year.

(2) It includes credit granted to general government (central government, local government and social security funds) in amount of RON 12,941.4 million and debt securities held, issued by these institutional sectors running at RON 125,982.7 million (outstanding at end-October 2020).

Table 4. Deposits of non-government resident customers*

RON-denominated household deposits advanced by 2.8 percent to RON 146,042.0 million month on month and by 15.8 percent (13.3 percent in real terms) year on year.

RON-denominated deposits of other sectors (non-financial corporations and non-monetary financial institutions) went up 1.2 percent (to RON 115,275.3 million) month on month and 12.1 percent (9.7 percent in real terms) versus the year-ago period.

Foreign currency-denominated deposits of residents, representing 35.3 percent of total volume of deposits of non-government customers, increased by 1.1 percent against September 2020 to RON 142,803.9 million when expressed in domestic currency (when expressed in EUR, these deposits went up 1.0 percent to EUR 29,297.3 million). In year-on-year comparison, this indicator grew 17.7 percent when expressed in RON and 14.8 percent when expressed in EUR.

Foreign currency-denominated deposits of households went up 1.7 percent from September 2020 to RON 103,700.3 million when expressed in RON (up 1.6 percent when expressed in EUR). On an annual basis, this indicator expanded by 17.6 percent when expressed in domestic currency and by 14.8 percent when expressed in EUR.

Foreign currency-denominated deposits of other sectors decreased by 0.3 percent against the previous month to RON 39,103.6 milion when expressed in RON (down 0.4 percent when expressed in EUR). Compared to October 2019, this indicator moved up 17.7 percent when expressed in RON (up 14.9 percent when expressed in EUR).

Note:

In the monetary balance sheets of monetary financial institutions, the accrued interest receivable/payable related to financial assets and liabilities is recorded under remaining assets/remaining liabilities.

Data for preparing monetary indicators are reported by monetary financial institutions in accordance with NBR Regulation No. 4/2014 on reporting statistical data and information to the National Bank of Romania, as subsequently amended and supplemented, Title I, Chapters I and II.

The statistical data are provisional and may be subject to periodic review. Series of indicators (available from January 2007) can be accessed in various formats (html, xls, xml and csv) in the interactive database http://www.bnr.ro/Interactive-database-1107.aspx. Statistical data series including monetary aggregates and non-government loans expressed as a share of GDP can be accessed here link.

The next press release on monetary indicators for end-November 2020 will be issued on 28 December 2020. Press release archive: http://www.bnr.ro/Press-Releases---Monetary-Indicators-4169.aspx