At the beginning of 2020, the global economy was threatened by geopolitical uncertainties, worsening business and consumer confidence, and slowing growth of industrial production. Yet, those proved to be mild perturbations compared to the chaos and ambiguity brought by coronavirus. The pandemics and consequent quarantine resulted in severe disruptions to supply chains, bankruptcies for some and reconsideration of business models for all corporate players. Companies that are flexible and able to react quickly to changing consumer needs are expected to survive and remain competitive. This piece gives an overview of emerging business models and their performance.

React to changing consumer trends – ‘the new normal’ is here to stay

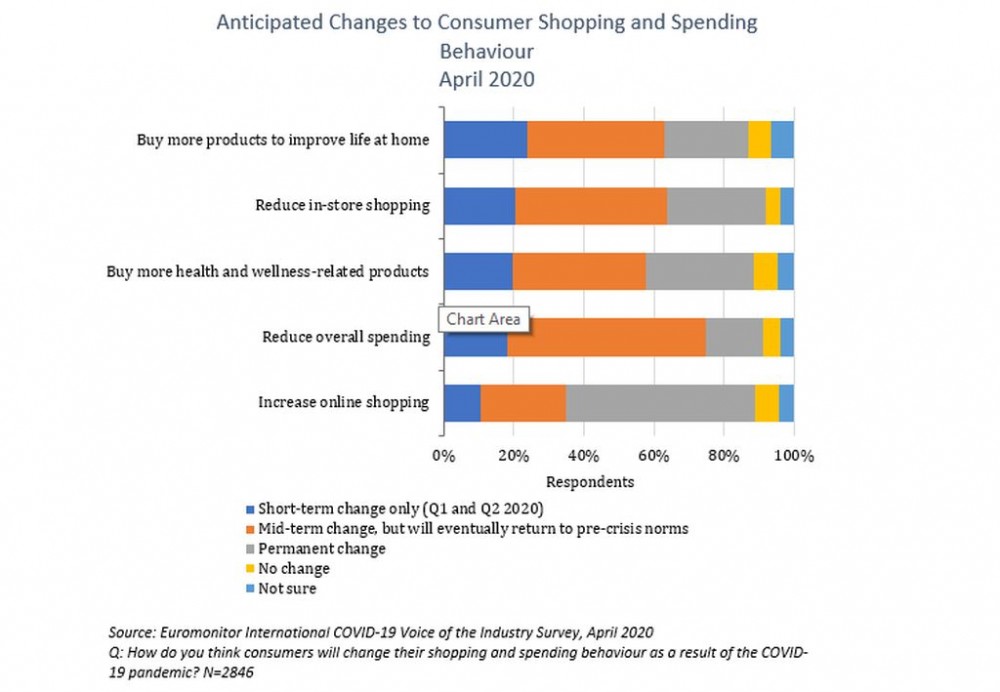

Changes brought about by the pandemic are making consumers re-evaluate their priorities, giving rise to new consumption patterns. Reduced consumption of non-essential items, increased focus on family/community, health, mental and physical wellbeing, artificial intelligence, retreat from globalisation, accelerated homeattainment - cooking, eating, online socialising and shopping - are the major consumer trends that will stick after the pandemic. For businesses, it is crucial to accept the new normal, where flexibility and adaptability become standard and future planning accounts for multiple scenarios.

Beyond human: helping simplify life

Usage of robotics and artificial intelligence has already been on the rise in the pre-COVID period, yet the trend is expected to intensify as more consumers are beginning to accept that robots and artificial intelligence (AI) can perform certain tasks instead of humans, and make life more comfortable, convenient and contactless. Furthermore, robot/AI companions for those living alone provide social interaction, communication links and general assistance. For example, the need for connection increases the popularity of the custom-designed chatbots, like avatar companion Replika, which combats loneliness by mimicking the consumer in the digital space. Meanwhile, virtual entertainment options vary from audible theatre festivals to online live music performances on, for example, the GigsGuide platform.

