Against this challenging backdrop, EMDE growth has stalled, with a sharply weaker-than-expected recovery in commodity exporters accompanied by a deceleration in commodity importers.

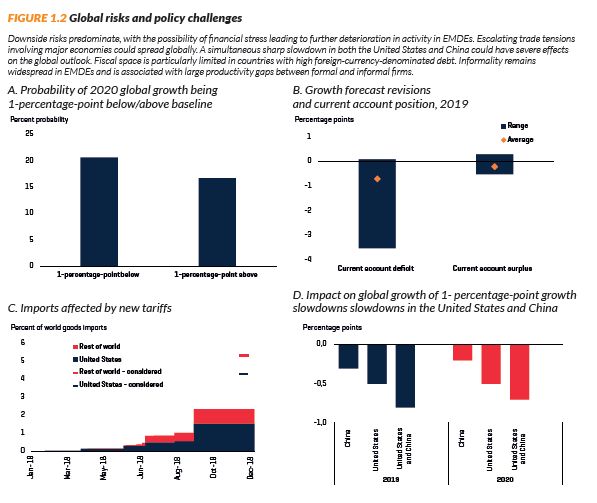

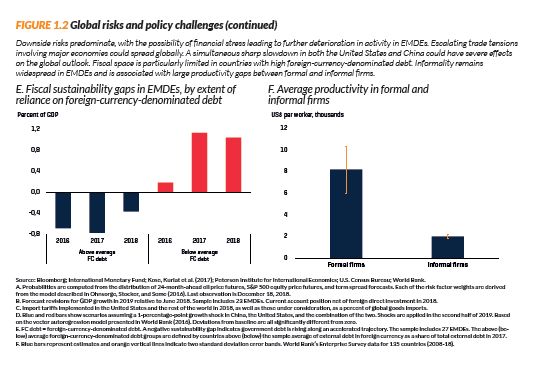

Downside risks have become more acute. Disorderly financial market developments could disrupt activity in the affected economies and lead to contagion effects. Trade disputes could escalate or become more widespread, denting activity in the economies involved and leading to negative global spillovers. To confront this increasingly difficult environment, the most urgent priority is for EMDE policymakers to prepare for possible bouts of financial market stress and rebuild macroeconomic policy buffers as appropriate. Equally critically, policymakers need to foster stronger potential growth by boosting human capital, removing barriers to investments, and promoting trade integration within a rules-based multilateral system. Such efforts would also help address the challenges associated with informality.

