Euromonitor International forecasts that the global economy will contract by 1.5-4.0% in real terms in 2020, which will make this the worst economic recession since the 1930s. Never have economies around the world completely shut down in this manner, with consumption halted by enforced lockdown and social distancing restrictions. Naturally, an economic shutdown on this scale raises many questions regarding the COVID-19-induced economic crisis, including whether we can compare this to previous crises, and what shape the recovery will take.

Q1. Why are economic forecasters revising their data so frequently?

The COVID-19 pandemic is an extremely unusual global shock, with high uncertainty surrounding its propagation and impact. This has been especially true in the early phase of the crisis, during January-April 2020. Previous pandemics provide only very rough and partial guidance. The 1918 influenza pandemic was deadlier but had lower infection rates, and it occurred against the background of a war economy, a greater proportion of the workforce in essential industries, and lower value attached to preventing pandemic deaths (due to shorter life expectancies and lower lifetime incomes). As a result, social distancing measures were less strict. Previous outbreaks in recent history such as SARS in 2003 had a much lower scale.

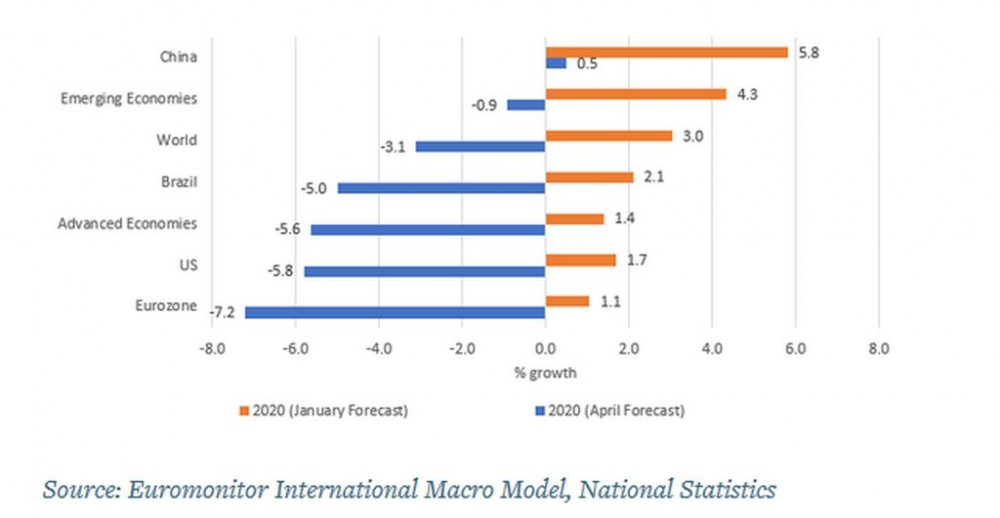

It is now estimated that every month of complete COVID-19-related economic lockdown in an advanced economy reduces real GDP by 25-45% relative to normal. At an annual level, this implies that every full lockdown month leads to a real GDP growth forecast revision of 2.0-3.8 percentage points. Furthermore, relaxation of a full lockdown must be gradual, likely involving around 50% recovery towards normal activity levels for several months or even quarters. For emerging and developing economies, lockdown measures are likely to be less strict but economically more costly. Nevertheless, these economies are much more vulnerable to global financial and export demand shocks caused by the pandemic. These spillovers imply a strong feedback effect between worsening economic forecasts for advanced economies and worsening economic forecasts for emerging ones too.

Combining these factors with the uncertainty and speed of news about the extent of the pandemic in different countries has led to a very challenging forecast environment, requiring several quick forecast rounds to converge towards a more stable baseline forecast. Most key private-sector forecasters in March-April revised forecasts every 1-3 weeks. According to the World Health Organization (WHO) statistics, the growth rate of COVID-19 infections appears to have stabilised or even declined.

This suggests that the global social distancing measures have been effective in controlling the pandemic’s spread so far, potentially leading to greater stability in forecasts. However, there is still high uncertainty about possible spikes in infection rates or second wave effects, perturbations in financial markets, and the adequacy of government fiscal and credit support measures. Euromonitor International’s global baseline forecast is still assigned less than a 50% probability, with significant downside risks captured by our pessimistic scenarios.

Real GDP Growth Baseline Forecasts: 2020 (January Pre-COVID-19 Pandemic January vs April Forecasts)

Q2. Is it valid to compare the economic impact of COVID-19 with that of the Global Financial Crisis?

The 2008 global financial crisis and the 2020 global COVID-19 crisis are very different in terms of initial shocks and causes. The 2008 financial crisis started in financial markets due to excessive household debt levels. This was transformed into an economic crisis due to declining real estate prices (lower loan collateral values), amplified by lack of information about loan quality and the repayment capacity of financial institutions and their borrowers. The crisis started out purely as a financial shock, causing real economy effects via higher borrowing costs, tighter borrowing constraints, lower private sector demand and falling capital investment.

