In the second quarter of 2020, the Coronavirus (COVID-19) pandemic caused unprecedented declines in global economic activity due to lockdown and severe social distancing measures. Social distancing restrictions have now been substantially relaxed in North America, Europe and Asia, with the first wave of the pandemic partially under control in most countries in these regions. However, since April 2020 the pandemic has intensified in Latin America and there are major risks of a second pandemic wave emerging in many countries.

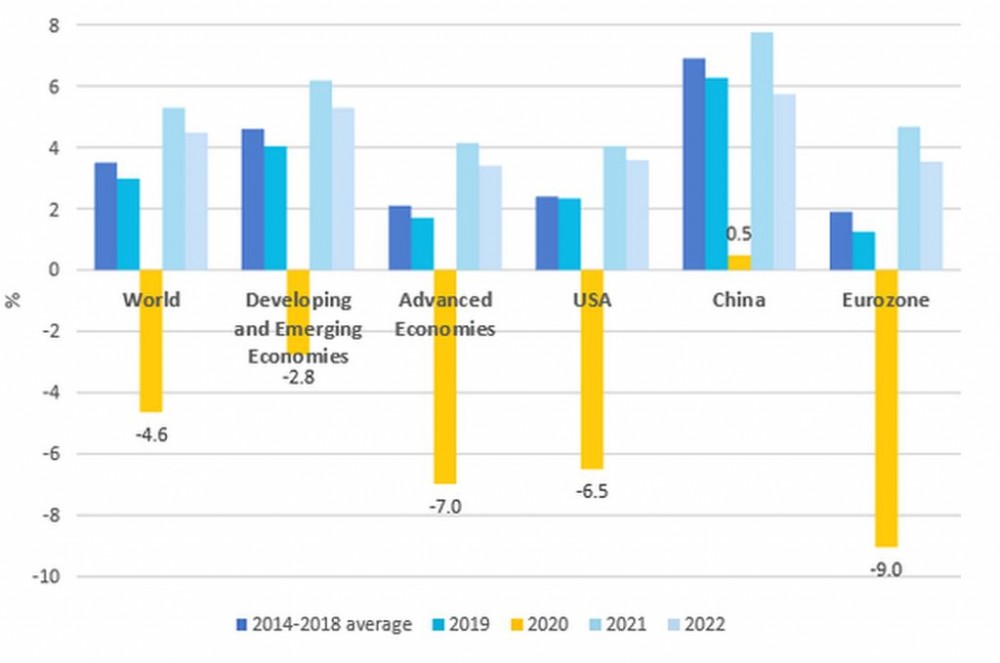

Euromonitor International’s new baseline COVID-19 forecasts for July are more pessimistic than those cited at the end of April, with global output set to decline by around 4.6% in 2020 (with a range of 3.5-5.5% contraction), with a recovery of around 5.3% growth in 2021 (with a range of 3.5-7.0%) and 4.5% growth in 2022. This would leave global economic activity levels in 2022 around 4.4% below the pre-COVID-19 forecast. This baseline forecast is assigned a 41.0-51.0% probability at a one-year horizon.

Global Real GDP Growth Baseline Forecast: 2014-2022

Source: Euromonitor International Macro Model, National Statistics. Note: Global real GDP growth using PPP weights; figures for 2020 onwards are forecasts; forecasts updated on 29 June 2020.

The most significant downward revisions are to developing economies, which are now expected to contract by almost 3.0% in 2020 and rebound by around 6.2% in 2021 (compared to a normal annual trend growth of around 4.5%). This reflects the strong spread of the pandemic in Latin America and the much worse than expected lockdown effects in India (with Brazilian and Mexico real output declines forecast at around 8.0-9.0%, and Indian real GDP expected to fall by more than 4.0% in 2020).