Summary

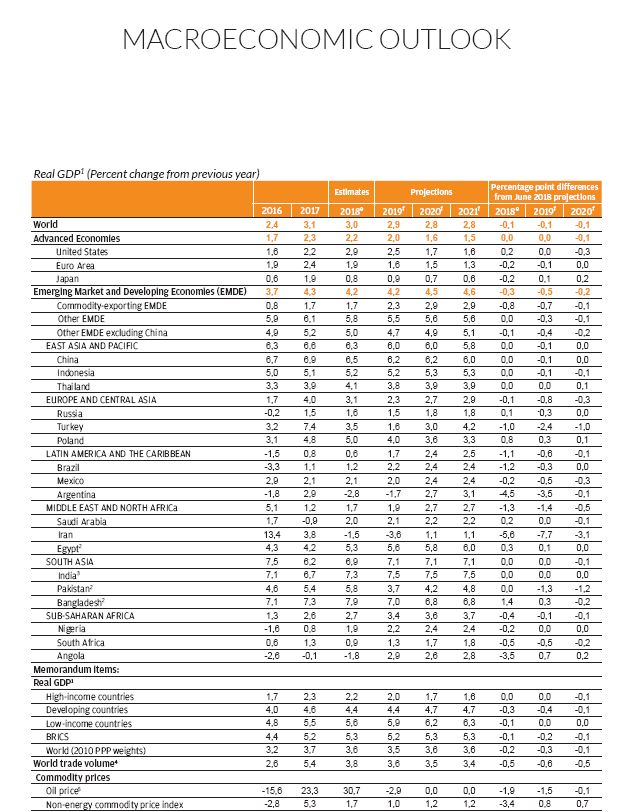

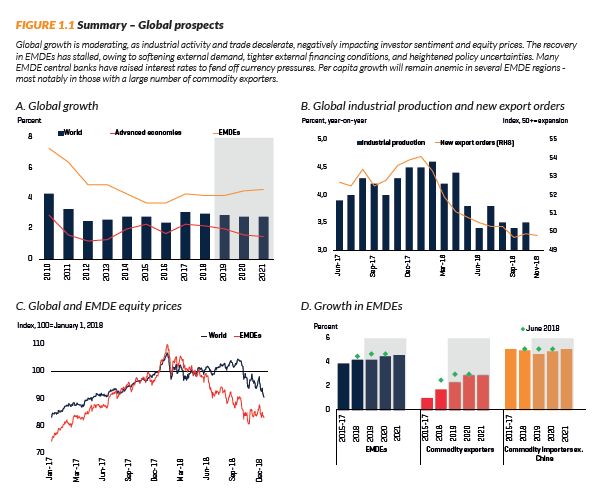

Global growth is moderating as the recovery in trade and manufacturing activity loses steam (Figure 1.1). Despite ongoing negotiations, trade tensions among major economies remain elevated. These tensions, combined with concerns about softening global growth prospects, have weighed on investor sentiment and contributed to declines in global equity prices. Borrowing costs for emerging market and developing economies (EMDEs) have increased, in part as major advanced-economy central banks continue to withdraw policy accommodation in varying degrees. A strengthening U.S. dollar, heightened financial market volatility, and rising risk premiums have intensified capital outflow and currency pressures in some large EMDEs, with some vulnerable countries experiencing substantial financial stress. Energy prices have fluctuated markedly, mainly due to supply factors, with sharp falls toward the end of 2018. Other commodity prices - particularly metals - have also weakened, posing renewed headwinds for commodity exporters.

Economic activity in advanced economies has been diverging of late. Growth in the United States has remained solid, bolstered by fiscal stimulus. In contrast, activity in the Euro Area has been somewhat weaker than previously expected, owing to slowing net exports. While growth in advanced economies is estimated to have slightly decelerated to 2.2 percent last year, it is still above potential and in line with previous forecasts.

EMDE growth edged down to an estimated 4.2 percent in 2018 - 0.3 percentage point slower than previously projected - as a number of countries with elevated current account deficits experienced substantial financial market pressures and appreciable slowdowns in activity. More generally, as suggested by recent high-frequency indicators, the recovery among commodity exporters has lost momentum significantly, largely owing to country-specific challenges within this group. Activity in commodity importers, while still robust, has slowed somewhat, reflecting capacity constraints and decelerating export growth. In low-income countries (LICs), growth is firming as infrastructure investment continues and easing drought conditions support a rebound in agricultural output. However, LIC metals exporters are struggling partly reflecting softer metals prices. Central banks in many EMDEs have tightened policy to varying degrees to confront currency and inflation pressures.

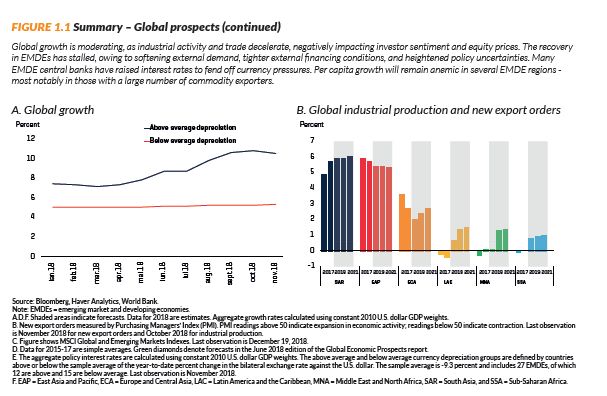

In all, global growth is projected to moderate from a downwardly revised 3 percent in 2018 to 2.9 percent in 2019 and 2.8 percent in 2020-21, as economic slack dissipates, monetary policy accommodation in advanced economies is removed, and global trade gradually slows. Growth in the United States will continue to be supported by fiscal stimulus in the near term, which will likely lead to larger and more persistent fiscal deficits. Advanced-economy growth will gradually decelerate toward potential, falling to 1.5 percent by the end of the forecast horizon, as monetary policy is normalized and capacity constraints become increasingly binding.

Softening global trade and tighter financing conditions will result in a more challenging external environment for EMDE economic activity. EMDE growth is expected to stall at 4.2 percent in 2019 - 0.5 percentage point below previous forecasts, partly reflecting the lingering effects of recent financial stress in some large economies (e.g., Argentina, Turkey), with a sharply weaker-than-expected EMDEs through trade, financial, and commodity market channels. A global downturn would be particularly detrimental for those EMDEs with reduced policy space to respond to shocks.

