Preliminary results for 2022

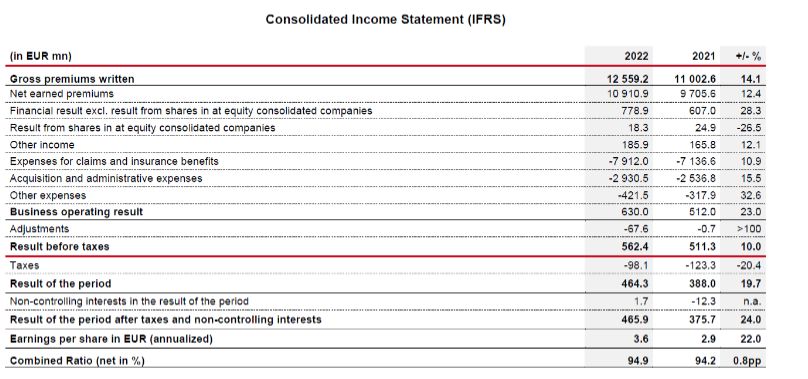

• Premium volume rises to EUR 12.6 billion (+14.1%)

• Profit (before taxes) increases to EUR 562 million (+10%)

• Net result of EUR 466 million (+24%)

• Combined ratio within target range at 94.9% (+0.8 percentage points)

• Strong solvency ratio of VIG Group at 280% (+12%)

• Proposed dividend increased to EUR 1.30/share (+4%)

Live broadcast of the press conference on 15 March 2023 from 10:00 a.m. CET at this link

With a premium volume of EUR 12.6 billion, Vienna Insurance Group (VIG) has exceeded the previous year’s figure of EUR 11 billion by 14.1%. Profit before taxes amounts to EUR 562 million, which is 10% above the value achieved in 2021. Profit after taxes reaches EUR 466 million (+24% compared with the previous year). The combined ratio of 94.9% is within the target range. The financial result increases by 26% to EUR 797 million. The operating return on equity before taxes of 11.9% clearly improved compared to the previous year’s figure of 10.9%. With a preliminary solvency ratio of 280%, VIG Group once again demonstrates its strong capital position.

“VIG Group’s preliminary figures for 2022 paint a highly satisfactory picture and underscore our growth strategy and our aim of being a stable and reliable partner even in challenging times. 2022 brought uncertainty in a variety of areas, and these uncertainties remain. In particular, the war in Ukraine, high inflation, which was in double digits in many of our markets last year and in some cases still is, and the pandemic, which was still making its presence felt last year. Despite this volatile environment, VIG Group demonstrates good resilience, as it did in the previous year. This is due, among other things, to our considerable diversity, our conservative investment and reinsurance policy and our very strong capital resources. Above all, however, it is due to the outstanding commitment of our employees, now numbering roughly 29,000, who serve around 28 million customers in 30 countries. Based on these good results, the VIG Managing Board is proposing an increase of the dividend to EUR 1.30 per share for the 2022 financial year”, explains Elisabeth Stadler, CEO of Vienna Insurance Group.

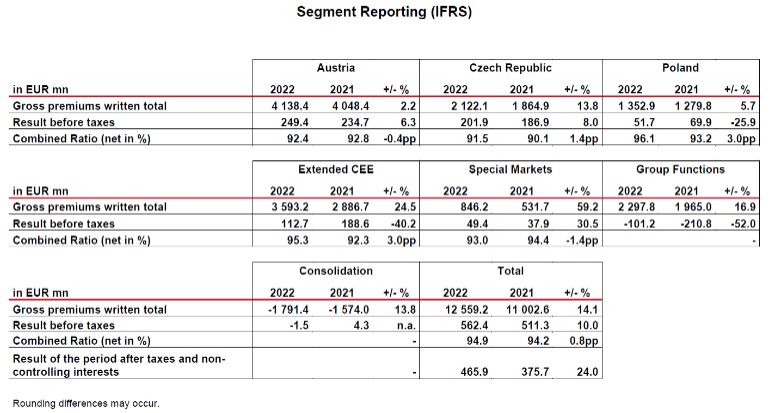

Strong premium increase

The total premium volume of EUR 12.6 billion exceeded the value of the previous year by EUR 1.6 billion, or 14.1%. This includes the newly acquired insurance companies in Hungary and Turkiye, which bring a premium volume of EUR 444.5 million. Even without taking into account this premium volume, the premium increase sits at an impressive 10.1%. Double-digit premium growth was achieved in all lines of business, except for single premium life insurance (-1%), which VIG deliberately restricts. Motor third-party liability increased by 20.1% (EUR 1,936 million) and motor own damage insurance by 16.1% (EUR 1,627 million). Other property and casualty is also up 16% thanks to a premium volume of EUR 6,112 million, and the premiums in health insurance of EUR 835 million grew by 12.4%. Regular premium life insurance has delivered very pleasing performance, increasing by 11.1% to EUR 2,980 million. There was particularly strong premium growth in the segments Czech Republic (+13.8%), Extended CEE (+24.5%) and Special Markets (+59.2%). Overall, 65.7% of premiums were generated outside Austria in 2022.

Profit before taxes up 10%

Profit before taxes is EUR 562.4 million, which is 10% higher than in the previous year. This significant increase in profit is due primarily to the good operating performance and the improved financial result.

The figure also includes impairment of goodwill and other intangible assets totalling EUR 67.6 million. Adjusted accordingly, the operating result for 2022 is EUR 630 million, which represents a 23% increase on the performance achieved in 2021. The net result of roughly EUR 466 million is 24% higher than in the previous year.

