„Compared to the results of the edition at the beginning of the year, the new survey report shows a strong contraction of the activity of the companies under the impact of the pandemic. However, respondents say that the second half of the year is not perceived as significantly more unfavorable than the first half, when the COVID-19 pandemic broke out. We can say that the top executives have managed, for the most part, to recalibrate the activity of the companies, depending on their industry sector, but the upturn is still far away.”, says Constantin Magdalina, Emerging Trends and Technologies Exper, co-author of the research.

Forecast on turnover growth

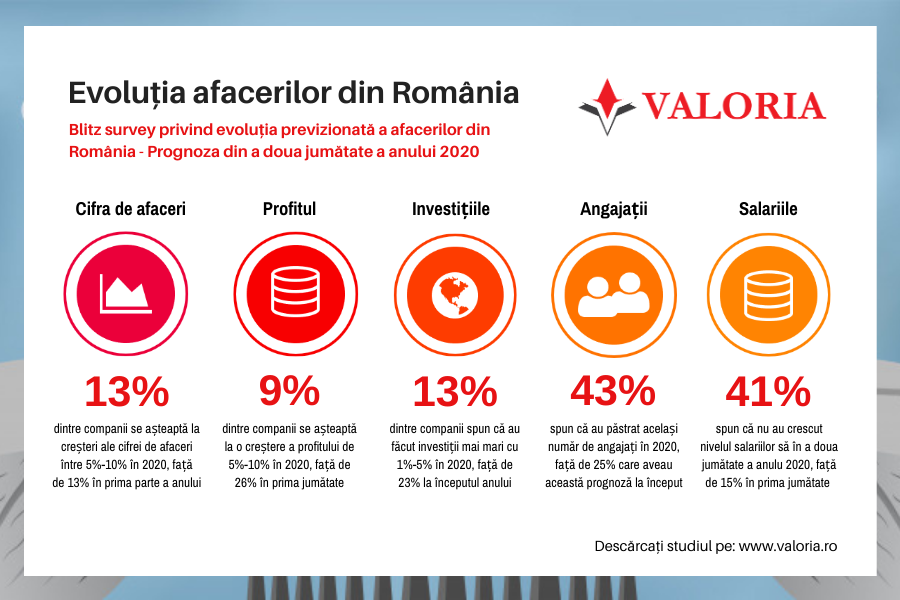

Compared to the forecast at the beginning of 2020, the growth perspective of companies is strongly adjusted in the second half of the year under the impact of the pandemic. We see decreases of -15pp (from 28% to 13%) of the percentages of companies that forecast a higher turnover by 5%-10%, respectively of -12pp (from 25% to 13%) of those that expect a higher turnover by 10%-20% this year. At the same time, no less than a quarter of the responding companies say that they expect a decrease in turnover of more than -30% in 2020.

At the level of industries, an increase in turnover of 10%-20% is forecast by 67% of companies in the pharmaceutical and health industry, 37% of companies in the IT industry, 32% of professional services companies, 23% between industrial production companies and 20% of telecommunications companies. On the other hand, most companies in the tourism industry (72%), media and advertising (61%), but also in construction and real estate (33%) predict decreases in turnover of more than -30%.

Forecast of profits growth

Profit forecast is strongly adjusted now compared to the beginning of 2020. We see a decrease of 17pp, from 26% to 9% on the 5%-10% level and of 10pp on, from 25% to 15%, on the 10%-20% bracket level. In the second half of the year only 11% of companies (compared to 25% previously) expect their profit to increase by 1% -5% this year. It remains about the same percentage of companies (9%-10%) that say profits will increase by more than 20% in 2020, but significantly increase, from 10% to 45%, the percentage of companies that forecast a decline in profit this year.

At the industry level, a 10%-20% increase in profit is expected by 40% of companies in the pharmaceutical and healthcare industry and by 31% of professional service companies. Decreases of over -30% in profit are foreseen by companies in the tourism industry (67%), media and advertising (57%) and construction (30%). Half of the transport companies say that their profit will stagnate this year.

Forecast of investments growth

If at the beginning of the year 11% of companies said that their investments will stagnate in 2020, in the research for the second half of the year 25% say so. We also note that only 13% of companies increased their investments by 5%-10% compared to 23% at the beginning of the year, and 16% compared to 24% previously say they have increased investments by 5%-10% in 2020. In the same time, the percentage of companies that have decreased investment this year goes from 6% in the first part of the year to 26% now.

At the level of industries, most companies in the IT industry (50%), in agriculture and food (30%) and trade (20%), say their investments have increased by 10% -20% this year. On the other hand, investments in the transport industry sector and in the media and advertising industry have stagnated, while those in tourism as well as in energy and utilities have declined.

Forecast on the number of employees

In the second half of 2020, 43% of the responding companies compared to 25% in the first half say they have no increase in the number of employees. The percentage of companies that have increases of 1%-5%, go from 24% to 15%, showing a decrease by 9pp, and the percentage of those that have personnel increases of 5%-10% go down by 14pp, from 19% at the beginning of the year to 5% currently. The percentage of companies that have reduced the number of employees increases from 14% to 26%.

At the same time, the results of the blitz survey show that most of the professional service companies (31%), 48% of the IT companies, 66% of the agriculture and food companies, 87% of the media and advertising, 73% of the pharmaceutical industry and 67% of the energy and utilities have no increases in the number of employees in 2020.

Forecast of salaries growth

At the beginning of 2020, 15% of companies did not anticipate any salary increases, but the percentage increases to 41% at the end of the year. Instead, the percentage of companies that say their salaries have fallen this year is rising from 3% to 23%. Moreover, none of the respondent companies say that has increased salaries with more than 10% in 2020.

On the other hand, most of the professional services companies (75%), 40% in the construction and real estate industry, 83% in the media and advertising industry, as well as 50% in the pharmaceutical and healthcare industry did not increase salaries at all in 2020.

Top 5 challenges and opportunities

The most important challenges identified by the top executives and managers of the responding companies in the second half of 2020 are the following: drastic decrease in demand/orders (78%), contraction of activity (75%), maintaining cash flow (68%), adapting the company to the new context (58%) and collecting invoices (45%).

The most important opportunities in the second half of 2020 are: access to European grants and funds (89%), development of online sales (66%), digitalization and automation of processes (53%), development of new business lines (38%) and the reduction of tension in the labor market (25%).

Moreover, the executives and managers of the responding companies say that the three main measures that would lead to improving the Romanian business environment are: supporting the private companies (85%), a program for infrastructure investments (73%) and digitalizing the relationship with the authorities (59%). At the beginning of the year the recommend measures were: investments in infrastructure (82%), lower labor taxation (76%) and political and fiscal stability (59%).

„The business outlook of the Romanian companies indicates a radical shift in perspective on the economic context transformed by the impact of the pandemic. Compared to the results of research conducted in the first part of 2020, those in the second part of the year reveal that the percentage of companies that say they will have a declining turnover is now 43% compared to 11% at the beginning of the year. Regarding the forecast on profits, the percentage is 45% compared to 10% at the beginning of the year, and in the case of the number of employees it is 26% compared to 14% in the previous edition of the study. What will the year 2021 bring? Perhaps a greater emphasis on productivity and agility through digitalization.”, says Dumitru Ion, CEO of Kompass Romania și Doingbusiness.ro, co-author of the survey.