As businesses recognize the advantages of globalization and digitalization, cross-border enterprises become a significant component of the EU market. Together with cross-border services comes international movement of staff, which is most often seen in the form of international posting of employees.

International postings bring a lot of baggage and recently they have been in the spotlight of the European Commission as the currently applicable regulations do not seem to fit today’s reality anymore. Various forms of abusive practice, circumvention and malpractice in the implementation of the Posting Directive have resulted in labor market distortions and “social dumping” in labor intensive sectors of higher wage countries.

With the increase in the numbers of posted workers comes a higher demand for fairer conditions for the workers and companies concerned. Consequently, the European Commission has adopted a revision of the Posting Directive based on the concept of “equal pay for equal work”.

The Revised Posting Directive must be implemented into the national legislation of each Member State no later than July 2020. This will bring a significant shift of approach as posted employees will be entitled not only to the minimum wage applicable in the host country but also to the same remuneration (including benefits, bonuses, etc.) as a local employee performing the same job in the host country.

However, until the Revised Posting Directive comes into effect, in the context of finding the right balance between the freedom to provide cross-border services and the social rights of workers, increased focus will be placed on genuine compliance with current requirements, mainly the minimum wage requirements.

What is the legal framework regulating the posting of employees?

EU law sets out mandatory rules on the terms and conditions of employment to be applied to posted workers. These rules establish that, even though workers posted to another Member State are still employed by the home company and are subject to the law of the home Member State, they are entitled to a set of core rights in force in the host Member State:

- minimum rates of pay

- maximum work periods and minimum rest periods

- minimum paid annual leave

- the conditions for hiring out workers through temporary work agencies

- health, safety and hygiene at work

- equal treatment between men and women

What is a posted worker?

A posted worker is an employee who is sent by his/her employer to carry out a service in another EU Member State, on a temporary basis, in the context of a contract of services, an intra-group posting or a hiring out through a temporary agency.

Is the business traveler a posted worker?

Not all countries define a posted worker in the same way. In some countries business travelers are subject to the same requirements as posted workers, while in others, they are not. Especially when it comes to registration procedures, business travelers may be treated differently.

However, business travelers are a very complicated subject and we recommend checking the applicable regulations in each host location.

Does the nature of the activity matter?

In some countries, exemptions may apply in the case of non-income generating activities such as training or internal meetings. However, since these cases are not clearly dealt with in the Posting Directive, the domestic requirements should be carefully observed.

What is the minimum wage within the EU/EEA/Switzerland?

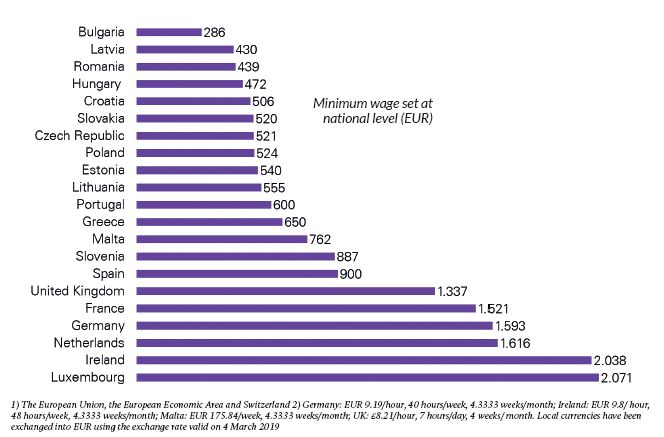

Out of the 31 Member States1 only 21 have a minimum wage set at national level. Luxembourg is the Member State with the highest minimum wage and Bulgaria has the lowest2 (see the table below).

How has the minimum wage changed over time?