Multifunctional home: a safe space

During quarantine, home became the sole venue for all consumer experiences. VPNs, video conferencing and other web-based communication tools enabled companies to maintain their operations through remote work. Home schooling also became available as classrooms moved to online platforms. Gyms and entertainment activities went digital; service providers tried to bring virtual as close to physical as possible. The health crisis has accelerated the homeattainment trend, pushing companies to make the changes here and now. Companies that were fast to adapt by digitalising their offline business models will be the winners in the post-pandemic period as consumers will remain accustomed to new ways of work, life and play. For example, in response to the lockdown, London-based fitness studios Frame launched Frame Online, an online fitness hub with a GBP10.99 per month subscription fee that allows people to keep fit via virtual classes.

Virtual search of mental and physical wellbeing

Labelled the ‘loneliness epidemic’, COVID-19 has heightened consumers’ quest for staying healthy, both physically and mentally. With concern over scarce resources and information overload adding to feelings of being out of control, consumers turn to self-medicating through immune and mood-boosting ingredients, such as herbal products and relaxation and meditation apps. New habits around preventative health, such as telehealth and tech-enabled diagnostics are set to grow in popularity in the long term, while mental and emotional health will play an even greater role in the pursuit of wellbeing. This will also create opportunities for digital health application developers. For example, as Chinese consumers were confined to home during the pandemic and hospitals focused on treating COVID-19 patients, the demand for digital healthcare in China surged. Health platforms like Ping An Good Doctor, WeDoctor and Haodaifu reported a huge increase in the number of registrations and daily online consultations.

Retreat from globalisation

The supply chain disruptions and distribution restrictions have resulted in many consumers turning to local sellers and producers. The sense of community and ‘getting through this together’ is another significant driver for choosing local produce. Buying local is expected to continue, with consumers buying more locally produced items and supporting local businesses as recession kicks in. Local and independent businesses will benefit while multinationals respond with more rapid investment in local manufacturing and supply chain services as well as adapting products and services to local tastes. For instance, Marks & Spencer’s new “Supporting British Farmers” campaign highlights the retailer’s existing sourcing of near 10,000 British farms for meat, fish, dairy, fruit and vegetables. Beyond these arrangements, M&S has also committed to initiatives such as launching a British meat-only box for online delivery and has written to government departments outlining its concerns for British agriculture.

Consider pivoting business area

Almost all businesses have the potential to continue functioning and even growing during the quarantine period, yet agile transformation might be needed. Despite being shut in, consumers still possess a desire for the goods and services they were accustomed to accessing in a pre-pandemic world. Pivot-ready companies have therefore launched new ways of delivering their products that are not just side-projects, added features or charitable initiatives, but a part of a fight for survival in the face of major disruption to their business model. For example, UK marketplace for booking musicians, Encore, has pivoted to become a marketplace for recorded musical messages; German organiser of art workshop events ArtNight has transformed into an edtech platform, offering online video tutorials and delivering painting kits to customers’ doorsteps. Meanwhile, UK manufacturer of goods for electric vehicles EO Charging has switched to creating online lessons for children on sustainability and energy in partnership with three other firms.