Combined ratio of 94.9%

The Group’s combined ratio for 2022 is 94.9%, which places it in the target range of 95%. The slight deterioration of 0.8 percentage points compared with the previous year’s figure is due to a normalisation of claims following the COVID-19 and lockdown years.

Financial result up 26%

The financial result (including the result from shares in at equity consolidated companies) was EUR 797.2 million in 2022. The increase of 26.2% compared to the same period in the previous year is due primarily to the first-time consolidation of the companies acquired in Hungary and Türkiye in 2022, as well as higher interest rates. Both effects overcompensated the impairments in connection with exposure to Russian government bonds and corporate bonds in the amount of EUR 84.1 million.

Operating return on equity (operating RoE)

Since last year, VIG Group has been reporting operating return on equity as a new profitability key figure. This ratio is calculated by dividing the business operating result by the average shareholders’ equity. VIG Group generated an operating return on equity before taxes of 11.9% in 2022; clearly higher than in the previous year (10.9%).

Insurance benefits

Expenses for claims and insurance benefits less reinsurer’s share amounted to EUR 7,912 million in 2022, sitting 10.9% higher than in the previous year. The increase is due to the significantly higher business volume.

Solvency

The preliminary solvency ratio of the Group as of 31 December 2022 is 280% (including transitional measures). This top value underscores the exceptionally strong capital position of VIG Insurance Group and therefore the strong resilience of the business model.

Investments

Total investments including cash and cash equivalents amounted to EUR 34.4 billion as of 31 December 2022. The decline of 8% compared to the previous year is due primarily to price drops, particularly for fixed-income securities, caused by the interest rate increase.

Proposed dividend of EUR 1.30 per share

Based on the very positive business development, the Managing Board of Vienna Insurance Group will propose a dividend increase from last year’s figure of EUR 1.25 per share to EUR 1.30 per share for the 2022 financial year. This equates to an increase of 4% and to a dividend payout ratio of 35.7%. The dividend yield is 5.8%. Compared to the previous year, earnings per share have improved by 22% to EUR 3.58.

Focus on digitalisation and sustainability

As part of the ongoing VIG 25 strategy programme, focus areas will include further expansion of digital services. The fully digital “Beesafe” sales platform was successfully launched in Poland during the pandemic. The platform allows customers to get an online motor insurance quote in only 35 seconds. In just two years, Beesafe has acquired more than 200,000 online customers. Sales via the customer platform of our partner Erste Group are also proving successful. In 2022 alone, around 175,000 insurance contracts were concluded via “George”. This represents an increase of around 80% compared to the previous year and means that around a quarter of all insurance contracts via Erste Group are now concluded digitally.

As part of VIG 25, sustainability will be concretised as an integral part of the Group’s business model. Intensive work is currently underway to establish the CO2 emission burden for all VIG insurance companies. This includes the entire investment and insurance portfolio with all associated locations. As part of the transition plans required by the EU, the details of how CO2 emissions will be systematically reduced towards zero by 2050 must be presented for the first time in 2025. Therefore, renewable energies are being promoted and further intensive investments in green bonds are being encouraged, among other things. In 2022, the volume of green bonds almost doubled compared to the previous year, increasing to EUR 829 million. There is also growing demand from consumers for green products in the investment sector. In the insurance sector, the focus will be on unit-linked life insurance, which offers added value for the environment and society.

The Group has recently begun to push ahead with its knowledge and risk assessment in the area of underwriting for renewable energy and e-mobility. In terms of renewable energy, the focus will be on hydropower, photovoltaics, wind power, biogas and geothermal energy. E-mobility currently still plays a very minor role in the VIG markets, but it will become increasingly important. VIG Group is also the largest motor insurance provider in the CEE region, insuring more than ten million vehicles.

Outlook 2023

Many uncertainties remain for the 2023 financial year. The war in Ukraine presents a particular challenge given that its effects continue to be felt by all sectors and the future course of developments cannot be predicted. VIG has confidence in the long-term potential of the CEE region and in continued significant economic growth in the VIG markets, exceeding that of Western Europe.

“The weaker macroeconomic environment and the expected higher volatility of the financial markets are currently restricting the ability to predict business trends. In this environment, and also given the switch to a new accounting system from 2023 onwards, any firm outlook for 2023 can only be provided during the course of the year, pursuant to IFRS 17/9. Given that VIG has been able to manage the current challenges in its insurance business operations very well so far, the Group aims for a further positive operating performance in 2023, subject to the factors mentioned above”, explains CEO Elisabeth Stadler.

Preliminary results

The information on the 2022 financial year contained in this press release is based on preliminary data. The final data for the 2022 financial year will be published in the Annual Report on 19 April 2023 on the website www.vig.com.

Vienna Insurance Group (VIG) is the leading insurance group in the entire Central and Eastern European (CEE) region. More than 50 insurance companies and pension funds in 30 countries form a Group with a long-standing tradition, strong brands and close customer relations. The more than 29,000 employees in the VIG take care of the day-to-day needs of more than 28 million customers. VIG shares have been listed on the Vienna Stock Exchange since 1994, on the Prague Stock Exchange since 2008 and on the Budapest Stock Exchange since November 2022. The VIG Group has an A+ rating with stable outlook by the internationally recognised rating agency Standard & Poor's. VIG cooperates closely with the Erste Group, the largest retail bank in Central and Eastern Europe.