BANKS HAVE SIGNIFICANTLY IMPROVED THEIR ASSET QUALITY SINCE THE GLOBAL FINANCIAL CRISIS OF 2008 09, built up larger capital buffers and strengthened their liquidity positions, therefore entering the economic slowdown in a better state than they did at the time of the previous financial crisis.

The combination of economic upturn over the past years, the supervisory and political attention as well banks’ commitment to tackle non-performing assets contributed to the considerable decrease of NPL volumes over the past years.

These challenging years also required banks to develop their NPL management and best practices as well as to tackle the build-up of non-performing exposures. The NPL strategies implemented prior to COVID 19 might need to be adjusted now, potentially affecting the servicer universe as well as the buyers’ market.

A U-SHAPED ECONOMIC RECOVERY IS EXPECTED. A prolonged economic recovery is expected over the next 12 months, with the majority of the respondents expecting a U-shaped (39.1%) or L-shaped economic recovery (21.7%). The view of respondents on the application of moratorium is positive overall, with 75% of the respondents considering it as an effective measure to maintain financial stability.

DELOITTE TEAM CONDUCTED THE SURVEY AMONG CROSAND HEADS OF WORKOUT DEPARTMENTS WHO PROVIDED THEIR VIEWS AND EXPECTATIONS IN RELATION TO THE IMPACTOF COVID-19 ON THE BANKING SECTOR COVERING FIVE MAIN AREAS. SOME OF THE FINDINGS MAY BEIN LINE WITH INTUITIONS, WHILE OTHERS MIGHT BESURPRISING.

MEASURES BY LOCAL AUTHORITIES WERE IMPLEMENTED IN TIME. The reception of the implemented fiscal and monetary stimulus package is rather miscellaneous; however, the participants were more satisfied with their national banks’ measures (nearly half of the respondents) than the acts of local governments, with more than 40% of our respondents expressing that the measures implemented by the local government are not sufficient to safeguard the economy.

NEW LOAN DISBURSEMENTS ARE TO DECREASE. Unsurprisingly, new loan disbursements are expected to slightly or significantly decrease in 2020 compared to 2019, whilst the expectations are more optimistic for the year 2021.

TIGHTENING CREDIT STANDARDS BOTH IN RETAIL AND CORPORATE SEGMENT. Credit standards of loans for both households and non-financial corporations are anticipated to tighten somewhat. This can be attributable to banks’ expectations in relation to the deterioration of economic outlook as well as the increased credit risk. Having the experiences from the global financial crisis of 2008-09, banks tend to also have a lower risk tolerance.

WHO EXPERIENCED THE MOST SIGNIFICANT DROP? Based on the responses, sectors that were hit hard by the pandemic situation such as hospitality and transport and storage experienced the most significant drop in demand for loans over the past 3 months.

ASSET QUALITY IS EXPECTED TO DETERIORATE SOMEWHAT. The asset quality is not expected to deteriorate considerably over the next 12 monthsas almost half of the respondents anticipate the retail NPL ratio to increase by 0-3% points, whilst two-thirds expect the corporate NPL ratio to rise at the same pace. It is anticipated that the inflow of non-performing loans will come mainly from hospitality, transport and storage as well as real estate & construction portfolios.

In contrast, the investors seem to be more pessimistic regarding the development of the asset quality, with nearly half of them expecting the retail NPL ratio to increase by 3-5% points, whilst one-third anticipate the corporate NPL ratio to deteriorate at the same pace over the next 12 months.

NPL TRANSACTIONS MARKET IS LIKELY TO REVIVE IN THE SHORT TERM. Almost a quarter of the respondents plan to dispose of non-performing loan portfolios over the next 6 months, whilst more than one-third do not plan any portfolio sales in the upcoming period. Retail unsecured portfolios will dominate the NPL transactions market, with more than one-third of banks expecting to dispose of non-performing loans in the largest amount in the aforementioned asset class. A fifth also consider the disposal of corporate single cases. Besides this, nearly half of the respondents expect the disposal of non-performing single tickets to increase over the next 12 months.

DEBT RESTRUCTURING IS ON THE RISE. Nearly one-third of respondents think that 5-10% of debtors in the retail segment with liquidity difficulties will require restructuring over the next 12 months. One-third expect that even more, 10-20% of households will require restructuring. However, the majority of participants (38%) think that maximum 5% of retail debtors will require restructuring due to fundamental financial difficulties.