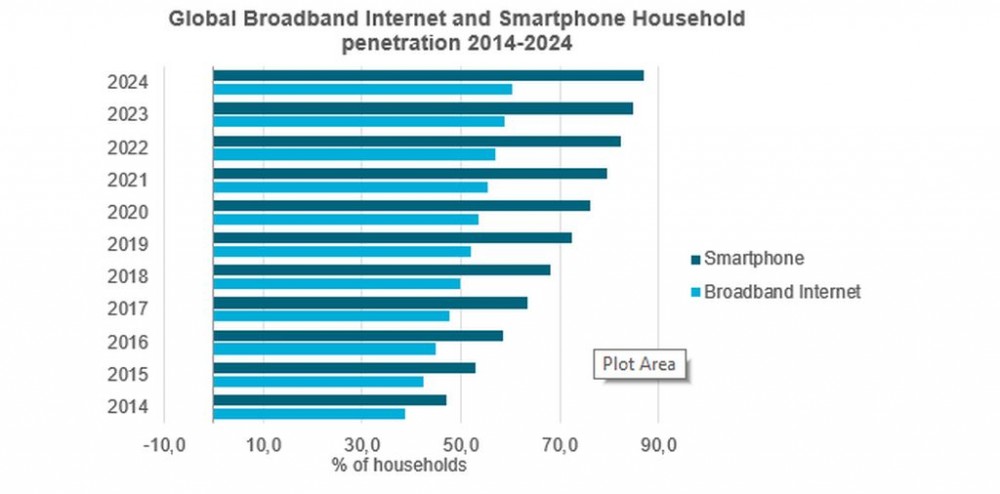

Go online or decline

With many consumers entirely reliant on the internet for social contact, leisure, entertainment, and shopping, growth in internet usage throughout the pandemic has spiked, with services globally reporting record levels of digital engagement. For example, Netflix stated in its first quarter earnings report that it saw record traffic and added more than 15 million new subscribers. Disney+ reported a similar surge in its digital streaming service. Digital presence is now essential for almost any business reliant on consumer sales and services. It should be seen as a longer-term opportunity for brands to elevate their omnichannel technologies, not just to push digital sales but also to create platforms and communities for product discovery, advice and sharing at a time of heightened uncertainty, insecurity and anxiety.

Keep clients engaged

With the decline of conventional shopping and growing information noise in the online channels, engaging and keeping the focus is difficult, though necessary. Even without actual transactions, keeping communication open with the client via entertaining apps, promotions, and games might prove to be a lucrative long term strategy, paying off when the restrictions are lifted. For example, Nike has decided to provide its NTC Premium service free of charge, reporting an 80% increase in weekly active users for all apps. Under Armour has encouraged engagement in fitness challenges via MyFitnessPal and MapMyRun apps, posting home workout videos by professional trainers on its Instagram page.

Advertise sensitively

In this period of uncertainty and heightened anxiety, a hard sell will not be appreciated, therefore, companies must market carefully and sensitively. Pivoting to new advertising models that will address entrenched consumer habits, is expected to result in moving towards cheaper and more flexible channels such as programmatic advertising – a way to automatically buy and optimise digital campaigns – where consumer presence and available impressions are increasing. An additional factor is the growing emphasis on purpose over profit, with such companies being rewarded by greater consumer loyalty and demand. The message “we’re in this together” has put community spirit at the forefront of consumer focus. In an example of responsible yet effective advertising, US direct-to-consumer mattress manufacturer Casper used powerful social messaging with its own product relevancy to reach consumers and urge them to stay home.

Transfer to leaner pricing

Consumers emerging from the COVID-19 pandemic are more cautious and selective. Global recessionary environment, growing unemployment and lower disposable incomes, coupled with anxiety and uncertainty will result in the manifestation of post-recessionary consumption habits such as thrift, bargain hunting, and access over ownership. Companies, in turn, should consider engaging price restructuring strategies, like price cutting, discounts, deferred payments, etc. For instance, Carlsberg was attempting to keep the on-trade alive in its home country at least virtually, by asking Danes to “adopt a keg”, which allows consumers to fill their adopted virtual keg online and exchange it for real beer in a real bar at a later date when it reopens. When someone drinks a bottle or can of Carlsberg at home, they can scan the label to add it to their virtual keg on Carlsberg’s website. Four scanned beers add up to one beer a day which earns the consumer two post-lockdown pints to share with a friend when they eventually visit a bar.

Collaborate and livestream

Transforming business models might prove to be difficult, therefore, collaboration with other companies is crucial for a successful pivot. Many businesses find themselves unable to deliver items through traditional sales channels, while new infrastructure was too expensive to develop at short notice. With in-store experiences severely limited, brands and manufacturers have to create strong tie-ins with social networks and livestreaming services in order to engage audiences and recreate a real-time shopping atmosphere. IKEA started selling around 4,000 of its 9,500 products on popular Chinese marketplace Tmall in March, complementing IKEA’s 30 big box stores and online store phone app. While IKEA offered goods, Tmall had the unparalleled advantage of reach, reliability, and was acting as a conduit for a foreign brand to market and service Chinese shoppers.

