CBRE, the world's leading national real estate consultant, today announced its findings on the evolution of the local real estate market, the segments of office, commercial and industrial premises.

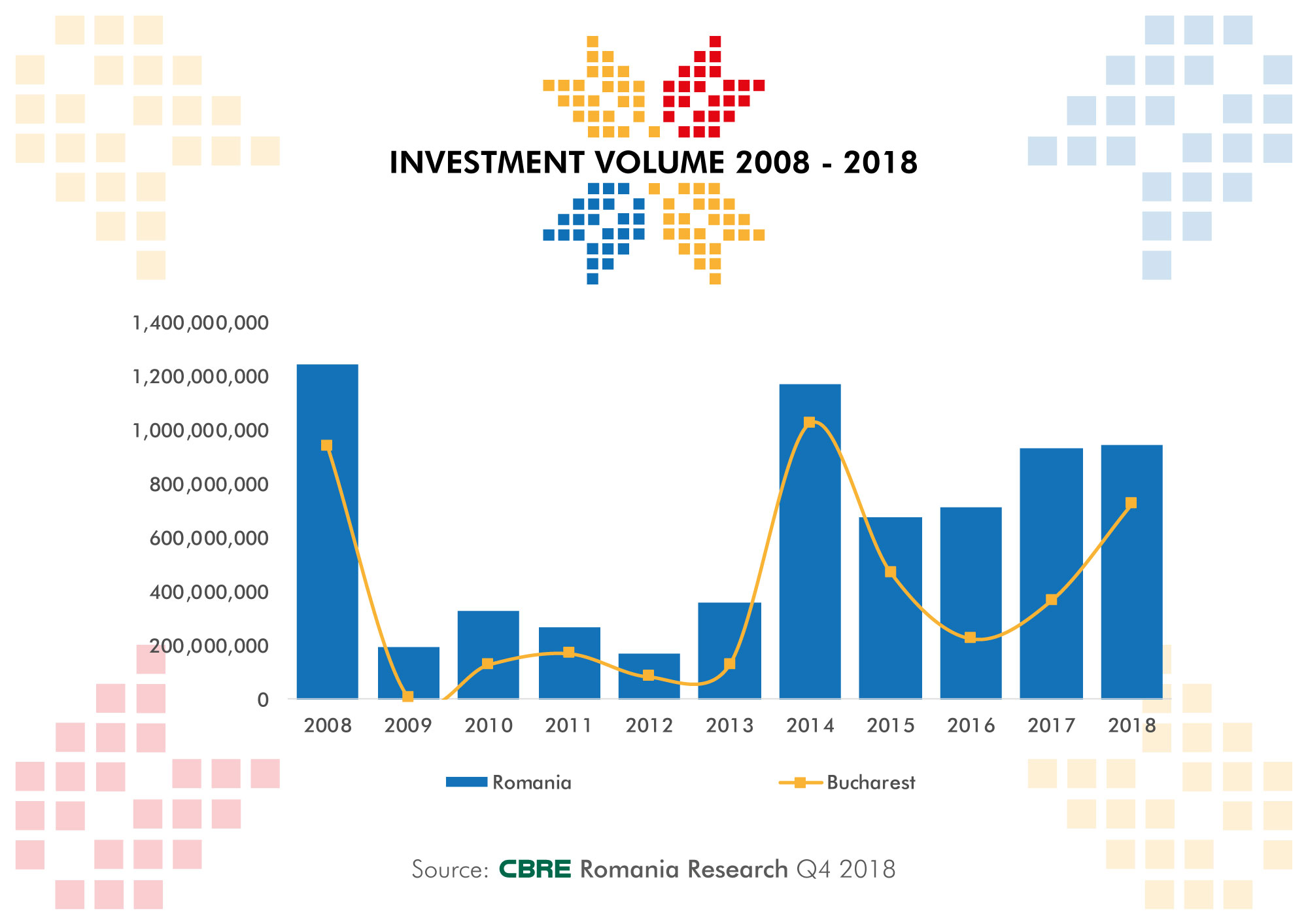

The volume of transactions ended in 2018 is 940 million euros, a level similar to that recorded in 2017, but 30% higher than the figure reported in 2016. For the fourth year in a row, the office space sector has attracted the largest number of transactions, with 55% of the total agreements signed in 2018.

The ranking is completed at a considerable distance by commercial spaces that have accounted for 33% of transactions, 7% for industrial space, and hotels and other transactions for the remaining 5%.