The 2020 pandemic crisis started out in the real economy, with COVID-19 directly causing supply chain disruptions and declines in consumer demand due to social distancing restrictions. These direct effects have spilled over into worsening financial conditions and private sector cash flow problems, which amplify the economic recession. In the baseline forecast, financial conditions are better than during the 2008 global financial crisis, but in our pessimistic scenarios, financial conditions worsen sufficiently to qualify as a financial crisis potentially worse than in 2008-2010.

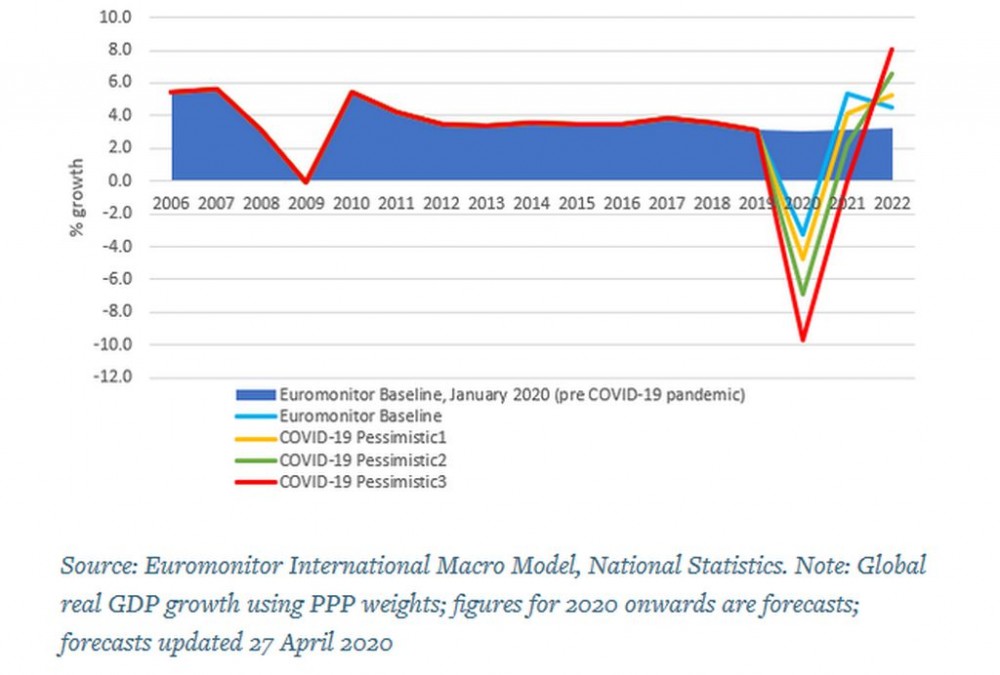

Global Real GDP Growth, Baseline and Alternative Scenarios: 2006-2022

The 2008 financial crisis reduced real global output growth to around 0% in 2009, followed by more than 5% global growth in 2010 and a return to more normal global growth of 3.6% annually in 2011-2015. Considering that the normal global growth trend was around 3-4% in 2001-2007, the recovery after 2010 left global output levels permanently below pre-crisis trends, especially in advanced economies. The 2020 COVID-19 crisis is expected to cause a sharper first-year contraction, with real global output growth around -3% in 2020. The baseline forecast assumes a partial recovery to pre-crisis trends in the level of output, with global annual growth rates around 4-6% in 2021-2022.

These recovery dynamics would be moderately stronger than in the 2008 financial crisis, but the recovery forecasts are highly uncertain, with our downside pessimistic scenarios featuring a slow recovery or even ongoing global recession in 2021.

Q3: What are the factors that might make the economic impact of COVID-19 worse?

There are several factors that could lead to a worsening impact of COVID-19:

• Projections on the virus spread might be inaccurate. The pandemic could last longer and infect more people than in the baseline forecast, and social distancing measures could have little impact to curtail the spread of the virus;

• Another issue could arise if the current economic crisis grows to become a full-blown financial crisis, where interest rates rise, and companies cannot access funding. There are at least two ways such a crisis could emerge. Firstly, cashflow mismatches between business costs and revenues could cause business liquidity problems and a rise in bankruptcies. Secondly, high-debt companies (e.g. the shale industry in the US) could be hindered from rolling over debts due to a slowdown in business, which would give rise to bankruptcies, also triggering a financial crisis;

• There are some long-term risks associated with the current economic crisis as well. For example, current short-term travel bans could develop into long-term protectionist policies, with global decoupling receiving an additional boost, meaning global trade would decline and stay low over time.

Q4: What are the factors that might make the economic impact of COVID-19 less severe?

There are several factors that could lead to a less severe impact:

• A coordinated global response could limit the spread of the virus. Advanced economies should help emerging economies with their response, and this would limit the spread and length of the pandemic;

• Effective treatment, widespread testing and a vaccine could help to curtail the pandemic. A vaccine would provide certainty that the virus will not return at pandemic levels, which provides security. This would allow the economy to quickly rebound;

• During the pandemic, fiscal and monetary policy stimulus needs to help companies and consumers stay afloat, as well as support demand through uncertain times. Once the pandemic finishes, the economy will quickly and fully rebound as no financial crisis with a considerable number of defaults and bankruptcies was triggered due to effective stimulus;

• It could become evident that the coronavirus spread is slowed down by higher temperatures, leading to a slowdown of the pandemic in warmer months. Countries could remove some of the most severe quarantine measures before the summer, which would alleviate some of the negative economic impact. Also, the virus might not return to the same pandemic levels in a second wave in autumn 2020.

