In addition, there is no unitary way of taxation, as shown by the latest EY study on the subject, "2018 Worldwide Estate and Inheritance Tax Guide".

By way of example, Italy currently has a distinct charging system for financial assets or real estate held abroad by residents, while the Netherlands has different tax rates depending on the net asset value dimension. In Spain, net wealth tax is an annual fee charged to individuals on 31 December of each year.

The property subject to this tax is defined as being composed of all assets and rights that can be evaluated economically, less all the duties or debts the person may have and which substantially reduce his wealth.

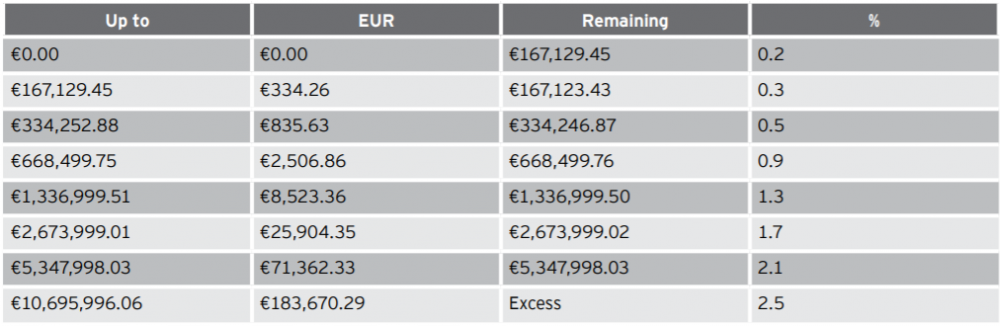

If the individual is resident in Spain, the tax is levied on the global wealth owned, while non-residents are taxed only on assets located in Spain. Below we've put a numerical example to illustrate the Spanish system:

In Norway, inheritance and gifts are added to the net asset of the taxpayer, and the basis of wealth tax is the market value of its assets minus debts. Net profit thus calculated is taxed only if it exceeds a ceiling of approximately EUR 150,000 per year (2018).

And if we still remember inheritances and gifts, it is worth moving our analysis to what was happening in Romania during this time.

Among other things, they recently took the front page of the "Wedding Taxation" newspaper and the ANAF initiative to send young married requests that they declare what economic relations they had in the context of civil and religious marriage with individuals or firms that have them provided photo services, party music and space, etc.

Can this action be an income tax test whose source is not identified?

Because, basically, this is the only procedure transposed into the 2011 Tax Code.

And, although already implemented for several years, the control procedure of the General Inspectorate for Personal Income Control did not leave much transparency to taxpayers subject to fiscal control, they risked a 16% tax liability plus default interest and penalties for each year subject to control.

As a matter of fact, in September 2018 only the forms and documents used in the verification of the personal tax situation were published and the indirect methods used by the tax inspectors in the analysis procedure still triggered many procedural controversies.

In order to recall some technical details, the verification of the personal tax situation of resident Romanian taxpayers in respect of income tax has as an object the examination of all rights and obligations of patrimonial nature, cash flows and any other elements relevant for determining the tax situation actual physical person verified.

To this end, documents and means of proof are required regarding the tax situation of the verified physical person, obtained also by requesting information, under the terms of the Fiscal Procedure Code, from third parties or authorities and public institutions holding, both from the country and from abroad, based on international information exchange conventions or, failing that, on a reciprocal basis.

From practical experience, in such tax audits, the control process can be considered difficult both from the point of view of the procedure and from the need to rebuild wealth at an initial stage (instead of the fiscal prescription period, considering the estimated value of the wealth acquired up to at that time).

We believe that it is important to stipulate in the Constitution of Romania that the licit nature of the acquisition of property is presumed and any verification of the person's tax situation must facilitate the procedure of restoring the property in reasonable time and effort.

Until now, in a first stage, only 313 cases of people - owners of luxury cars, large buildings or substantial bank deposits - have reached the point of view of the Tax, after a risk analysis revealed that their wealth does not correspond to the income declared.

It remains to be seen what will be the balance of the efforts made so far by fiscal inspectors with this control procedure initiated in the last years (2011 being the first subject to such control) and if the legislator would like to keep a fiscal record and accounting for the personal situation where the verification threshold exceeds the minimum required by the law (the difference between estimated and declared revenues of more than 10%, but not less than 50,000 lei).

Until then, instead of concluding: in the review of the EY guide mentioned above, we observe both an increased refinement of the mode of taxation of wealth in various countries (including some close ones, for example Bulgaria or Poland), and an increase in those interested in introduces clear procedures for this purpose. Do we just want to stay with "wedding tax"?