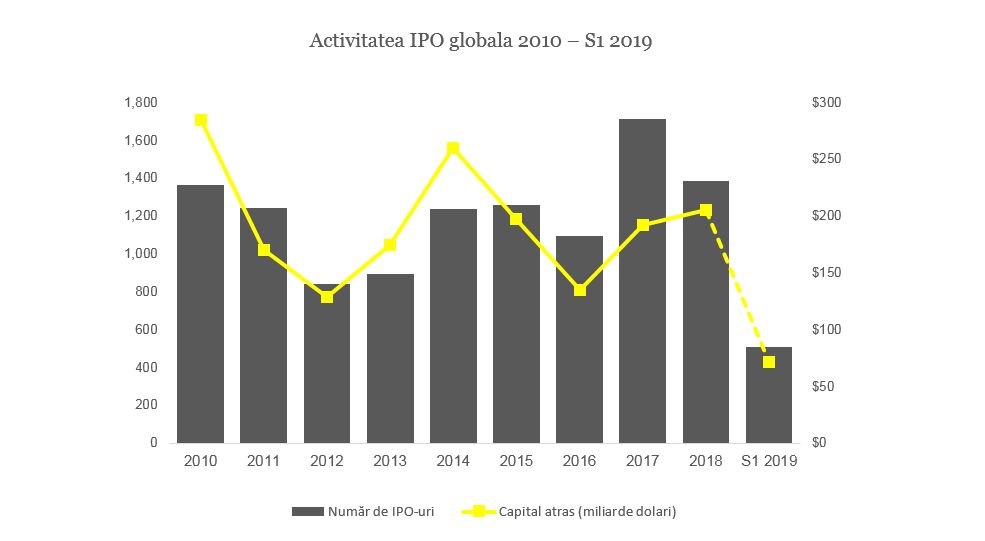

The trend of listing "unicorn" companies and rising underwritings to their record continued in the second quarter of 2019, according to the quarterly report EY-Global IPO trends: Q2 2019. Despite maintaining geopolitical uncertainties and commercial tensions, 507 IPO transactions were recorded in the first half of 2019, totaling 71.9 billion dollars. Although the number of transactions declined by 28% compared to the first half of 2018, first day earnings on major markets rose by an average of 15.4% and post-listing prices rose 28.4%.

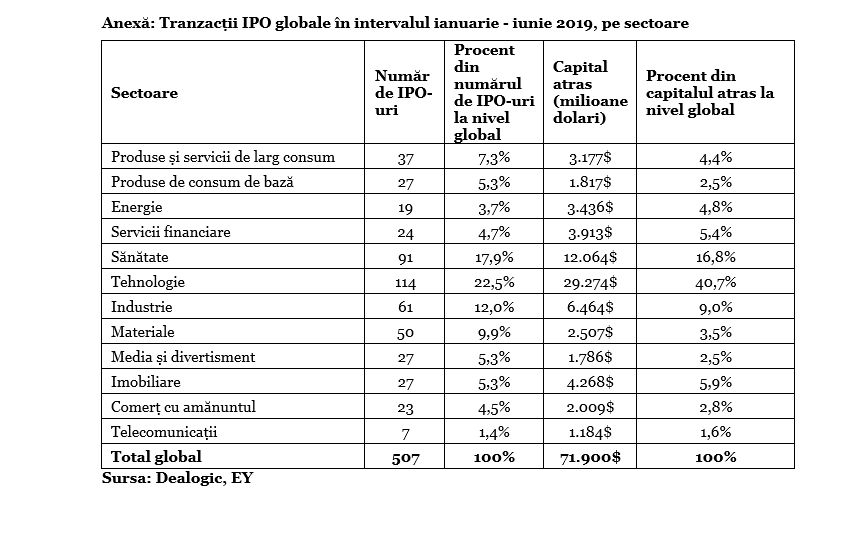

The technology, health and industrial sectors recorded the largest share of total IPO transactions in the first half of 2019, cumulating 266 IPOs (52% of total IPO transactions), totaling 47.8 billion dollars (66% of the capital attracted globally). Depending on the value of the capital attracted, technology was the strongest sector with underwritings worth $ 29.3 billion (41% of the value of the capital attracted globally).