Q5: Do you expect a V or U (or some other) shaped recovery?

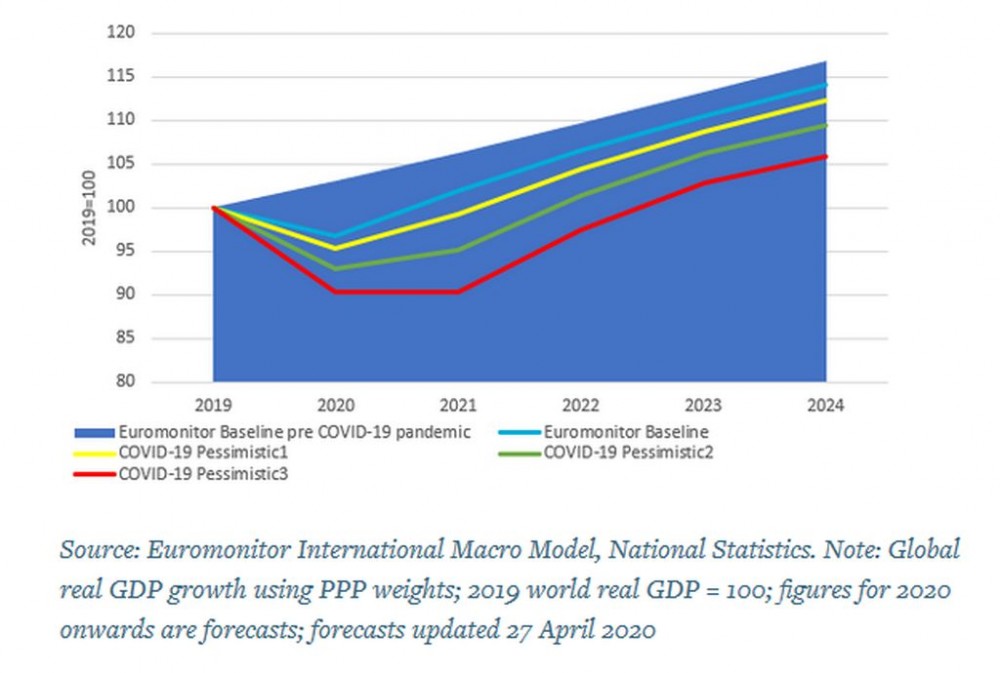

The baseline forecast for the global economy is a mixed V and L shaped recession: a partial rebound in output relative to the pre-recession forecast in 2021-2022, but leaving global output 2-3% below the pre-recession trend over a 5-year horizon. A pessimistic scenarios imply an L-shaped recession relative to the pre-recession forecast over a 5-year horizon.

Global Real GDP Index, Baseline and Alternative Scenarios: 2019-2024

Recession shapes such as V or U are usually defined relative to the level of economic activity or the level of economic activity compared to the pre-recession forecast. A V-shaped recovery features a strong rebound in economic activity after a short-term recession. A U-shaped recession has a longer period of output of ongoing negative growth or no growth, followed by a more gradual recovery. L-shaped recessions feature a drop in economic activity followed by weak or no recovery in the level of economic activity (relative to trend). From a quarterly perspective, one could see a U-shaped path in economic activity if the recession lasts a few quarters, but in annual forecasts, the recession would look V-shaped. The initial quarters’ recession would just display as a contraction in annual economic output, followed by a rebound in the second year.

The definition in terms of level or level relative to pre-recession forecast/trend also affects interpretation. A rebound in economic activity back to the initial pre-recession level can still leave the economy with output significantly below the pre-recession forecast level for the year of the recovery. This is typical for growing economies, especially for fast-growing emerging market and developing economies.

Q6: Why is it important to track oil prices? What does it mean for the world economy that prices turned negative?

Oil prices are one of the strongest leading indicators of demand in the real economy. Continuously declining oil prices show that global demand is still suppressed and worsening. However, the negative price observed in West Texas Intermediate (WTI) futures (with a delivery date in May 2020) is a market technicality and does not contribute to the economic shock. The negative price mainly shows that storage of oil has reached its capacity. In these circumstances, no one wanted to have oil delivered and, hence, had to be paid to take oil delivery. The price of oil futures turned negative during the settlement week when the liquidity in such contracts went down as market makers stopped trading the contract to avoid the risk of getting oil delivered. Participants in the WTI oil market are likely to be more cautious in June (the next oil future delivery date), reducing the risk of prices turning negative again. Nevertheless, as the global economy collapses, the downward risks for oil prices and oil-exporting economies remain.

Q7: Do Euromonitor International baseline GDP forecasts account for the impact of the COVID-19 pandemic?

Baseline economic forecasts provide the most.....................................................

By: Giedrius Stalenis and Daniel Solomon

The article is property of Euromonitor International, a market research provider, and can be read in full at: https://blog.euromonitor.com/qa-how-will-coronavirus-impact-the-global-economy/