• Total value of transactions was estimated at US$ 6.6bn in 2022

• Technology was the most active sector by deal count, displacing real estate from the top position

• The United States were the #1 country by origin of investor for inbound transactions

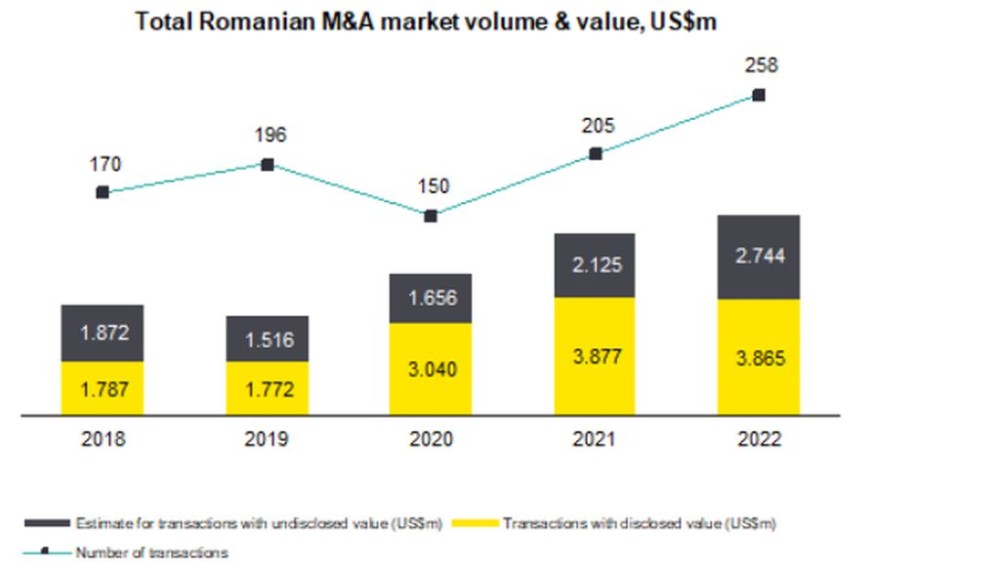

The Romanian mergers and acquisitions (M&A) market recorded 258 transactions(1) during 2022, with a total estimated value of US$ 6.6bn(2). This represents a 26% increase compared to the deal count of 2021 (206), and a higher estimated value by 10% on a year-on-year basis (US$ 6.0bn in 2021).

On a global level, after one of the most successful years on record for M&A activity in 2021, last year marked a significant slowdown due to elevated uncertainty, increased financing costs, higher energy prices and supply-chain disruptions. Multiple headwinds led the value of global M&A to decrease by 37% year-on-year, while the value of European M&A decreased by 28%. In this context, Romanian M&A activity bucked the global and regional trends and was a clear outperformer.

Strategic investors continued to be the dominant players in Romanian M&A, accounting for 88% of transactions in 2022. Domestic transactions showed a slight increase with 119 deals recorded (compared to 112 in 2021), while the number of transactions undertaken by foreign investors (inbound) increased by 38% year-on-year, to a total of 119. Notably, the number of outbound transactions more than doubled year-on-year, reflecting the increased willingness of Romanian investors to execute cross-border transactions.

“While market data suggests highly positive dynamics for the full year of 2022, we note a slowdown in M&A activity observed in the second half of the year. In particular, widening gaps in price expectation between buyside and sellside have gradually become a prominent factor.

While the environment is still volatile, we expect 2023 activity to reflect that the underlying fundamentals driving record levels of transactions in recent years are largely still in place. Moreover, we see the current market context representing a unique opportunity for strategic players with strong balance sheets to strategically reposition for the long term”, said Iulia Bratu, Head of Lead Advisory at EY Romania.

The most active sectors by deal volume were technology (19.4% of transactions) and real estate (16.3%), followed by healthcare (11.2%), power and utilities (8.1%) and diversified industrial products (7.8%). The top position was reversed between technology and real estate compared to 2021, showing the growing importance of addressing digital transformation needs as well as the slowdown brought to the real estate sector by higher interest rates. Furthermore, M&A activity in the healthcare space was boosted by well-capitalized corporates coming stronger out of the COVID crisis, while power and utilities targets benefited from the acceleration of the energy transition at a European level.