IN-HOUSE VS. OUTSOURCING? The majority of respondents indicated they have sufficient human resources to handle the increased need from debtors for restructuring(64%) and the potentially increased amount of workout cases (55%) in-house. Banks tend to allocate resources internally from departments (e.g. lending) experiencing less workload recently and to some extent also standardise processes. However, a fifth of participants indicated that in-house resources are not sufficient to handle the extra workload in case of workout. Nearly half of the banks indicated they are ready to outsource workout activities to external servicers.

At the time of writing, the majority of investors stated intentions to continue buying despite the pandemic situation but selecting deals more cautiously. Investors felt the transaction activity to come to a halt in the CEE region, with some ongoing deals put on hold. The majority of respondents expect the NPL market activity to revive over the next 12 months, with some deals already in the last quarter of the year. This expectation is visible on the loan sales market with some banks already indicating that postponed deals will proceed and even new deals will start in 2020.

Half of the investors expect banks to dispose of corporate unsecured assets in the largest amount. Expectations for the corporate segment do not differ materially from those for the households.

OVERVIEW OF THE CENTRAL AND EASTERN EUROPEAN BANKING SECTOR

After the global financial crisis of 2008-09, the banking system had to face the rapidly increasing NPL amounts and operate under heterogeneous, distinct monetary and fiscal measures introduced by local governments and national banks. Consequently, the first seven years of the crisis resulted in the accumulation of a significant amount of distressed assets across Europe emerging as one of the main challenges in the upcoming years for the monetary and financial authorities to handle.

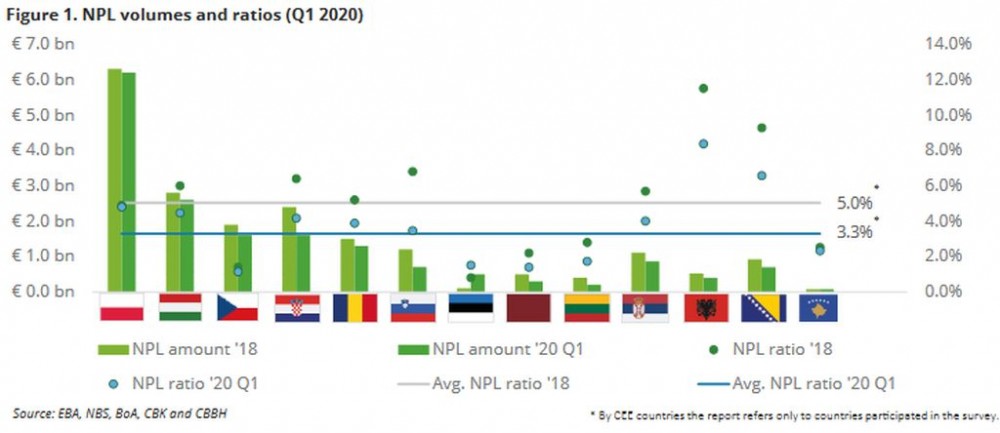

AS FIGURE 1. SHOWS, THE AVERAGE NPL RATIO OF THE CEE REGION HAS DECREASED BY NEARLY 2% POINTS OVER THE PAST TWO YEARS AND THE NPL VOLUMES WERE STILL SHOWING THE SIGNS OF RECOVERY WITH DECREASING AMOUNTS COMPARED TO PREVIOUS YEARS.

In 2015, the European Central Bank and national banks outside of the Eurozone announced several schemes and measures to support the recovery and contraction of underperforming assets on the banks’ balance sheets across the European Union, which led to a successfully decreasing trend in non-performing loan volumes.

This progress enabled banks to be resilient against shocks and severe potential losses in an upcoming economic downturn.

However, similarly to the global financial crisis of 2008-09, another unexpected and unprecedented event of the COVID-19 pandemic crisis hit the global economy in the first quarter of 2020, which will most probably have an effect on the asset quality of the banks in a longer term. It is worth mentioning that the pandemic crisis has a different impact on the financial sector compared to the financial crisis of 2008-09, as the signs of slowdown were visible and experienced more in the real economy and not directly in the financial sector.

