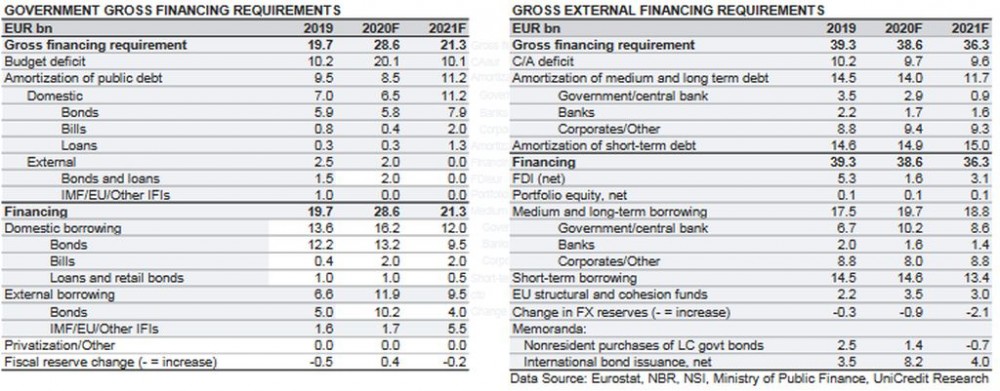

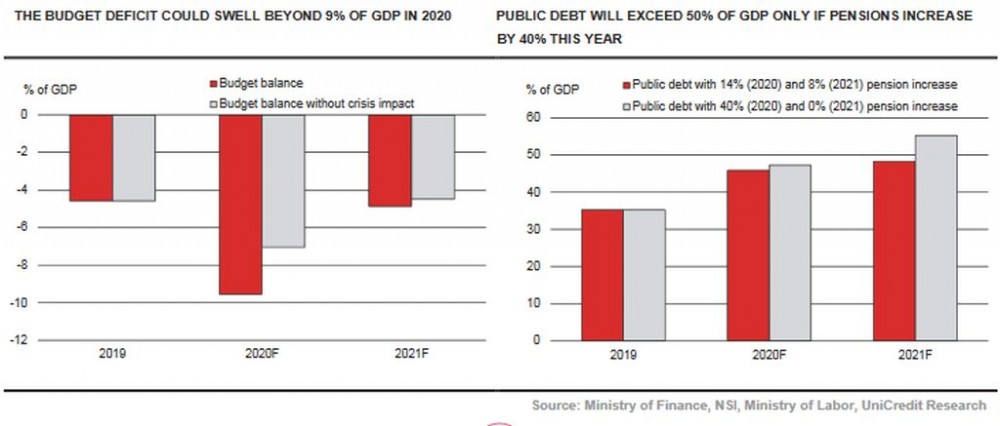

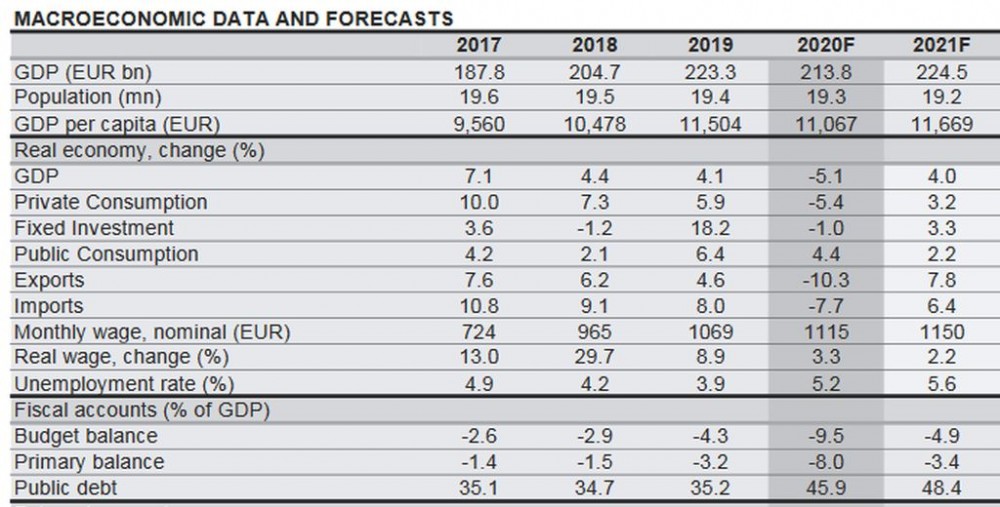

THE PNL GOVERNMENT FACES A CHALLENGE TO ITS DECISION TO SCALE BACK THIS YEAR’S PENSION INCREASE FROM 40% TO 14%. The Constitutional Court (CC) is expected to rule on this issue before mid-January. We assume that the pension increase will remain at 14% this year, which would cap this year’s budget deficit at around 9.5% of GDP and, more importantly, allow next year’s deficit to fall. In order to reduce the budget deficit below 5% of GDP in 2021, the next government will need to cut the expenditures or to boost revenues. This year’s deficit could be lower if fiscal reserves are used, while the Fiscal Council’s estimate is at 9.8% of GDP according to the cash methodology.

So far, the government’s support measures including tax breaks and direct support for furloughed workers, poor households and SMEs fall slightly short of 2% of GDP. In addition, the loan guarantee program supporting SMEs exceeded RON 12bn (1.2% of GDP) by the end of August. Other programs, including support for leasing and factoring BY UNICREDIT BANKfor large companies affected by the pandemic, were launched later this year. In mid-September, Finance Minister Florin Cîțu estimated