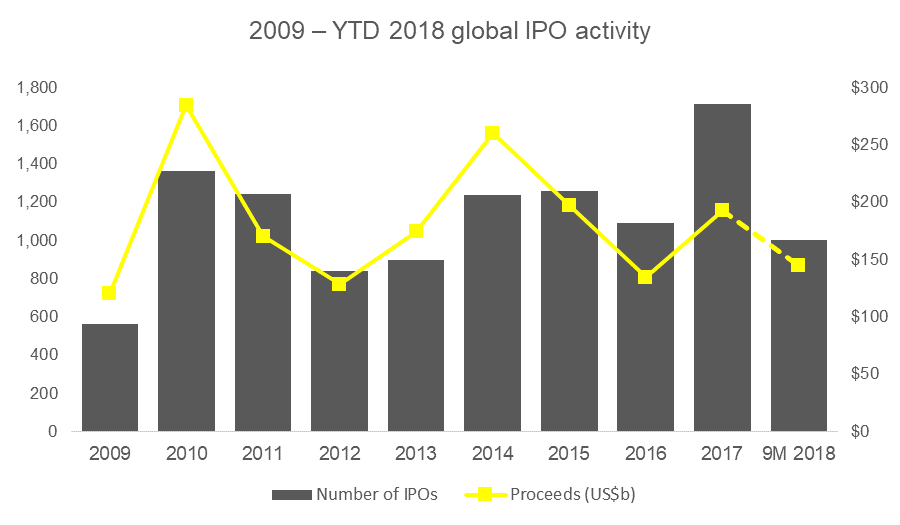

Geo-political uncertainty and trade issues continue to reduce investors' enthusiasm, leading to a drop in the number of IPOs at 1,000 globally in the first nine months of 2018.

This is a decrease of 18% compared to the same period last year. Despite this slowdown, initial public listings in 2018 were above the average of the past 10 years, with global IPO markets attracting USD 145.1 billion, with an annual increase of 9%.

In Q3 2018 there were 302 IPOs and revenues of US $ 47.1 billion, a 22% decrease in transaction volume and a 9% increase in revenue compared to Q3 2017.

In 2018, the technology, industrial and health sectors generated the largest number of IPOs globally, accounting for 468 IPOs (47% of total transactions) and USD 62.9 billion (43% of revenues global).

In addition, the rise in unicorn listings in T3 2018 increased global IPO revenues by 20% in 2018 compared to the same period in 2017, according to the quarterly EY, Global IPO trends: Q3 2018.

"The global IPO market experienced the full strength of geopolitical tensions, trade problems between the US, the EU and China and the imminent UK outpouring of the European Union in the third quarter. However, if the megatranzactions marked the first half of 2018, the growing phenomenon of IPO among unicorn companies dominates the second half of 2018.

We expect global 2018 revenues to exceed the 2017 figures. However, the total volume of transactions in 2018 will probably be lower than in 2017, "said Dr. Martin Steinbach, leader of EY Global IPO and EMEA.

America's activity intensifies

IPO activity in the Americas remains strong in 2018, with transaction revenue rising 41 percent to $ 50.1 billion, and 27 percent of transactions at 195 IPOs.

The United States recorded 47 IPOs that attracted US $ 11.9 billion in Q3 2018, an increase of 150% in revenue and 31% in volume compared to Q3 2017 US IPOs recorded average returns on the first day of about 15% and the average post-IPO price increased by 28%. Cross-border transactions accounted for 31% (18 IPOs) of US T3 2018 transactions, marking an increase in confidence in US stock markets.

NYSE and NASDAQ ranked globally among the top three stock exchanges in terms of revenue in 2018, while the Mexican stock market recorded a 70% increase in revenue to 2.9 billion USD in 2018, compared to the same period in 2017.

The Asia-Pacific region benefits from Hong Kong's megatranzactions

In Asia-Pacific, Hong Kong was the most active player in the region. The Hong Kong IPO market recorded strong increases in Q3 2018 both in terms of transactions and revenue, with 18% of IPOs and 49% of global revenue.

Three mega-IPOs (two of which were unicorn) set a record for July IPO listings in July, becoming the most active global stock market this quarter. Hong Kong has also been the second most attractive global destination for cross-border listings after the US.

Overall, in Asia-Pacific, the appetite for IPO investors remained, with revenue of 2018 recording a 16% increase over the same period in 2017, despite a 31% drop in transaction volumes.

Five of the ten most stock exchanges in terms of number of transactions and revenues attracted in 2018 were from the Asia Pacific region.

EMEIA's activity diminishes due to delays in listing and geopolitical changes

In the EMEIA region, initial public listing activity in Q3 2018 slowed down significantly, recording a 48% decline in transaction numbers and 85% in revenue compared to the same period in 2017.

In the first nine months of 2018, the volume of transactions dropped to 11% and 24% to 2017.

However, according to the number of IPOs, the EMEIA region is the second largest market at a global level, with a 33% share. Average day yields for the main IPOs on this market were about 12%, and post-IPO stock price performance rose 25% on average, indicating investors remain confident in the deals on this market.

In spite of a quiet quarter, three of the top ten stock exchanges globally, volume-based (India, Italy and the UK) and two, according to revenue (India and the UK), were from the EMEIA region. Although political stability continues and positive economic prospects have boosted IPO activity in India, performance over Q3 2018 has not been maintained, and Indian IPOs have seen a sharp drop in post-IPO stock prices over the past two months.

Sursa: Dealogic, EY