The short term effects of COVID-19 are not yet taking place in the European banking market in terms of the potential increase of distressed asset amounts, also mainly due to the measures implemented by local governments and national banks to safeguard the economies such as moratorium on loans payments. Nevertheless, there is still some uncertainty from 2021 onwards regarding the payment behaviour of borrowers when the moratorium relief stops as it can temporarily mask the economic damage incurred during the lockdown.

However, compared to previous crises, the banking system in the CEE region is facing the pandemic with a larger capital buffer, strengthened liquidity positions and relatively low NPL ratios in case of the majority of the banking sectors.

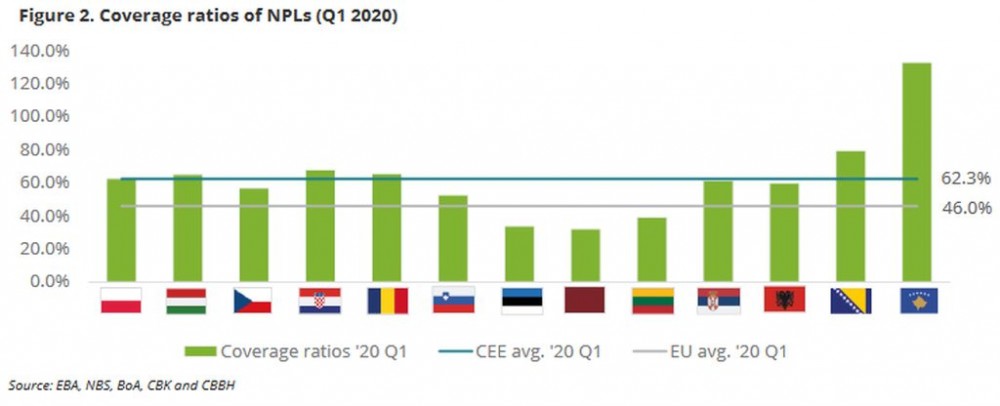

Provisioning policies can differ across the countries and banking groups, but in overall the coverage ratio of non-performing loans and advances were 16.3% points higher in the CEE region compared to the EU average in Q1 2020, which indicates that most banks already built up a sufficient amount of risk provisions for NPLs.

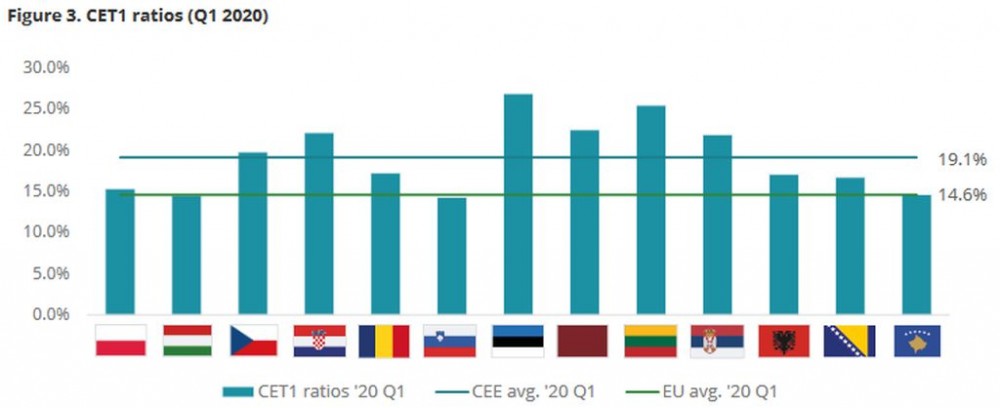

The significant decrease in NPL volumes over the recent years –among others -allowed banks to strengthen their capital positions and fulfil their role in funding the real economy. In Q1 2020, the Common Equity Tier 1 (CET1) ratios of Central and Eastern European banks stood at 19.1%, which is 4.5% points higher than the European average and well above the regulatory minimum of 4.5% (set as a per cent of total risk exposure amount). Out of the 13 CEE countries, the Baltics are far above the CEE and the EU average with an average CET1 ratio of 24.9%.