The softening outlook and heightened downside risks exacerbate various challenges faced by policymakers around the world. Advanced economies should use this period of above potential growth to rebuild macroeconomic policy buffers and lay the foundation for stronger growth with reforms that bolster potential output. Care should be taken to avoid shifts in trade and immigration policies that could negatively affect longer-term growth prospects, both domestically and abroad. A renewed commitment to a rules based international trading system would also help bolster confidence, investment, and trade.

In a context of limited policy buffers, EMDE policymakers need to bolster the capacity to cope with possible bouts of financial market volatility, including sharp exchange rate movements - while undertaking measures to sustain the ongoing period of historically stable inflation (Box 1.1). This immediate priority will require a credible commitment to price stability from central banks, underpinned by strong institutional in dependence, as well as efforts by regulators and prudential authorities to reduce persistent financial fragilities. EMDEs also face substantial fiscal challenges and the risk of worsening debt dynamics as global financing conditions tighten. For many EMDEs, it will be imperative to restore fiscal space given cyclical conditions, as well as address the vulnerabilities associated with elevated foreign-currency-denominated debt.

Equally critically, amid a projected deceleration in potential growth, EMDEs face the pressing challenge of ensuring sustained improvements in living standards. This will require investments in human capital and skills development to raise productivity and take full advantage of technological changes. In the current environment of limited fiscal resources, the urgency of these investments highlights the critical need to prioritize effective public spending and increase public sector efficiency.

Moreover, facilitating the expansion of small-and medium-sized enterprises, including by improving their access to international markets and finance, would also spur productivity and stimulate growth - enhancing investments. For many EMDEs, there is scope to further liberalize trade and improve the extent to which they are integrated into global value chains, which would foster a more efficient allocation of resources, job creation, and export diversification. Policies that help improve outcomes in these areas would also contribute to address the challenges associated with informality, thus reinforcing the basis for future productivity growth.

Europe and Central Asia

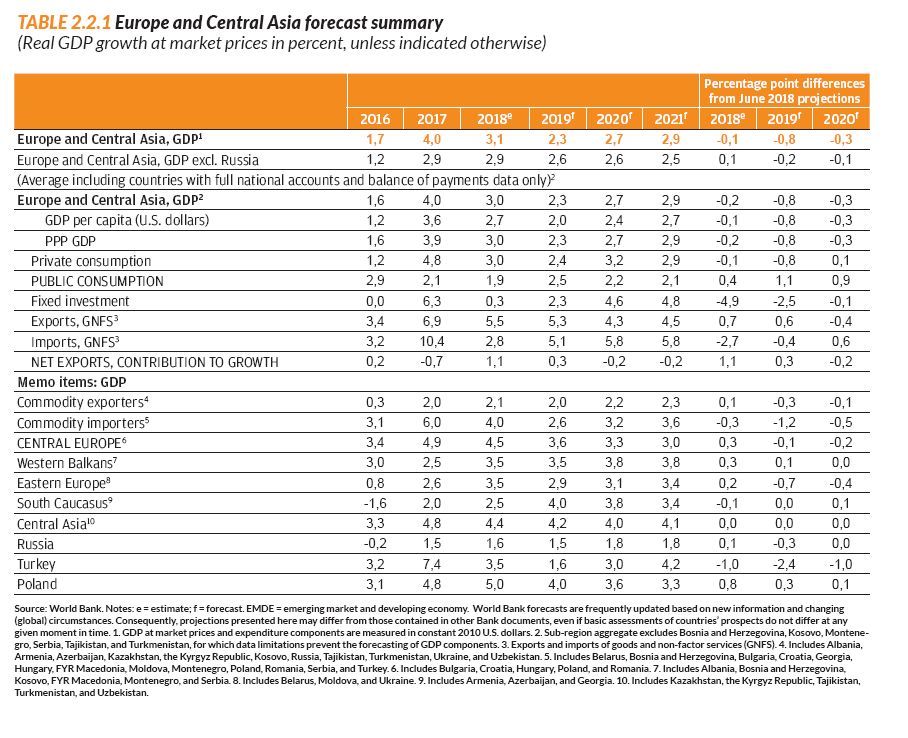

Regional growth is estimated to have decelerated to an estimated 3.1 percent in 2018 and is projected to further slow to 2.3 percent this year, mainly because of weakness in Turkey. Regional growth is expected to pick up modestly in 2020-21, as a gradual recovery in Turkey offsets moderating activity in Central Europe. The main risks to the region are weaker-than-expected investment due to heightened policy uncertainty, and a renewal of financial pressure in Turkey combined with possible contagion to the rest of the region.