existing support lines at RON 61.8bn (6% of GDP). Some of the support measures were already extended. For example employees and the self-employed whose activity is affected by COVID-19 will benefit from furlough support until the end of the year. In our view, the government might have to extend the direct support programs beyond the end of this year.

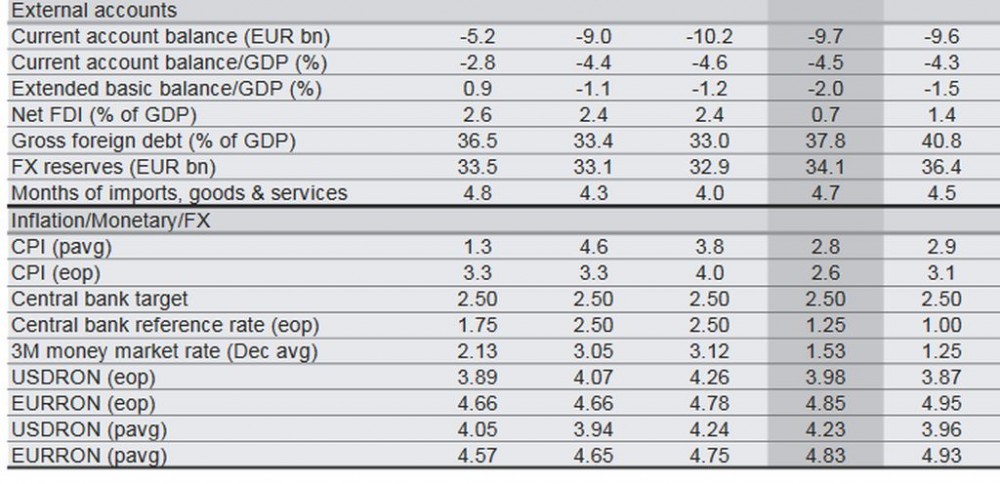

Next year’s efforts to reduce the deficit would need to go beyond capping the 2020 pension increase at 14%. The Fiscal Council estimates the 2021 budget shortfall at 8% of GDP (or even 9% of GDP considering that some of the one-off measures to combat the effects of the COVID-19 pandemic could be prolonged) without corrective measures. In our view, public-sector wages will have to be at most flat compared to 2020 and transfers will have to fall to close to 2019 levels if pensions are to increase by up to 8%. Preventing a sharp increase of the public debt above 50% of GDP would leave leaving Romania under the BBB median debt thresholds for all three rating agencies and thus supporting Romania’s investment-grade rating. This year’s economic contraction could be close to 5% if the recovery loses speed in 2H20. Due to needed fiscal tightening, next year’s recovery is likely to be incomplete.