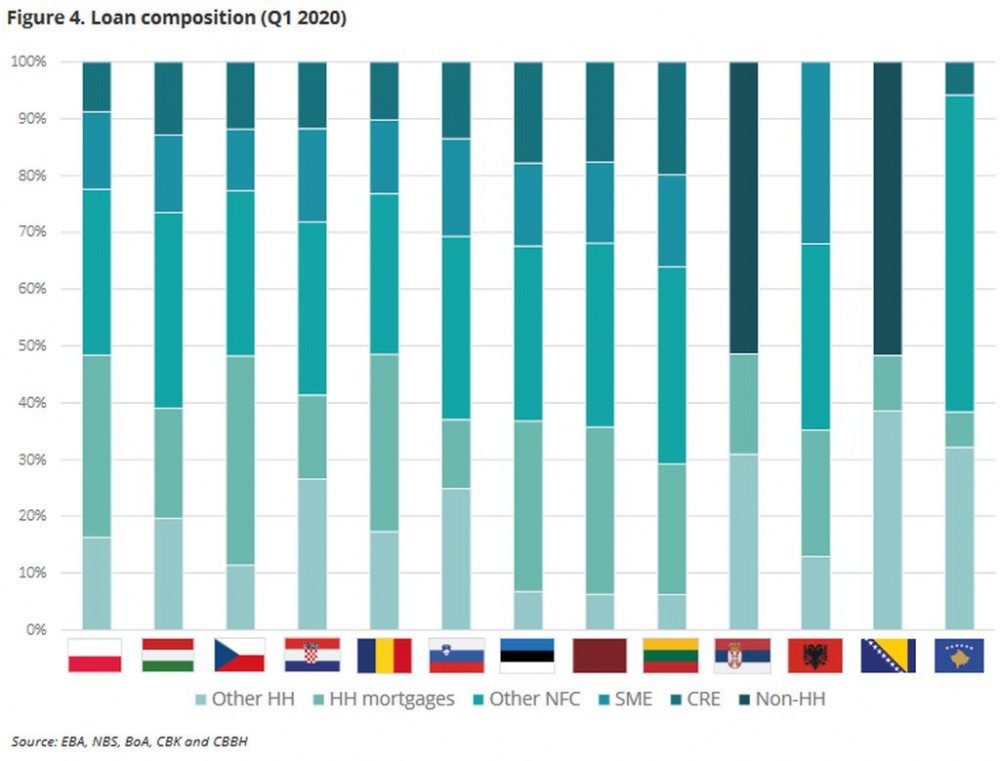

The retail segment is the most dominant sector among CEE banks thus the lending activity may decrease at a slower pace compared to those countries where corporate loans, especially the SME segment, constitute a higher portion in the banking system.

Moratorium on loans and other measures could also restrain the slowdown in the lending activities.Asset quality and adequate capital amounts are a key concern for banks to overcome the economic downturn. According to EBA, European banks on average have shifted their loan portfolio structure to the riskier segments as the exposures in the SME and retail unsecured segments have been increasing over the past few years.

As presented in the survey report, banks are more positive about the lending activity for 2021 compared to 2020 and believe that economies will require additional lending to stimulate the real economy and to recover from the pandemic situation.

COVID-19 MEASURES ACROSS EUROPE

In January 2020, coronavirus emerged in the European countries and the pandemic situation required an immediate and firm response from local governments and national banks to mitigate the social and economic impact of the outbreak. The measures in the first place were health-centric with the priority of protection of health and to slow down the spread of the virus.

This resulted in a wide range of measures and policy responses from school closing and travel restrictions to the introduction of economy protection measures such as the moratorium on loan payments, tax reliefs, job guarantees, state guarantees for bank loans and other types of state aid to the real economy as well as temporary relief on capital and liquidity buffer requirements for banks. European regulatory authorities like the EBA, ESMA and ECB have also released multiple guidelines in order to mitigate the impact of COVID-19 on the economy and to support banks in finding their way in this complex and unprecedented situation.

In the framework of the survey, our aim was to understand the general opinion of banks on government and national bank measures as the number and the characteristics of the measures could differ significantly country by country.

In our survey, we also investigated whether banks considered the responses of the local authorities to be carried out in time as timing was considered as a crucial factor by epidemiologists to stop the spread of the infection. One of the most impactful response from national banks to protect the economies and support borrowers was the introduction of moratorium on loan payments. As a result, questions on the effectiveness of the measure to safeguard the economy were also raised among banks.

One of the first countries to implement measures among the analysed countries was Poland.