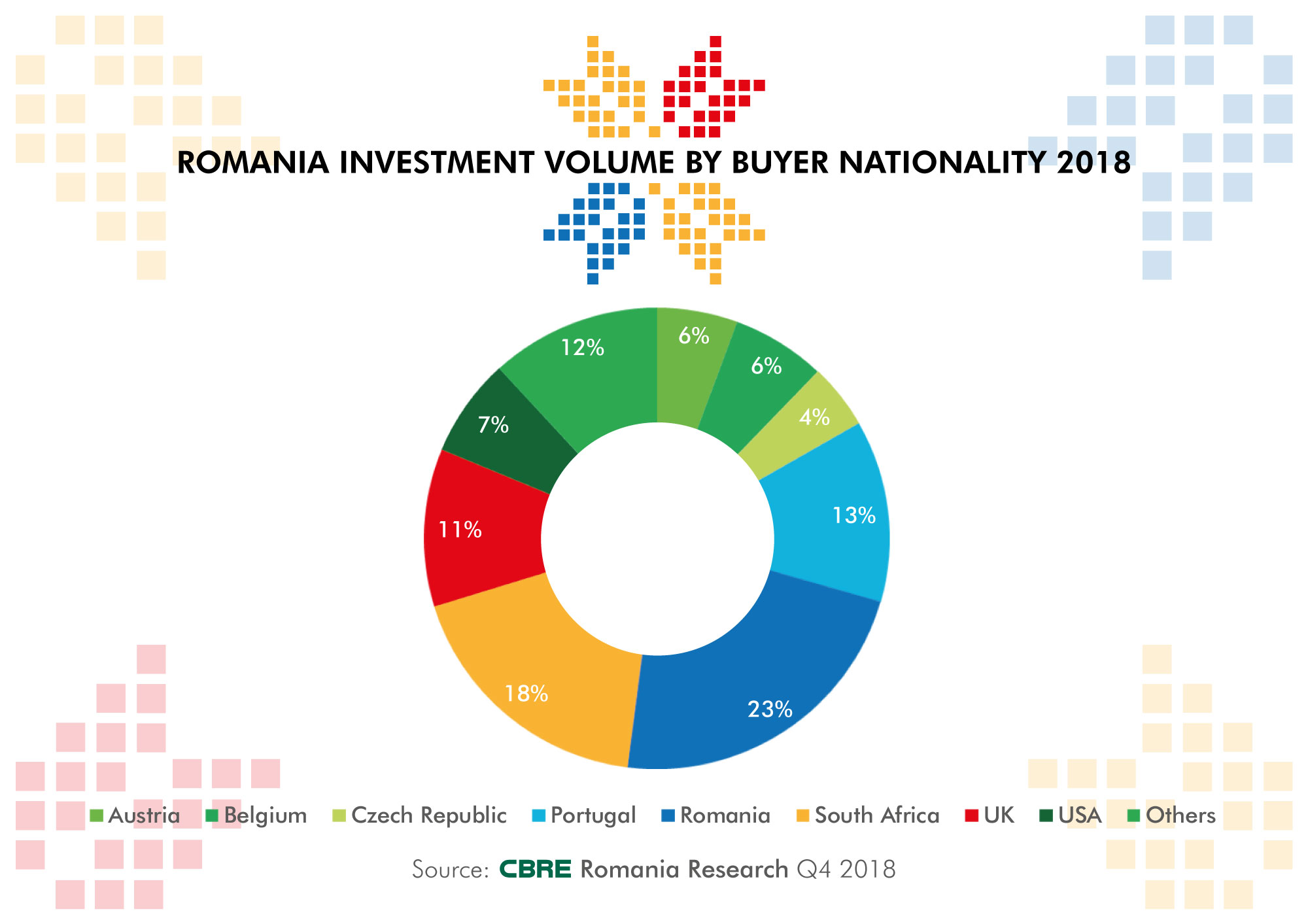

The Bucharest real estate market had the most intense activity in 2018, with 77% of the total investments registered at the national urban level. Domestic investors were the most active, accounting for almost 25% of total transactions, followed by South African funds, which accounted for 18% and Portuguese investors, 13%.

According to CBRE, the largest transactions in 2018 took place in the second half of the year, on the segments of office space and retail space. The biggest deal was the sale of The Bridge (I and II) office project, which passed from Forte Partners developer to Dedeman, following an agreement worth 150 million euros.

The second transaction, in value terms, aimed at changing the structure of the ParkLake Shopping Center and amounted to 120 million euros. Thus, Sonae Sierra became the sole shareholder of the shopping center by acquiring 50% stake in Caelum Development.

Top of the most valuable transactions in 2018 is complemented by five other agreements:

- Sales of Oregon Park (I and II) office buildings, developed by Portland Trust, to Lion's Head Investment, for 110 million euros;

- Selling Militari Shopping Center, the West Midlands commercial center, to the South African investment fund, Mas Real Estate, with 95 million euros;

- Selling The Landmark office project to Revetas Capital and Cerberus Capital Management for € 65 million;

- Sale of the first building in the Campus 6 office complex, Skanska developer's project, to the Austrian company CA Immo, with 53 million euros;

- Selling the Crystal Tower office building to the Czech investment company, PPF Real Estate, for 43 million euros.

In 2018, the total transaction volume remained close to the same level in 2017 and reached 940 million euros, and the average value of transactions declined 5% over the previous year, up to 29 million euros. Capital offices have attracted the highest interest, accounting for 97% of total transactions in this segment. In the case of commercial spaces, 69% of the agreements covered projects in Bucharest, and the rest took place in other cities in Romania.

Raw yield (yield of Class A projects in the best-rated areas) is declining for all sectors analyzed: industrial, office and retail. The evolution of the local yield on the local market is in line with the trend in Central and Eastern Europe, which is a sign that the market is active with a good level of investments and transactions.

The gap between Romania and other countries in the region, such as Hungary and Slovakia, has diminished, but there is room for further decreases in this yield in all sectors of the domestic real estate market. Thus, the lowest yield was recorded by the commercial sector, by 6.5%, followed by the office space segment, by 7% and by the industrial spaces, by 7.75%.

"The real estate investment market had a good year, with a dynamism felt in the second semester. A clear signal of the maturing of the Romanian market is the increased interest shown by new investors. Thus, the size and potential of the domestic real estate industry attracted major players in the first interaction with the local market, such as Hagag Development, MAS Real Estate, ForeVest Capital Partners or Lion's Head, who mainly purchased office and retail building projects. In 2019, we expect the investment activity to have a similar pace to that of 2018, due to important agreements that are currently in different phases of negotiation. We estimate raw premiums will continue to decline slightly, especially in the office space market, "said Razvan Iorgu, Managing Director of CBRE Romania.