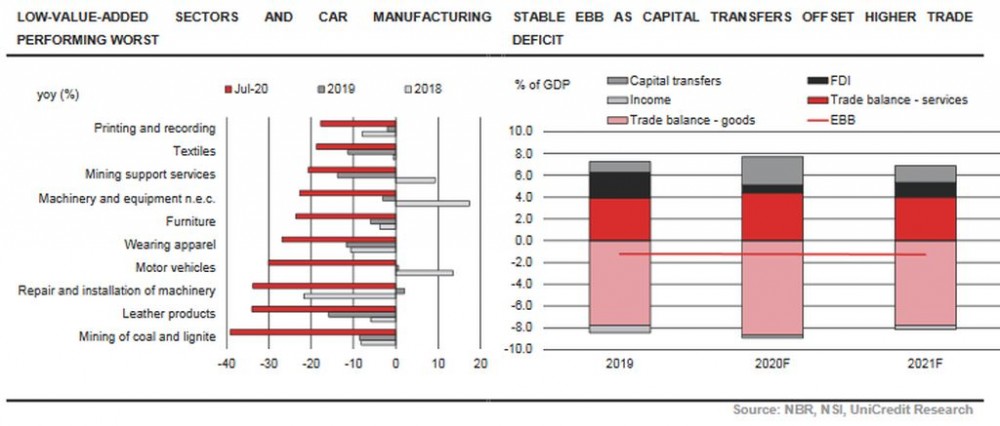

Romania stands out in EU-CEE due to the sharp widening in its trade deficit in goods. One reason for this is falling demand for cars, clothing and apparel, all of which are important export staples. However, the crisis exposed the lack of competitiveness for some of Romania’s industrial sectors. Most low-value-added sectors suffered more than average, which may indicate that their small margins could not accommodate weaker demand. The overvalued RON also played a role, as did the rise in minimum and average wages that has outpaced productivity in the past six years. Meanwhile, the trade balance with services improved due to fewer Romanians travelling abroad.

Income transfers are likely to fall further amid lower corporate profits, offsetting lower remittances and the higher trade deficit. As a result, the C/A deficit could remain stable this year, declining only marginally in 2021. FDI was hit hard in 7M20 as new equity inflows fell fivefold yoy and debt flows were down a third compared to 7M19. The improvement in 2H20 is likely to be only marginal. At the same time, transfers from the EU could rise to close to EUR 4bn this year, as Romania benefitted from support funding from the EU in addition to larger inflows of structural and investment funds at the end of the EU budget 2014-20. Next year, we expect Romania to borrow from the EU, starting with SURE support for employees and companies (country allotment of EUR 4bn), but also from the NGEU. The authorities submitted the absorption frameworks for the EUR 13.7bn in grants and EUR 16.6bn in loans. These loans may help Romania cover the negative EBB in 2021. This year, part of the coverage will come from the cash brought back by Romanian workers who returned home during the pandemic. In May, the government estimated the number at 1.3 million. If every returning person spends EUR 2,000 (a conservative assumption) two thirds of the negative EBB could be covered in 2020. Many of these workers will not return quickly to their previous jobs in Italy and Spain, with those working in care homes and in tourism worst affected. Thus, the authorities expect 500-600,000 of these workers to add to unemployment, which could exceed 6.5% in 1Q21.

Higher unemployment and lower wage growth are likely to weigh on core inflation from 4Q20 onwards. This may keep headline inflation inside the target range in 2020-2021, despite pressure from higher excise duties. If the budget deficit remains manageable, the NBR could cut the policy rate twice more to 1%, to smooth the end of the moratorium on loan repayments, which is currently covering 20% of private-sector loans.

While elections are likely to result in a pro-European parliamentary majority, reform momentum is unlikely to pick up if the coalition comprises more than two parties.