Reuse existing resources

Contactless and remote living cut the demand for conventional hospitality services considerably, yet pivoting the business to use the existing resources helped companies stay afloat, explore new business areas and gain advantage for the post-COVID period. Restaurants started to offer takeaway services, meanwhile, in the UK, around 2,000 pubs have converted into mini stores selling essential items and grocery goods. Smaller players such as farm stores started offering home delivery, especially for vulnerable consumer groups. Rediscovering cooking as a part of homeattainment, also increased the demand for livestreaming cooking lessons and recipe apps. Helping to give consumers what they need or want, such as freshly baked goods or restaurant quality meals, showing care and concern and prioritising communities helped businesses to survive.

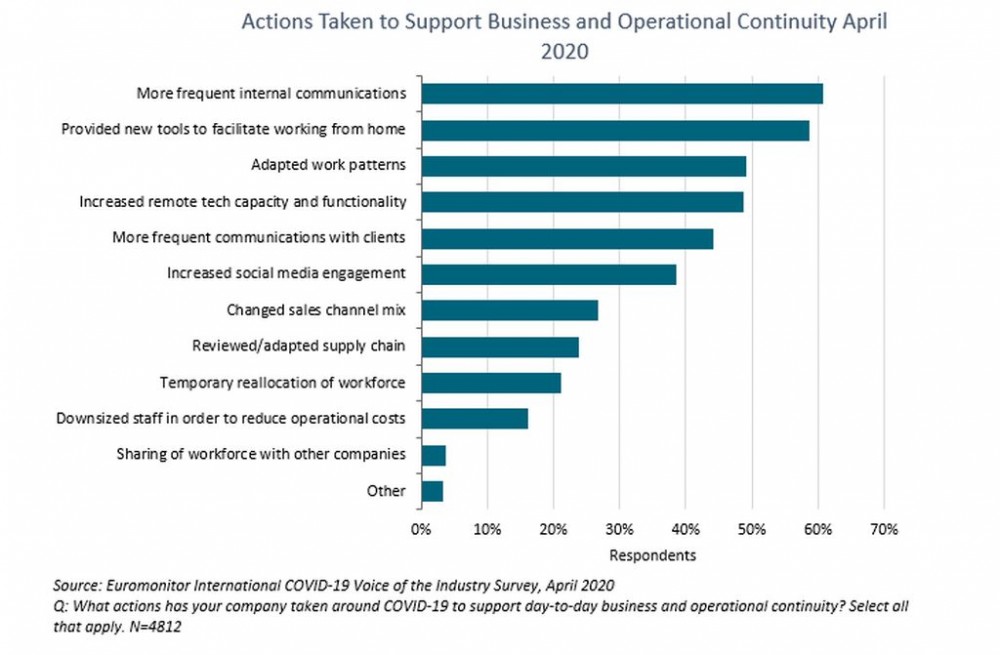

Be ready to adopt home office culture

The pandemic has resulted in companies adapting their routines to the new reality and redefining the way they work. The most noticeable change for most businesses is transferring from a work-in-office to work-from-home model and keeping staff productive, healthy and happy while doing so. Making the move is especially paramount if further waves of the infection are to come. Increasing the frequency of internal communication and embracing the home-office have been listed among the top actions taken to support business and operational continuity, according to the Euromonitor International COVID-19 Voice of the Industry Survey.

Furthermore, according to Survey, more than 65% of corporate respondents expect that remote working will also continue post-COVID, making home-office a long-term policy in the corporate world. Due to the recessionary impact of COVID-19, many freelance marketplaces have experienced an unprecedented rise in demand for ad-hoc work, while demand for talent in specific areas has also risen. PeoplePerHour.com, a leading UK-based freelance service, recorded a 500% surge in the number of firms seeking freelance support for enterprise resource planning, while demand for media planning and brand development creatives surged by 400% and 200%, respectively, between February and March.

Closing remarks

The health crisis, lockdown and ongoing recessionary forces will severely change the normal for consumers around the world. As a result, corporate reality must also change. Survival definitely involves agile innovation and ability to pivot and reinvent business models to service changing consumer needs. Virtual marketplaces, collaboration and higher engagement with clientele, leaner pricing strategies and sensitive and carefully targeted marketing coupled with the ability to react fast and be flexible will be crucial in the pandemic and post-COVID-19 period.

The article is property of Euromonitor International, a market research provider