Recent developments

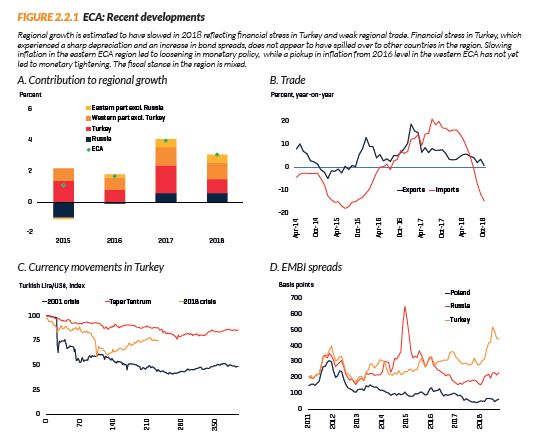

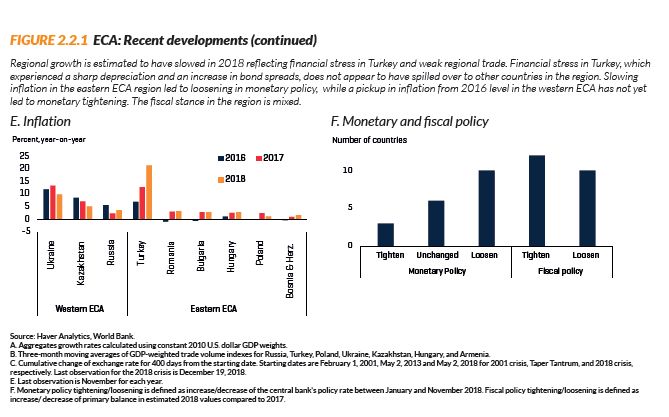

Activity in Europe and Central Asia (ECA) is estimated to have slowed to 3.1 percent in 2018 from 4 percent in 2017, reflecting the marked weakness in activity in Turkey in the second half of the year. Excluding Turkey, regional growth remained unchanged at an estimated 2.9 percent in 2018, as slowing activity in countries in the western part of the region, such as Bulgaria and Romania, offset an acceleration in the eastern part of the region that benefitted from higher oil prices (Figure 2.2.1). Regional trade growth declined during 2018.

In Turkey, the lira declined around 30 percent over the course of 2018, reflecting capital outflows in response to accelerating inflation, a perceived delay in monetary tightening, and rising private sector debt. The country accumulated a sizable current account deficit and a large foreign currency-denominated debt load, leaving it vulnerable to shifting investor sentiment and currency depreciation. Output shrank by 1.1 percent from the second quarter to the third quarter amid plummeting consumer confidence and credit scarcity. Despite this contraction, strong growth in the first half of the year will bring Turkish growth to an estimated 3.5 percent for 2018.

Growth among the Central European economies slowed in 2018. Softening exports and labor shortages restrained growth in Bulgaria, Croatia, and Romania. In contrast, despite labor shortages, growth in Poland accelerated slightly because of strong consumption and investment. Robust domestic demand supported activity in the Western Balkans, except for Montenegro. In the Former Yugoslav Republic of Macedonia, grow the bounded in 2018 as the formation of a new government ended a prolonged political crisis and improved investor sentiment (World Bank 2018i).

The Russian Federation and other oil exporters in Central Asia maintained steady growth in 2018, supported by a rise in oil prices. Although economic sanctions tightened, Russia experienced relatively low and stable inflation and increased oil production. As a result of robust domestic activity, the Russian economy expanded at a 1.6 percent pace in the year just ended (World Bank 2018j). Higher-than-expected production in the Kashagan oil field and strong domestic demand supported growth in Kazakhstan. A stabilization in the financial sector and higher oil prices contributed to a slow recovery of growth in Azerbaijan in 2018.

The stance of fiscal policy in the region varies. Turkey has committed to tight fiscal policy to help curb high inflation and currency depreciation. Romania’s fiscal stance is mixed, with income tax reductions and increased public sector benefits offset by an increase in social contribution revenue. Fiscal policy has become more procyclical in some Central European countries. In the eastern part of the region, the Russian government has implemented a new fiscal rule and is estimated to have recorded its first surplus since 2012 in 2018. As fiscal stimulus measures are phased out, Kazakhstan has started to tighten its fiscal stance, resulting in improvements in its non-oil fiscal balance. Azerbaijan continues to rely on fiscal measures to support its economy.

