Incentives for Research and Development („R&D”) are at the forefront of tax changes, perhaps more obvious than in any of the other categories of taxes on globally pursued activities, according to a recent EY study on the subject („EY Worldwide R&D Incentives Reference Guide”).

According to this annual EY publication, 14 out of 41 - or 34% of the interviewed jurisdictions - forecast new or more generous R & D incentives in 2018 (compared with only 22% in 2017). Moreover, nine of the 14 countries that increased R & D incentives in 2018 are taking measures for the second consecutive year.

According to the study, between 2015 and 2017, countries introduced minor changes in tax incentives in the R & D area. In 2018, however, the improvements were significant and much more important.

As an example, Singapore has increased the tax deduction for labor costs and consumables needed to qualify for research and development projects in Singapore from 150% to 250%; Poland has also similarly increased its tax deduction from 100% to 200% starting on 1st January 2018.

Romania, on the other hand, appears, at least for the time being, not to place a major focus on fiscal competition, in terms of facilities granted in 2018, with no changes or increases for the R & D area.

Currently, there are four research and development incentive programs in Romania:

- exemption from corporate income tax in the first 10 years of activity for companies performing exclusively R & D and innovation activities as well as related activities;

- additional deduction of 50% of eligible R & D expenditure in the calculation of corporation tax;

- accelerated depreciation of qualified research and development assets;

- tax exemption on wage income for employees carrying out research and development or technological development activities.

From the perspective of the eligibility conditions for the exemption from the payment of the income tax, these have changed, being to some extent less restrictive.

In practice, however, employees who already applied the tax exemption on earnings in December 2017 were potentially affected by the transfer of social security contributions from the employer to the employee starting with January 2018.

Tax legislation has, however, brought a legal delay to compensate for the net loss of salaries for these categories of employees, under certain conditions.

The provisions governing the exemption from corporate income tax were introduced in the Romanian Tax Code in January 2017.

However, to date, the rules for the application of these provisions have not been issued.

From a corporate tax point of view, although a large proportion of taxpayers working in this area know the tax benefits, most of them are still in the process of eligibility analysis, with no clear implementation phase.

This is largely due to the lack of consultation of the R & D Expert Registry, the latter not being functional, although the law provides that the employer, the employee or the tax authorities may request expert reports drawn up by experts enrolled in the Register of Experts on Domains research and development for the validation of the R & D activities.

The business environment appears to need more confidence in fiscal policy to stimulate investment and R & D facilities in close connection with the National R & D and Innovation Plan.

Moreover, the tax exemption facility for 10 years is inapplicable, as there are no implementing rules and a well-founded fear of taxpayers that this measure can be categorized as state aid.

We consider it opportune to access the tax incentives in Romania where the activities undertaken can justify their innovative character, apart from those ineligible (eg chromatic or aesthetic changes on products, current testing and analysis programs to control quality or quantity).

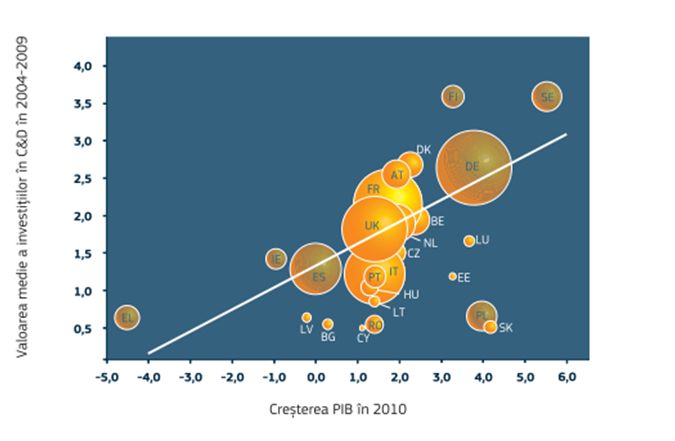

In addition, it is good to know that countries investing in research-development is recovering faster from the crisis. Economic recovery can be seen in the chart below, according to the European Union Guidelines issued in 2013, "Innovation Union".

In order for Romania to no longer rank on the last places among the top European innovation rankings, the private sector should be stimulated to invest in technology at all stages of the innovation process (idea, prototype, testing, production).

Romania has all the ingredients that allow it to capitalize on this potential, but it remains to be seen if this field will be at the top of strategic development priorities in the coming period.