The coronavirus (COVID-19) pandemic in 2020 is expected to cause the greatest disruption to the global economy since the Great Depression. This economic shock has already manifested itself in a variety of ways across industries, including consumer payments and financial services. The full extent of the impact may not be fully realised for many months to come, but Euromonitor International’s initial impressions of how the pandemic is changing the industry include a shift to contactless payments, a rise in value lost to fraud, and a weakening of travel loyalty cards as travel is put on hold:

1) Card function use to follow previous recession trends: Initial spending data suggest that consumers are putting down their credit cards in favour of debit or other “pay now” card functions. In times of increased uncertainty, consumers pivot from utilising higher reward “pay later” card functions to lower or no reward debit or pre-paid cards. Following the Great Recession from 2008 to 2009 credit card payment value growth dropped into negative territory while debit payment value had a y-o-y growth rate of 9%. From 2018 to 2019, consumer credit card payment value grew 15% y-o-y., nearly as high as debit growth of 18% y-o-y. We expect a decline in credit payment value going forward while debit growth will contract to a lesser degree as total consumer spending slows. In the case of commercial payments however, we expect many struggling small and medium businesses to utilise more commercial credit to cover short- and medium-term expenses.

2) Contactless payments expected to accelerate: As the consumer in-store payment experience is changing to allow for greater social distancing, contactless payments will benefit. While card networks and issuers had already started the push for greater contactless adoption before the pandemic, both consumer and merchant demand for greater distance and safety at the checkout will lead to more merchants upgrading equipment to meet consumers’ expectations. Mastercard announced a 40% quarterly increase in contactless payments during its Q1 2020 earnings call.

3) Cash volume to drop: The transition to cash alternatives is well established in most markets around the world, but the pandemic will further accelerate this transition. For in-store payments, cash can increase the physical interaction a consumer may have with a merchant, while contactless is a safer way to pay. For the rapidly expanding non-store retail channel, card and electronic payments are already the standard. The transition to cash alternatives is likely to persist beyond the pandemic.

4) Travel decline to impact card rewards: Co-brand travel credit cards are among the most popular in developed markets, but they will be impacted the most if programs are not updated. American Express has announced temporary statement credits for certain streaming and online services to continue to provide value to consumers who cannot utilise the travel benefits that justify higher annual program fees. We expect more co-branded travel cards to update their rewards and benefits to appeal to consumers with less opportunities to travel.

5) Fraud levels expected to accelerate: With more online payments and electronic transfers, more value lost to fraud is expected going forward. In the US, the largest market in terms of total value lost to fraud, there has yet to be a comprehensive solution to address card not present fraud, and with greater volumes, there will be greater losses to fraud. Additionally, with government disbursement of stimulus payments to consumers in several markets globally, cheque fraud may also increase.

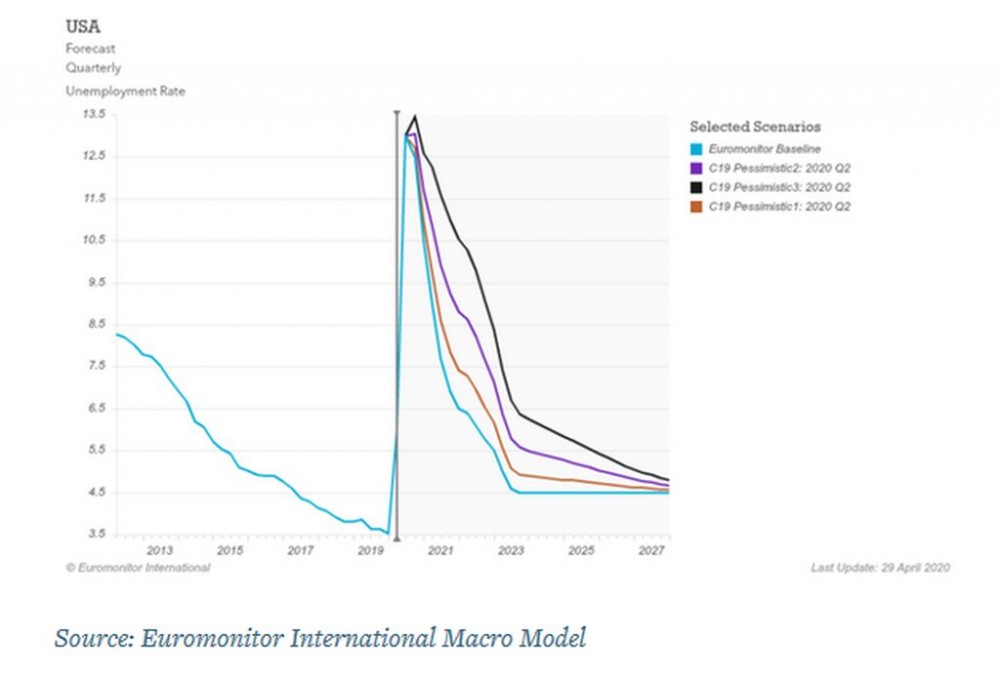

6) Issuer competitive landscape may shift: As with any economic downturn, financial institutions are in a vulnerable position, facing higher default rates on loans. While many financial institutions are better positioned due to increased capital requirements put in place after the previous recession, they are still likely to face significant losses which may result in company failures and a degree of consolidation. Additionally, consumer default rates on credit cards are likely to increase significantly as the unemployment rate rises. In the USA, for example, Euromonitor’s baseline forecast for the pandemic in Q2 2020 expects unemployment to reach 13% compared to 3.7% in 2019 overall and not fall below 5% until 2023.

7) Cross-border spend down significantly: With travel restrictions in place..................................................................

By: Kendrick Sands

The article is property of Euromonitor International, a market research provider, and can be read in full at: https://blog.euromonitor.com/coronavirus-pandemic-to-change-consumer-payments/