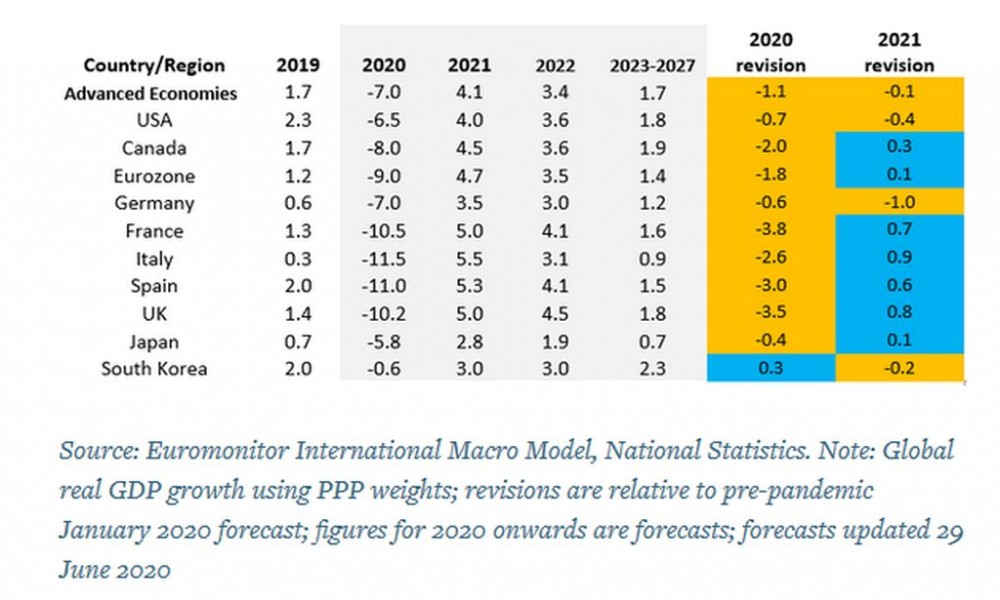

There have also been further significant downgrades to economic growth forecasts in Western Europe for France, Italy, Spain and the UK towards 10.0-12.0% real declines in 2020. The scale of the economic contractions partly explains the strong push from governments in trying to relax social distancing restrictions and reopen the tourism industry, despite major second pandemic wave concerns. Overall advanced economies’ GDP is expected to decline by around 7.0% in 2020, rebounding by 4.1% in 2021 (compared to normal annual trend growth of around 1.7%).

Advanced Economies Real GDP Growth Baseline Forecasts: 2019-2027

Developing Economies Real GDP Growth Baseline Forecasts: 2019-2027

Baseline revisions reflect worsening economic conditions

The baseline forecasts reflect the combined adverse effects of COVID-19 social distancing restrictions and behaviours, supply chain disruption, significant tightening of financial conditions, rising private sector uncertainty, falling household disposable incomes and sharp drops in global trade and commodity prices. Social distancing restrictions have led to large declines in business revenues, employment and wages, with each month of strict quarantine/lockdown estimated to cause a 20-45% decline in economic activity relative to normal. While lockdowns and other strict official social distancing restrictions have been relaxed, many restrictions remain in operation in the food, leisure and hospitality service sectors. Furthermore, consumers are expected to maintain some precautionary social distancing and reduced consumption due to infection concerns.

The baseline forecasts assume that the strict social distancing measures of Q2 2020 have successfully contained the pandemic in most economies, allowing a gradual recovery in consumer spending during the second half of 2020 and in 2021. Significant COVID-19 social distancing effects are expected to last for another 1-3 quarters (as of mid-2020). A reasonably effective vaccine or antiviral treatment is expected to be available around the middle of 2021, though sufficient availability in the population may take until the end of 2021.

Large government fiscal and credit support programmes have helped to stabilise the declines in disposable incomes during the peak of lockdowns and social distancing restrictions in advanced economies, but businesses and households continue to face high-income uncertainty. This has caused a spike in household precautionary saving and lower consumption, as well as large cuts in business investment. These negative uncertainty effects on private-sector spending are also likely to unwind only gradually. Developing economies are less likely to maintain strict social distancing measures, but any measures that are undertaken are more likely to disrupt economic activity, and these economies are also more vulnerable to adverse global trade and financial conditions and resultant shocks caused by the pandemic.

A second pandemic wave is very likely, leading to a much slower economic recovery

The baseline forecast assumes no significant second pandemic wave and is assigned around 46% probability over a one-year horizon. Around 54% probability over a one-year horizon is assigned to either a mild second pandemic wave in Q3-Q4 (COVID-19 Pessimistic1 scenario at around 29% probability) or more severe second pandemic wave scenarios in Q3-Q4 (COVID-19 Pessimistic2 or Pessimistic3 scenarios assigned jointly around 25% probability). The main effect of the pessimistic COVID-19 scenarios is to substantially reduce the strength of the economic recovery, potentially delaying it until 2022.

.................................................................................................................................................................

By: Giedrius Stalenis

The article is property of Euromonitor International, a market research provider, and can be read in full here.