Investors in the EMEIA region remain cautious due to the persistence of global uncertainties

In EMEIA, the number and value of transactions have fallen since the first half of 2018.The stock markets in this region registered 123 IPOs (a 53% drop) and attracted capital totaling $ 16 billion (a 48% drop). Despite the difficulties, five of the top ten stock exchanges as transaction value and two of the top ten global stock exchanges came from EMEIA. Overall, given the strong first-day returns, the performance of IPO transactions in the first half of this year, and investor confidence, an increase in EMEA IPO market activity is expected in the second half of 2019. In Europe, there was a marked increase in IPO activity in the second quarter of 2019.

In Europe, there was a marked increase in IPO activity in the second quarter of 2019. The number of initial public offerings increased by 100% (48 transactions) and the value of the capital attracted by 3.338% (12.5 billion dollars) compared to the first quarter of this year.

"EMEIA is a region more dependent on global trade than other regions and is therefore more sensitive to the persistence of geopolitical uncertainties. Given that the largest trade flows in the world are between the US and China, on the one hand, and the European Union, on the other hand, EMEIA has an indicator role in setting the health of the global economy. If the US and China resolve their trade-related conflict and tariffs, and the UK and the EU agree on conditions that will lead to a Brexit agreement, we can expect IPO activity to recover in the second half of 2019. Meanwhile, EMEA IPO candidates continue to prepare themselves to be ready to take action at the right time, " said Dr. Martin Steinbach, Coordinator of EY Global and EY EMEIA IPO.

IPO markets on the American continent are recovering

On the American continent, there were 87 initial public offerings, totaling $ 28.1 billion in the second quarter of 2019, which meant a 5% increase in the number of transactions and 50% of the value of transactions compared to the second quarter of 2018. However, at the level of the first half of 2019, activity decreased by 14%, 118 transactions were recorded, and the value of attracted capital decreased by 12% to 33.6 billion dollars, compared to the same period last year.

Nevertheless, the NYSE and NASDAQ indices ranked first and second respectively in the global capital appreciation chart attracted in the first half of 2019.

US stock exchanges recorded 75% of US IPOs (88 IPOs) and 96% of transaction value ($ 32.2 billion) in the first half of 2019, following the public listing of several important "unicorn" technology companies in the second quarter of the year.

Initial public listing schedules in the Asia Pacific region have been hurried to outpace the economic turmoil

The constant trade tensions between China and the US continued to affect the IPO activity in the first half of 2019, preventing a return to 2018 levels. The IPO activity in the entire Asia Pacific region in the first half of 2019 recorded a 12% drop in volume (266 transactions) and 27% in attracted value ($ 22.3 billion) from the first half of 2018.

However, the Asia-Pacific exchanges have maintained their domination on the global IPO market this six months as six of the top ten stock exchanges in the world from this region. In terms of attracted capital, three of the top ten stock exchanges are in this region. Asia-Pacific main markets recorded average day-to-day returns of about 19% and average current returns of 34%, which means that the performance of IPO transactions continues to improve investors' attitude towards them.

Stock exchanges in Mainland China registered 27% more IPO transactions (33) in the second quarter of 2019 compared to the same period last year, but also a 38% drop in attracted capital ($ 5.1 billion), due to the absence of IPO mega-transactions. But an increase in IPO activity in Mainland China is expected in the second half of this year as a result of the launch of the Platform for Innovation in Science and Technology (STAR Market) at the Shanghai Stock Exchange.

IPO markets in Japan remained stable in the first half of 2019, recording a slight increase in the number of transactions over the same period last year. There were 41 IPOs in the first half of 2019 compared to 39 IPOs in the similar period last year, while the value of the attracted capital ($ 1.3 billion) was significantly lower than in the first semester of 2018 ($ 2.8 billion).