Capital value attracted from IPO transactions globally increased in 2018, on the background of increased investor confidence, high liquidity, solid market value and low interest rates.

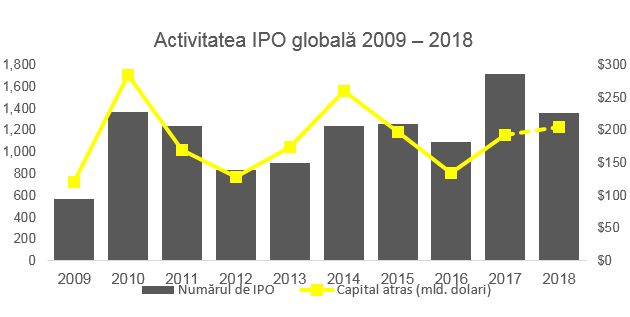

Since the beginning of 2018, 1,359 initial public offers (IPO) has been issued, totaling USD 204.8 billion, marking a 6% increase in attracted revenue, despite a 21% drop in volume.

The intensification of IPO transactions involving "unicorn" companies (companies with a market value of more than USD 1 billion) and IPO megatransactions have propelled the value of capital attracted in 2018 above the 2017 level.

This trend is expected to persist in 2019 due to the increase in the number of IPO candidates and higher capital availability.

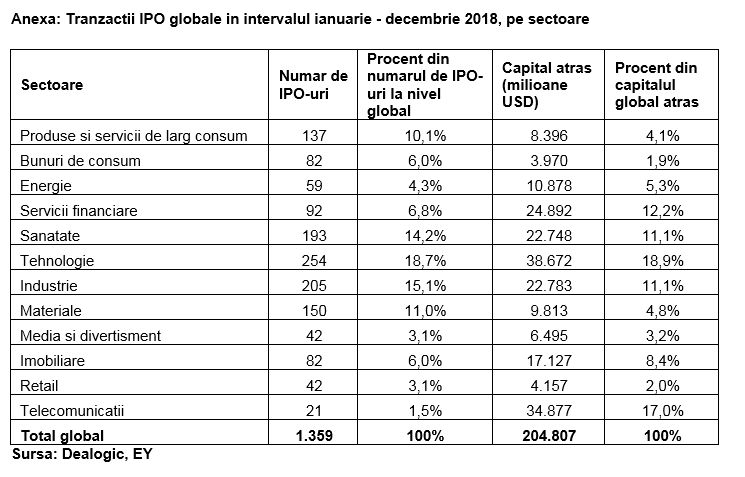

In terms of volume of transactions, the Asia Pacific region recorded a decline but maintained its dominant position, while the North and South America and EMEIA regions recorded a larger share in the volume of transactions. The technology, industrial and health sectors were the most prolific in terms of number of transactions in 2018, bringing together 652 IPOs (48% of global IPO transactions), totaling 84.2 billion USD (41% of the capital attracted globally).

In the last quarter of 2018 (326 IPOs and capital attracted by 53.7 billion USD), there was a 34% decrease in the volume of transactions and 10% in the value of the capital attracted compared to the same period in 2017.

The volatility of markets and the persistence of geopolitical uncertainties contributed to a strong decline in IPO activity in all regions in Q4 2018 as compared to the previous quarter, indicating a cautious start to 2019. These findings, as well as other findings, were published in the EY quarterly report Global IPO trends: Q4 2018.

The momentum of IPO activity in North and South America were maintained in 2018

Due to the 261 IPOs with a capital value of 60 billion US dollars, volume and transaction revenue on IPO markets in North and South America exceeded 2017 values in 2018 by 14% and 16%.

USA maintains its main source of IPOs in 2018, accounting for 79% of the number of IPO transactions and 88% of IPO revenues in the region.

29% of the US IPO stock exchanges were cross-border, with 60 companies in 15 countries choosing to register in the US in 2018, up from 24% in 2017.

26 "unicorn" companies preferred USA public markets in 2018, attracting a total of 15 billion USD.

Asia-Pacific collects the benefits of mega transactions across the region

Asia-Pacific continued to dominate the global IPO activity, with six of the top ten stock exchanges in the region as number of transactions and five of the top ten stock exchanges as revenue. However, the number of transactions in 2018 (666 transactions) decreased by 31% compared to 2017, while the attracted capital value (97.1 billion USD) increased by 28% due to the numerous IPO megatranzactions in the region.

In Japan, 97 initial public offers were launched in 2018, a modest 2% increase in volume compared to 2017, but represent a significant 333% increase in capital attracted compared to 2017.

This development can be attributed to the $ 21.1 billion listing of the telecommunications giant SoftBank Corp. on the Tokyo Stock Exchange in mid-December, representing one of the largest initial public offerings ever recorded in Japan, as well as listing the first two "unicorn" companies in Japan.

EMEA has seen an increase in global IPO market share despite the global geopolitical tensions

In the EMEA region, the number of transactions (432) and attracted capital (47.7 billion USD) declined in 2018. IPO activity in EMEIA decreased by 16% and 26% respectively in 2018 compared to 2017 in terms of number of transactions and value of attracted capital, geopolitical tensions having a clear impact on IPO activity.

However, it retained its position as the second largest IPO in the world, hosting two of the five largest global megatransactions in 2018, and four IPO transactions involving "unicorn" companies (which attracted funds worth 2 , 7 billion USD). In 2018, EMEIA posted an increase in the global IPO market share, reaching 32% of the global transaction volume and 23% of the capital attracted. Also, EMEIA comes from three of the top ten stock exchanges, depending on attracted capital (Germany, UK and India) and two of the top ten volume exchanges (India and NASDAQ OMX).

Perspectives of 2019: a prudent start, but an acceleration in the second half of the year

Looking at the future, more uncertainties will prevail in 2019. The trade tensions between the US, China and the EU, the Brexit result and the uncertainties surrounding the stability of several European economies will continue to exist and eventually give the overall tone of the IPO market. At the same time, as the interest rates are expected to rise in the US, the European Central Bank may feel forced to do the same, which will also influence IPO activity in the coming quarters.

Although IPO transaction values in 2019 may be lower than those recorded in 2018, global revenue may well be likely to exceed or exceed the high 2018 levels, especially if a larger number of "unicorn" companies and several companies in the technology sectors , industrial, consumer and health products enter the public capital markets in 2019, as expected.

It is expected that cross-border activity will keep its edge well beyond the beginning of the year, with the US, Hong Kong and London continuing to represent the main destinations for IPO activity.