For the majority of ECA countries, monetary policy is either stable or loosening. At the end of 2018, nine countries have policy rates lower than a year ago, while three countries have higher policy rates (Romania, Ukraine, Turkey). Inflation peaked at 25 percent in Turkey in October, significantly above the 5 percent target amid an overheating economy in the first half of 2018 and currency depreciation in the second. To ward off inflationary and currency pressures, Turkey’s central bank increased the average cost of funding by more than 10 percentage points over the course of 2018. In Central Europe, tightening labor markets and increasing energy prices have pushed inflation up toward target, with monetary policy remaining stable in most countries. One exception is Romania, where robust domestic demand pushed inflation above the upper bound of the target band, prompting monetary policy tightening. Gradually accelerating inflation has also led to policy tightening in Ukraine. In the Western Balkans, Albania, FYR Macedonia, and Serbia have lowered policy rates amid stable and below-target inflation. For oil exporters, such as Azerbaijan and Kazakhstan, the stabilization of currency following the 2014-16 oil price plunge has resulted in lower inflation and looser monetary policy. In Russia, monetary policy was tightened in late 2018 amid pressures on the currency.

Outlook

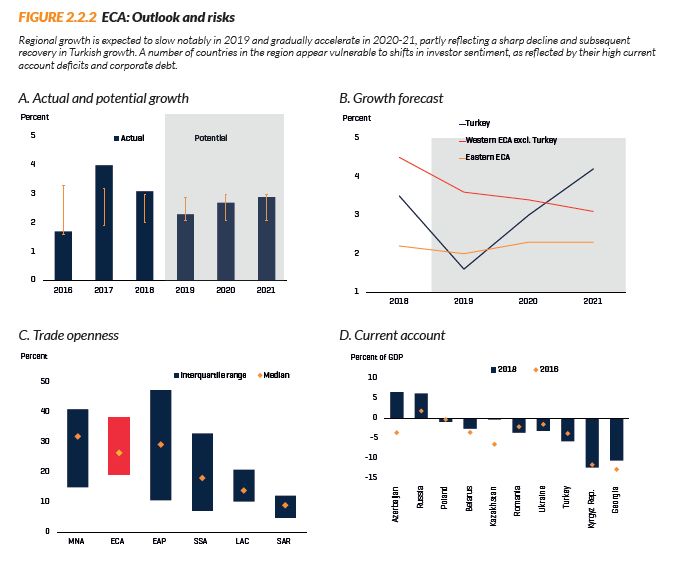

The lingering effects of financial stress in Turkey are expected to further slow of regional growth in 2019. Growth is expected to slide to 2.3 percent, before recovering to 2.7 percent in 2020 (Figure 2.2.2). Excluding Turkey, regional growth is expected to average 2.6 percent during the forecast horizon, compared to 2.9 percent in 2018, with a gradual deceleration in Central Europe. This outlook is predicated on an orderly tightening of global financial conditions, oil prices averaging $67 in 2019-2021, a gradual slowdown in the Euro Area, and the absence of heightened geopolitical tensions.

While the outlook for Turkey is subject to considerable uncertainty, the country is expected to be weighted down by high inflation, high interest rates, and low confidence, which will dampen consumption and investment. Turkish growth is expected to slow to 1.6 percent in 2019 and begin to recover by 2020 through a gradual improvement in domestic demand and continued strength in net exports. However, this outlook assumes that fiscal and monetary policy successfully avert further sharp falls in the lira and, that corporate debt restructurings help avert serious damage to the financial system. A comprehensive stabilization package with consistent policy framework, clear milestones, and effective communication would help reduce risks and support recovery.

Spillovers from Turkey to the rest of the region are expected to remain modest, as trade and financial linkages are relatively limited. On the trade side, Azerbaijan has the largest exposure, as 9 percent of its exports are directed to Turkey. Financial linkages are also small - only Georgia receives meaningful amounts of FDI from Turkey, and foreign bank ownership of Turkish assets is limited in scale.

Growth in western ECA, excluding Turkey, is projected to gradually slow toward potential, driven by a slowdown in Central European economies. Domestic demand in this sub-region will be constrained by tight labor markets, while a continued slowdown in the Euro Area will limit export growth. Poland is expected to slow from 5.0 percent in 2018 to 4.0 percent in 2019, as Euro Area growth slows.