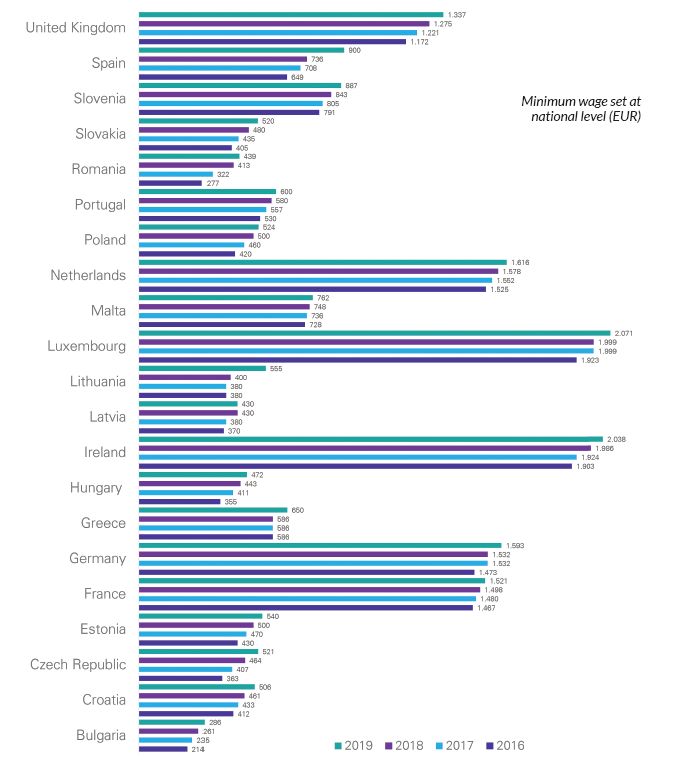

Generally, the minimum wage set at national level changes on an annual basis.

Changes in the minimum wage have a direct impact on the costs of the employer making the posting. Therefore, companies must be constantly on the lookout for any changes in the minimum wage requirements and adjust the remuneration of their mobile employees accordingly.

In the last four years, all countries under review have registered increases in the level of their minimum wage (see the table on the right).

What can be included in the minimum wage?

At first glance, complying with a minimum wage requirement does not appear to be a complicated issue. Once the level of the minimum wage in the country where the posting takes place is known, all the employer has to do is make sure that level is reached. That might sound simple. However the practical difficulties and the challenges lie in understanding how the minimum wage is determined. The following questions may come up in such cases:

- Would a salary rise be enough if the employee does not earn enough income in the home country to meet the level of the minimum wage in the posting country?

- Can the posted employee be granted an assignment allowance on top of the home-country base salary to reach the minimum wage requirement in the country of posting?

- Would a bonus be sufficient?

- What about per-diems?

- Can transport and accommodation allowances be considered part of the minimum wage?

Of course, the above list can go on, with many more similar questions. The posting employer will also have to deal with issues relating to its country’s domestic legislation, as well as internal policy (where appropriate), such as:

- An increase in salary to meet the minimum wage in the posting country could lead to employment law implications in the home country (e.g. what happens upon termination of the assignment, and can the base salary be decreased back to the home-country level after repatriation?).

- How can a different increase in salary for two assignees with the same position be justified, when staff are posted to two different countries with different levels of minimum wage (e.g. assignment to Romania and assignment to Germany).

- The Directive clearly states that allowances specific to the posting are to be considered part of the minimum wage, unless they are paid to reimburse expenditure on travel, board and lodging.

- The concept of minimum rates of pay is defined by the national law and/or practice of the Member State to which the worker is posted, the so called Host Country. Therefore, differences may appear, depending on each Member State’s domestic legislation.

For example, certain bonuses or allowances are constituent parts of pay in some Member States but not in others. The absence of a clear definition of the constituent elements of pay results in legal uncertainty and practical difficulties for the employer, when determining the wage due to a posted worker.

Minimum wage requirements within Europe in the context of posting of workers 2019 - a KPMG Guide on Posting of Workers, 4th edition

To help companies meet their legal obligations in relation to posting of workers, KPMG has initiated a series of annual surveys covering minimum wage and registration requirements within the European Union, the European Economic Area and Switzerland.

The main purpose of this survey is to give companies an overview of the potential costs and obligations related to mobile workers. In this respect, the guide includes:

- A General overview section - this part of the KPMG Guide on Posting of Workers aims to give companies a clearer view on what a posting is, how it is regulated and what the main changes are which may have an impact from a cost or compliance perspective.

- A Main findings section – which provides an overview of our main findings on the minimum wage levels across the EU, EEA Member States and Switzerland, trends observed and conclusions.

- A Country by country section - which includes information specific to each Member State on:

- Minimum wage requirements and what can be included in the minimum wage

- Working time

- Registration requirements and

- Penalties for non-compliance and public sources of information.

The latest edition of the KPMG survey can be found here.