The largest transactions of the year

• Natural gas producer Romgaz acquired ExxonMobil Exploration and Production Romania Limited and its 50% stake in offshore project Neptun Deep for $1.06 billion

• The acquisition of automaker Ford Romania by Ford Otosan Netherlands for US$ 785m

• CA Immo’s office portfolio in Romania was acquired by Paval Holding for US$ 389m

• GlobalLogic, a Hitachi Group company, acquired Fortech, one of Romania’s leading independent digital engineering firms for an estimated consideration of US$ 255m

• Bank of Cyprus’ Romanian NPL portfolio was acquired by APS Holdings Corporation for US$ 158m

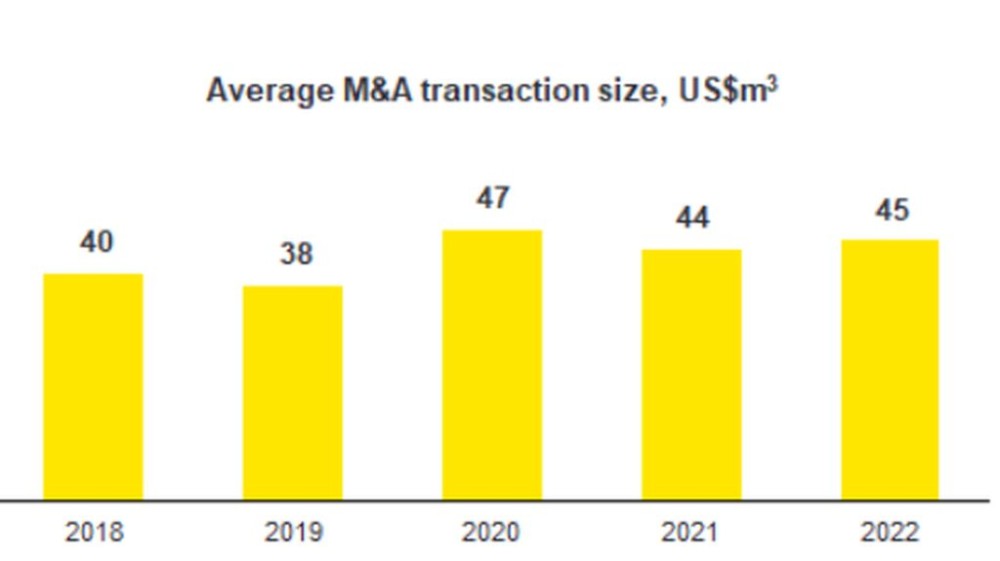

In 2022, the average transaction size remained steady at US$ 45m, but below its most recent high in 2020. This effect is also amplified by the consistent trend of unreported transaction values for larger deals. Lastly, the most active investors by country of origin came from the United States (11.6% of inbound deals), Germany (8.3%), United Kingdom, Belgium and Poland (6.6% each).

Note: (1) EY’s M&A database for Romania excludes transactions with stakes acquired of less than 15% as well as the transaction value for multi-country deals if the value of the country-specific assets are not disclosed. (2) includes an estimate of the value of transactions where no data was formerly disclosed by the parties or is not available in third party databases and/or reported by media sources (3) refers to transactions with disclosed values between US$ 5m – 500m

About EY Romania

EY is one of the world's leading professional services firms with 365,399 employees in more than 700 offices across 150 countries, and revenues of approx. $45,4 billion in the financial year that ended on 30 June 2022. Our network is the most integrated worldwide, and its resources help us provide our clients with services allowing them to take advantage of opportunities anywhere in the world.

With a presence in Romania ever since 1992, EY is the leading company on the market of professional services. Our more than 900 employees in Romania and Moldova provide integrated services in assurance, tax, strategy and transactions, and consulting to clients ranging from multinationals to local companies.

Our offices are based in Bucharest, Cluj-Napoca, Timisoara, Iasi and Chisinau. In 2014, EY Romania joined the only global competition dedicated to entrepreneurship, EY Entrepreneur Of The Year. The winner of the national award represents Romania at the world final taking place every year in June, at Monte Carlo. The title of World Entrepreneur Of The Year is awarded in the world final. For more information, please visit: www.ey.com