Growth in eastern ECA is forecast to slow in 2019, as the large economies including Russia. Kazakhstan and Ukraine decelerate. The VAT in Russia is expected to rise from 18 to 20 percent in 2019, weighing on near term growth. Kazakhstan’s economy is also expected to decelerate as oil production growth levels off and fiscal consolidation efforts continue (World Bank 2018k).

Risks

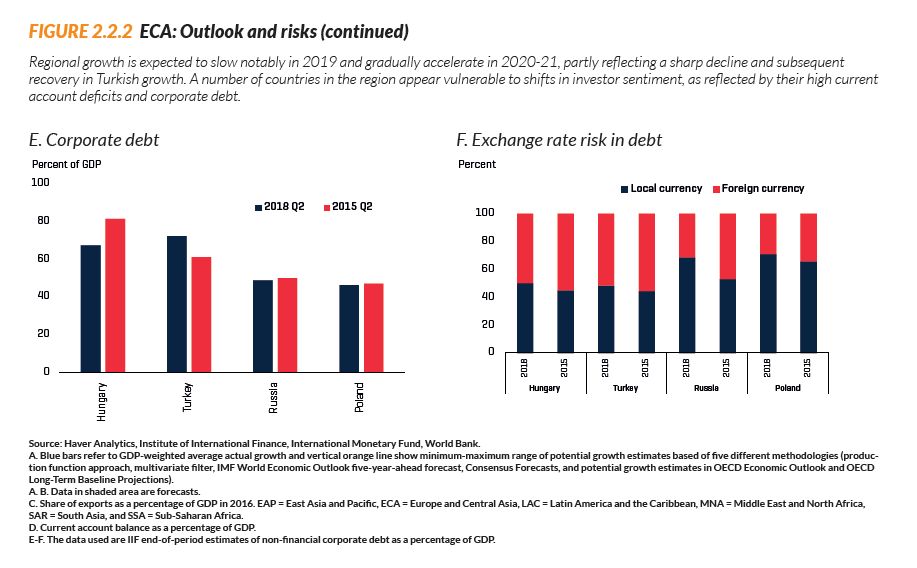

While there are some upside risks to the forecasts - for example, that stronger-than-expected energy prices may support activity in Russia and other e nergy exporters - the balance of risks is increasingly tilted down. The most important downside risk is the possibility that the recent financial stress in Turkey worsens and triggers widespread bank failures. Turkish corporations carry significant debt, much of which is denominated in or linked to foreign currencies. Although many corporations are hedged against exchange rate risks, and corporate debt restructuring is on its way, falling domestic demand and forex exposure of the non-tradable sector pose risks. Currency depreciation and high interest rates could push corporate borrowers into bankruptcy and depleting banks’ capital buffers. Renewed pressure in currency markets and increased uncertainty about the policy framework would increase the probability of a deepening crisis, implying a longer and more severe slowdown than currently forecast for Turkey (World Bank forthcoming). While direct linkages between Turkey and the rest of the region are small, an intensification of financial stress in Turkey or other EMDEs could also lead investors to re-evaluate their exposure in the region, which in turn could lead to capital outflows, currency depreciations, and rising borrowing costs.

The potential for financial stress is more elevated in countries with domestic vulnerabilities like Romania and Belarus, which have large current account deficits or large foreign-currency denominated debt. Public debt, which remains high despite recent declines, and private borrowing in foreign currencies makes Central European countries vulnerable to financial pressure. Public debt has also been trending up in Central Asia and the Western Balkans.

Increases in policy uncertainty could undermine confidence in the region and impact growth. A slowdown or reversal of ongoing structural reforms remains a risk in many countries in the region, especially in Armenia, Azerbaijan, Belarus, Ukraine, and Turkey. Tension concerning Syria or Ukraine could trigger new sanctions. Policy disagreements between the European Union and some Central European countries could deter international investors and reduce fiscal transfers. An escalation of trade restrictions between the United States and the Euro Area could have a negative impact on western ECA countries, as the Euro Area is the largest trading partner for all countries in the sub-region.

Global Economic Prospects is a World Bank Group Flagship Report that examines global economic developments and prospects, with a special focus on emerging market and developing countries, on a semiannual basis (in January and June). The January edition includes in-depth analyses of topical policy challenges faced by these economies, while the June edition contains shorter analytical pieces. The full report can be downloaded here.