However, the changes in the regulatory area and the intensification of the anti-corruption fight change the perspectives of the risks. And organizations need to take these challenges into consideration: although emerging markets are very promising and offer abundant opportunities, the growing risks of fraud, bribery and corruption remain potential obstacles to their growth.

Bribes and corrupt practices are perceived as more widespread in emerging markets

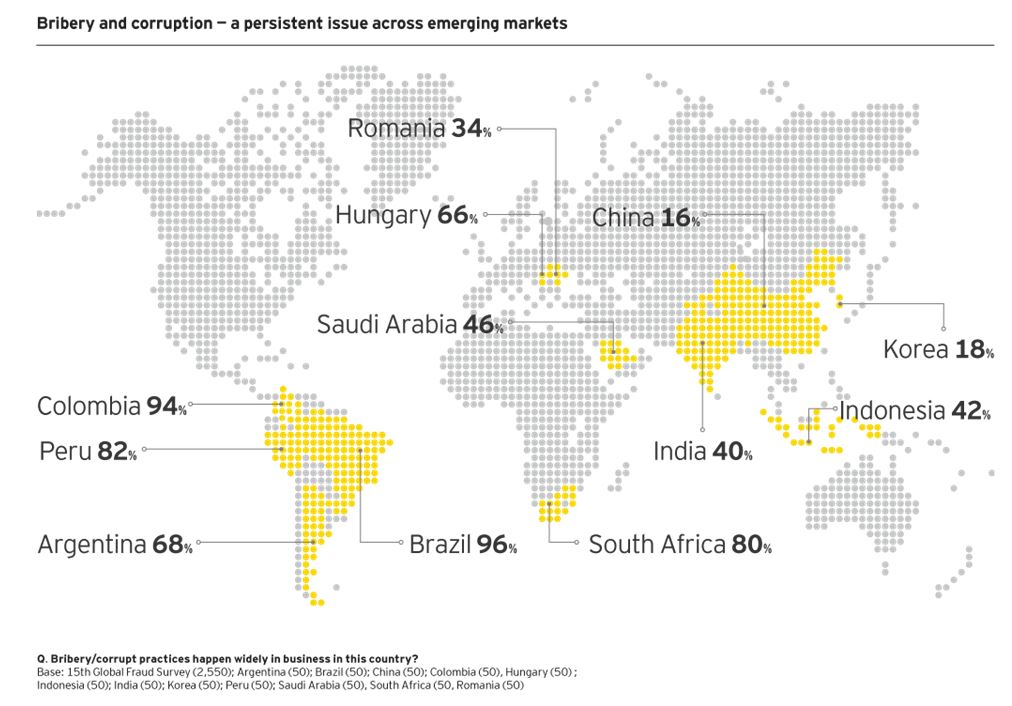

According to the EY study investigating the perception of fraud in emerging markets, including Romania, 42% believe that fraud and corruption represent some of the greatest risks for their businesses, compared to 29% of respondents in developed markets. More than 52% of surveyed respondents consider that corruption practices are widespread in emerging markets where they are large-scale, compared to 20% in developed markets.

Compared to the 2012 edition, bribery and corruption levels in emerging markets have doubled against those in developed markets. Given the rise in regulatory levels, enforcement efforts and compliance compliance in emerging markets, it is ingenious that this gap has not diminished.

16% of respondents in emerging markets have admitted that "giving bribes is a common practice to win contracts". In this context, the survey finds that there are many situations in which organizations, employees, or representatives find it necessary to have some form of incentive for a third party to guarantee the survival of the company. High risk activities include licensing, acquisitions, billing, payments for materials and supplies. A bribe can vary, for example, from a small amount of money to facilitate the release of customs goods to hundreds of thousands of dollars to win a public auction for a major infrastructure project.

The risk of criminal prosecution for the company goes beyond the activities of their employees related to corruption in relation to third party representatives, extending the distributors, agents and partners.

Moreover, the EY report shows that there are still many executives who think it is acceptable to pay cash in return for commercial advantages. 19% of respondents in emerging markets believed that this could be justified, compared to only 6% in developed markets.

In many countries, cultural traditions, such as meals, gifts and quality entertainment are considered to be an integral part of business relationships.However, such practices have become much less common in recent years, especially in developed markets.

In emerging markets, trying to gain a commercial advantage by offering such evidence of hospitality before concluding a deal or an important contract puts companies and their directors at the risk of being considered responsible for bribery under anti-corruption legislation in force.

The study also identifies a number of economic factors that can lead to fraud. In most emerging markets, there is a significant difference between the incomes of employees, both in the private and public sector, and the temptation of the public sector to acquire personal gain can be much higher.

Impact of changing legislation

Generally, corporate executives in emerging markets say they saw only a slight improvement in the business environment in terms of fraud and corruption over the last four years.

In some countries there have been significant changes in perception of fraud and corruption practices. For example, in Romania this perception has fallen from 46% to 34% and in India from 67% to 40%.

Therefore, an important approach that multinationals operating in emerging markets need to support is the assimilation and more rigorous application of local anticorruption legislation in internal and external procedures.

From a legal point of view, most countries, including many of the emerging markets, have anti-corruption policies embedded in their legislation for many years and apply them increasingly rigorously. Some have signed the UN Convention Against Corruption, and many have also signed the Anti-Corruption Convention of the Organization for Economic Cooperation and Development (OECD).

Reducing the difference between intentions and behavior

In an increasingly competitive environment, where we are witnessing the use of technology as a facilitator of unethical conduct, the role of management becomes vital in redefining the agenda related to ethics and updating the compliance programs based on data analysis to minimize integrity errors. So that technology can be used to detect and prevent illicit acts.

At the same time, companies must ensure that they have implemented adequate reporting procedures, including reporting irregularities mechanisms to support the process of obtaining allegations of fraud from employees and other third parties.

In conclusion, although states have introduced more and more anticorruption provisions in their legislation, and organizations are investing more in their compliance programs, the battle has not come to an end.