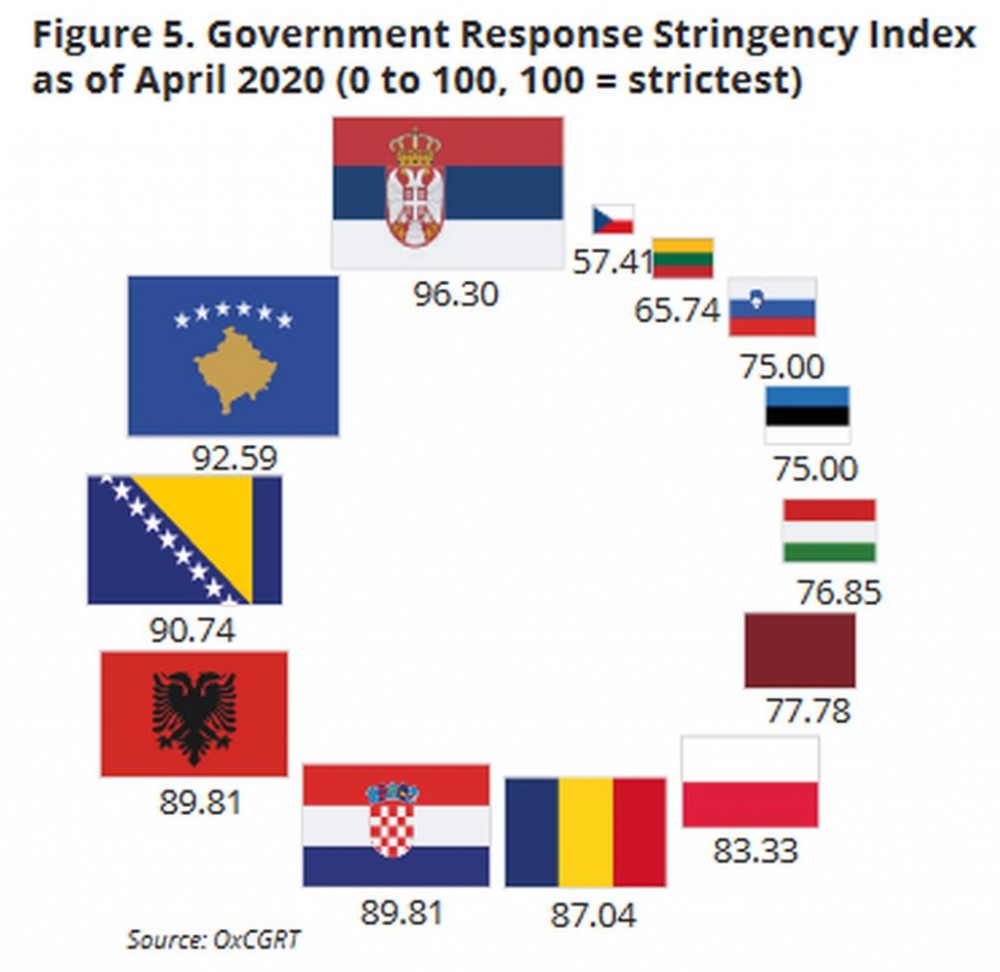

The OxCGRT provides a systematic analysis of the measures implemented by the governments across countries and time but should not be interpreted as a measure of effectiveness of the government responses.

According to EBA’s Thematic Note, however, the indices might be viewed as an indication of the magnitude and length the countries could be affected by the pandemic crisis economically.

In line with our survey results, countries with higher stringency indices like Serbia, Croatia or Kosovo considered the government measures less effective compared to the general sentiment of the CEE and overall these countries are expecting a longer economic recovery.

*The COVID-19 CEE banking sector impact survey was conducted among chief risk officers and heads of workout departments in Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Kosovo, Poland, Romania, Serbia, Slovakia and Slovenia. The full results are available upon request, on Deloitte website (https://www2.deloitte.com/ro/en.html).

FIGURE 5. PRESENTS THE STRINGENCY OF CONTAINMENT MEASURES BASED ON THE OXFORD COVID-19 GOVERNMENT RESPONSE TRACKER IN APRIL, WHICH WAS CONSIDERED ONE OF THE PEAKS OF THE PANDEMIC.

You can read the article also in the document below: